Instructions for Form 6395 Alaska Passive Activity 2024-2026

What is the Instructions For Form 6395 Alaska Passive Activity

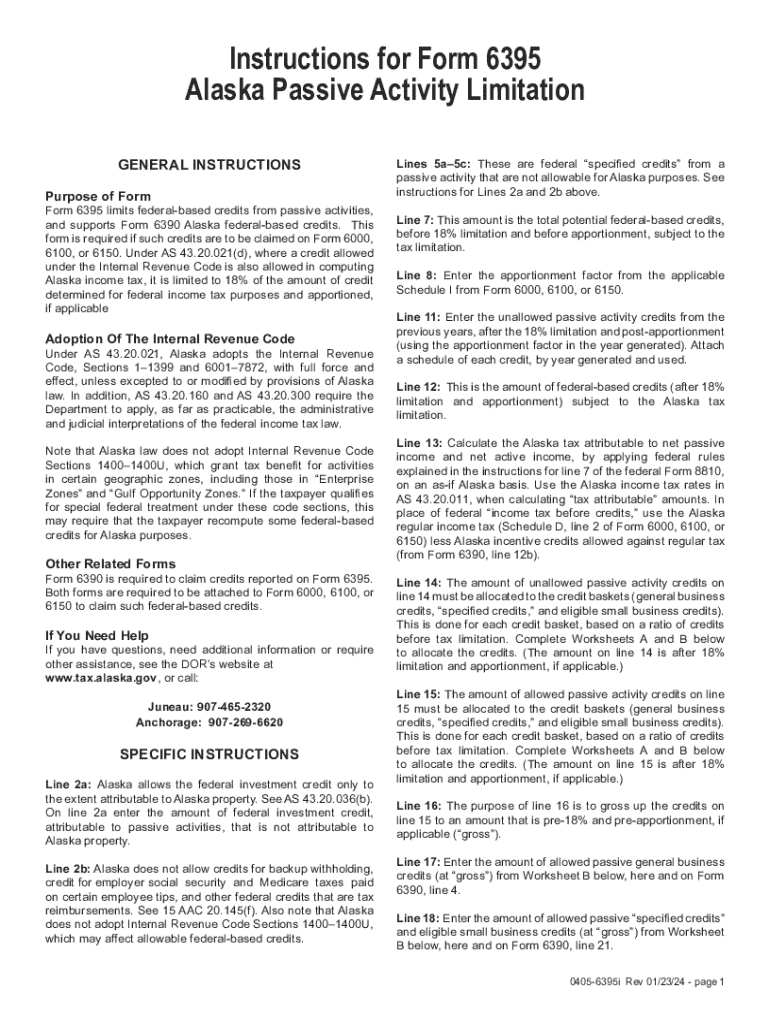

The Instructions For Form 6395 Alaska Passive Activity provide guidance for individuals and entities involved in passive activities in Alaska. This form is essential for reporting income, losses, and credits associated with passive activities, which typically include rental properties and limited partnerships. Understanding these instructions ensures compliance with state tax regulations and helps taxpayers accurately report their financial activities.

Steps to complete the Instructions For Form 6395 Alaska Passive Activity

Completing the Instructions For Form 6395 involves several key steps:

- Gather necessary financial documents, including income statements and expense records related to passive activities.

- Review the specific requirements outlined in the instructions to ensure all relevant information is included.

- Fill out the form accurately, providing details on income, losses, and any applicable credits.

- Double-check all entries for accuracy and completeness before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the Instructions For Form 6395 Alaska Passive Activity

The legal use of the Instructions For Form 6395 is crucial for compliance with Alaska state tax laws. Taxpayers must adhere to the guidelines provided to ensure that all passive income and losses are reported correctly. Failure to follow these instructions can result in legal repercussions, including fines or audits. It is important for users to understand the legal implications of their submissions and to maintain accurate records of their passive activities.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 6395 are critical for taxpayers to observe. Generally, the form must be submitted by the state’s tax deadline, which aligns with federal tax filing dates. Specific dates may vary each year, so it is advisable to check the Alaska Department of Revenue’s website for the most current information. Timely submission helps avoid late fees and ensures compliance with state regulations.

Key elements of the Instructions For Form 6395 Alaska Passive Activity

Key elements of the Instructions For Form 6395 include:

- Definitions of passive activities and how they apply to various taxpayers.

- Detailed instructions on how to report income and losses from passive activities.

- Information on allowable deductions and credits related to passive income.

- Guidelines for record-keeping and documentation to support claims made on the form.

Examples of using the Instructions For Form 6395 Alaska Passive Activity

Examples of using the Instructions For Form 6395 can help clarify its application. For instance, a taxpayer who owns rental properties in Alaska may use the form to report rental income and associated expenses. Another example includes a limited partner in a business who needs to report their share of passive losses. These scenarios illustrate the practical use of the form in real-life situations, emphasizing the importance of accurate reporting.

Who Issues the Form

The Instructions For Form 6395 are issued by the Alaska Department of Revenue. This state agency is responsible for the administration of tax laws and provides the necessary forms and instructions to ensure compliance among taxpayers. It is important for users to rely on the official resources provided by the Department of Revenue for the most accurate and up-to-date information regarding the form.

Quick guide on how to complete instructions for form 6395 alaska passive activity

Effortlessly prepare Instructions For Form 6395 Alaska Passive Activity on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate template and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without any delays. Manage Instructions For Form 6395 Alaska Passive Activity on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign Instructions For Form 6395 Alaska Passive Activity with minimal effort

- Locate Instructions For Form 6395 Alaska Passive Activity and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, unique link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Form 6395 Alaska Passive Activity and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 6395 alaska passive activity

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 6395 alaska passive activity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 6395 Alaska Passive Activity?

The Instructions For Form 6395 Alaska Passive Activity provide detailed guidelines on how to report passive activity losses and credits for Alaska residents. This form is essential for ensuring compliance with state tax regulations. Understanding these instructions can help you maximize your tax benefits.

-

How can airSlate SignNow assist with completing the Instructions For Form 6395 Alaska Passive Activity?

airSlate SignNow offers a user-friendly platform that simplifies the process of filling out the Instructions For Form 6395 Alaska Passive Activity. With our eSigning features, you can easily collaborate with tax professionals and ensure that your documents are signed and submitted on time. This streamlines your tax preparation process.

-

What features does airSlate SignNow offer for managing tax documents like Form 6395?

airSlate SignNow provides features such as document templates, secure eSigning, and cloud storage, which are ideal for managing tax documents like Form 6395. These tools help you organize your paperwork efficiently and ensure that you have access to your documents whenever needed. This enhances your overall productivity during tax season.

-

Is there a cost associated with using airSlate SignNow for Instructions For Form 6395 Alaska Passive Activity?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Our plans are designed to be cost-effective while providing robust features for managing documents, including the Instructions For Form 6395 Alaska Passive Activity. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to streamline your workflow when dealing with the Instructions For Form 6395 Alaska Passive Activity. This integration ensures that you can easily transfer data and documents between platforms, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Instructions For Form 6395 Alaska Passive Activity, offers numerous benefits. You gain access to a secure, efficient, and user-friendly platform that simplifies document management and eSigning. This can lead to faster processing times and improved accuracy in your tax submissions.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents like the Instructions For Form 6395 Alaska Passive Activity. Our platform ensures that your data is safe from unauthorized access, giving you peace of mind while managing your tax-related paperwork.

Get more for Instructions For Form 6395 Alaska Passive Activity

Find out other Instructions For Form 6395 Alaska Passive Activity

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast