Ap 133 2017

What is the AP 133?

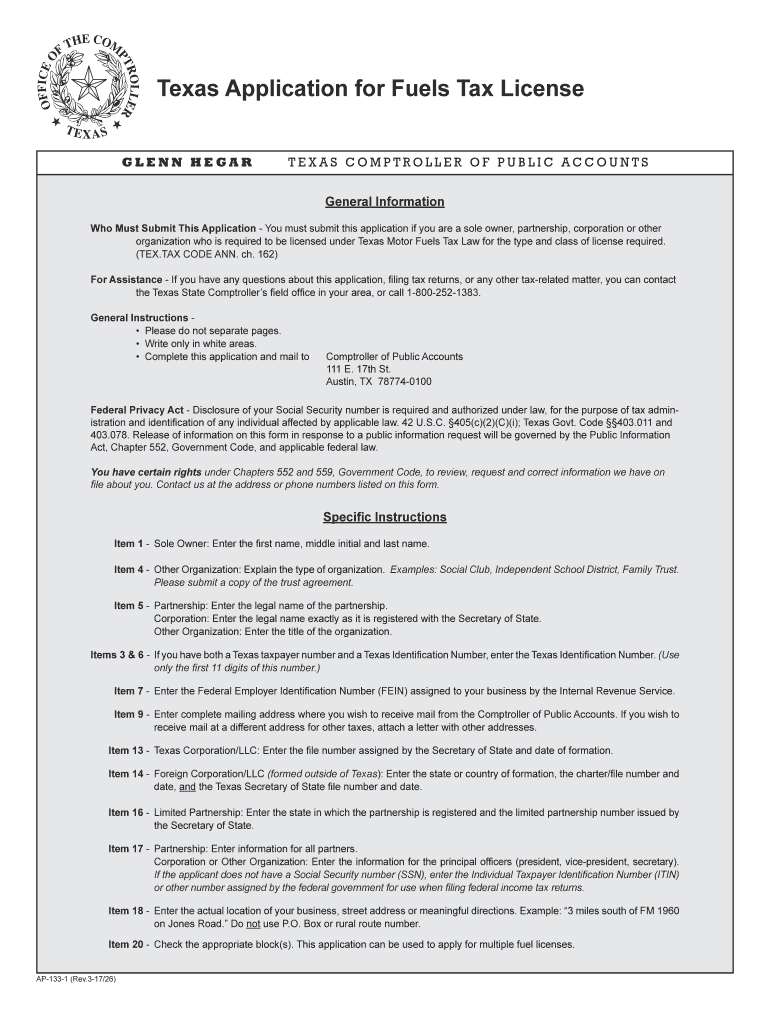

The AP 133 is a crucial form used in Texas for obtaining a fuels tax license. This form is specifically designed for individuals and businesses that wish to engage in activities involving the sale or distribution of dyed diesel fuel. The Texas application fuels tax license, commonly referred to as the AP 133, ensures compliance with state regulations governing fuel taxes. By completing this form, applicants declare their intent to operate within the state's fuel distribution framework, which is essential for legal operations in the fuel industry.

How to Obtain the AP 133

To obtain the AP 133, applicants must follow a structured process. First, individuals or businesses need to gather the necessary documentation, which may include proof of business registration and identification. Next, the completed AP 133 form must be submitted to the appropriate Texas state agency, typically the Comptroller of Public Accounts. It is advisable to check for any specific requirements or updates on submission procedures, as these can vary. After submission, applicants should allow time for processing, which may take several weeks, depending on the volume of applications.

Steps to Complete the AP 133

Completing the AP 133 involves several key steps to ensure accuracy and compliance. Begin by carefully reading the instructions provided with the form. Next, fill out the required fields, which typically include business information, contact details, and the type of fuel being handled. Ensure that all information is accurate and complete to avoid delays. Once the form is filled out, review it for any errors, then sign and date the form. Finally, submit the AP 133 along with any required supporting documents to the designated state agency.

Legal Use of the AP 133

The legal use of the AP 133 is governed by Texas state law, which outlines the requirements for obtaining and maintaining a fuels tax license. This form must be completed accurately to ensure that the applicant is authorized to engage in the sale or distribution of dyed diesel fuel. Failure to comply with the legal stipulations associated with the AP 133 can result in penalties, including fines or revocation of the license. It is essential for applicants to understand the legal implications of their application and to maintain compliance with all relevant regulations.

Key Elements of the AP 133

Several key elements are essential when completing the AP 133. These include the applicant's legal name, business structure, and the specific type of fuel involved. Additionally, it is important to provide accurate contact information and any relevant tax identification numbers. Understanding these elements helps ensure that the application is processed smoothly and that the applicant receives the necessary approvals to operate legally within the Texas fuel market.

Required Documents

When applying for the AP 133, several documents are typically required to support the application. These may include:

- Proof of business registration or incorporation.

- Identification documents for the business owner or authorized representative.

- Tax identification number (TIN) or employer identification number (EIN).

- Any additional documentation requested by the Texas state agency.

Having these documents ready can facilitate a smoother application process and help avoid unnecessary delays.

Form Submission Methods

The AP 133 can be submitted through various methods, depending on the preferences of the applicant and the requirements of the state agency. Common submission methods include:

- Online submission through the Texas state agency's official website.

- Mailing the completed form and supporting documents to the designated office.

- In-person submission at local or regional offices of the Texas state agency.

It is important to verify the preferred submission method and any associated deadlines to ensure timely processing of the application.

Quick guide on how to complete form ap 133 texas application for fuels tax texas comptroller

Complete Ap 133 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without holdups. Manage Ap 133 on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to edit and eSign Ap 133 without any hassle

- Find Ap 133 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, arduous form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device of your choosing. Modify and eSign Ap 133 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ap 133 texas application for fuels tax texas comptroller

Create this form in 5 minutes!

How to create an eSignature for the form ap 133 texas application for fuels tax texas comptroller

How to generate an eSignature for the Form Ap 133 Texas Application For Fuels Tax Texas Comptroller in the online mode

How to create an electronic signature for your Form Ap 133 Texas Application For Fuels Tax Texas Comptroller in Chrome

How to create an electronic signature for putting it on the Form Ap 133 Texas Application For Fuels Tax Texas Comptroller in Gmail

How to make an electronic signature for the Form Ap 133 Texas Application For Fuels Tax Texas Comptroller straight from your smartphone

How to make an electronic signature for the Form Ap 133 Texas Application For Fuels Tax Texas Comptroller on iOS

How to make an eSignature for the Form Ap 133 Texas Application For Fuels Tax Texas Comptroller on Android

People also ask

-

What is Texas 133, and how does it relate to airSlate SignNow?

Texas 133 refers to a specific legislative requirement for electronic signatures in Texas. airSlate SignNow fully complies with Texas 133, enabling businesses to securely eSign documents while meeting state regulations. This ensures that your electronic signatures are legally binding and recognized in Texas.

-

How does airSlate SignNow help me comply with Texas 133?

airSlate SignNow provides features that comply with Texas 133, ensuring that electronic signatures meet legal standards for enforceability. By using airSlate SignNow, you can confidently send and sign documents knowing they adhere to the necessary guidelines in Texas. This compliance protects your business and enhances your operational efficiency.

-

What are the pricing plans for using airSlate SignNow with Texas 133 compliance?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for Texas 133 compliance. These plans are designed to be cost-effective, ensuring that you get the features you need without overspending. Check our pricing page for detailed information and to find the perfect plan for your business.

-

What key features does airSlate SignNow offer for Texas 133?

Key features of airSlate SignNow relevant to Texas 133 include secure eSigning, document tracking, and customizable templates. These features streamline the document signing process while ensuring compliance with Texas regulations. You'll improve efficiency and maintain the integrity of your documents.

-

Are there any integrations available with airSlate SignNow for Texas 133?

Yes, airSlate SignNow offers seamless integrations with popular applications and software, which are crucial for businesses working under Texas 133. You can connect it with CRM tools, project management software, and more to enhance your workflow. These integrations simplify the signing process, making it easier to manage documents.

-

What benefits does airSlate SignNow provide for businesses in Texas?

For businesses in Texas, airSlate SignNow offers an easy-to-use platform that adheres to Texas 133 standards, ensuring compliance and security. Benefits include faster turnaround times for contracts, improved document management, and reduced paper waste. This helps companies save time and resources while maintaining legal integrity.

-

Can I access airSlate SignNow from anywhere to fulfill Texas 133 requirements?

Absolutely! airSlate SignNow is cloud-based, allowing users to access the platform from anywhere, which is essential for complying with Texas 133. Whether you’re in the office or on the go, you can send and eSign documents easily and securely. This flexibility helps enhance productivity and supports remote work.

Get more for Ap 133

- Pohnpei state scholarship form

- Fsa 153 form

- How to pay anywhere usps form

- Ls 56 0311pdffillercom form

- Report form harris county public infrastructure department hcpid

- Perpetual bond covering construction of facilities hcpid form

- Realpropertyhonolulu form

- Sel 114 oregon secretary of state oregonvotes form

Find out other Ap 133

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now