AP 133 Texas Application for Fuels Tax License Texas Comptroller Window State Tx 2019-2026

Understanding the AP 133 Texas Application for Fuels Tax License

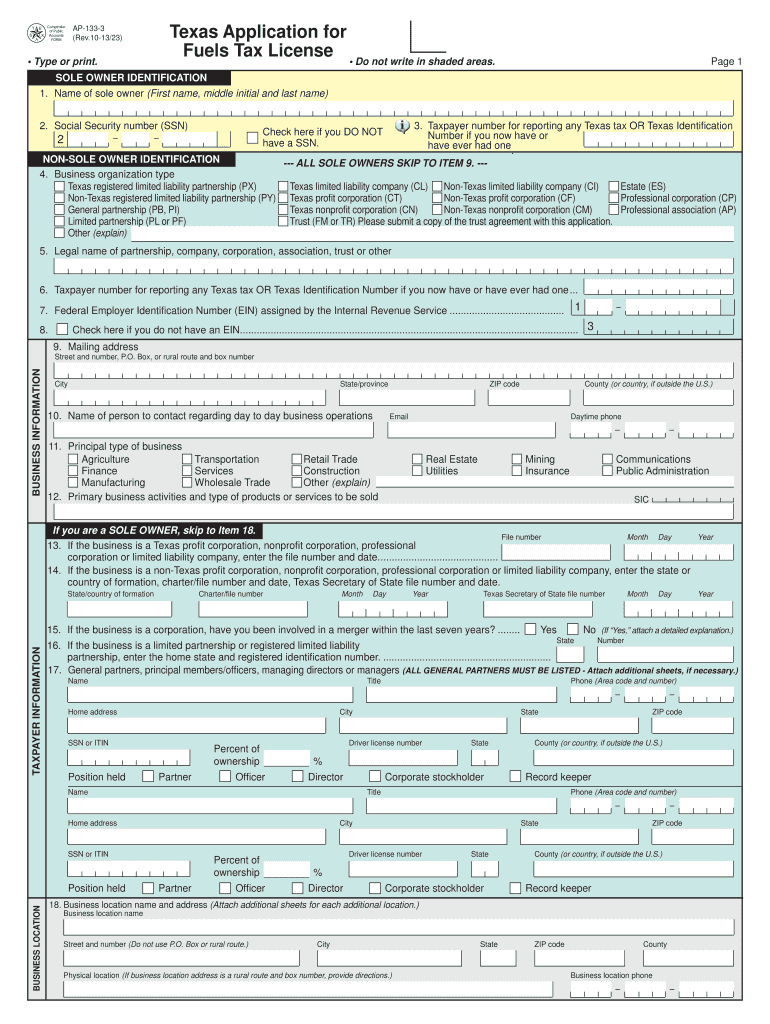

The AP 133 Texas Application for Fuels Tax License is a crucial document for businesses involved in the distribution or sale of motor fuels in Texas. This application is required to comply with state regulations and to obtain a fuels tax license from the Texas Comptroller. The license allows businesses to legally collect and remit fuel taxes, ensuring compliance with Texas tax laws. Understanding the purpose and requirements of this form is essential for any business operating in the fuel sector.

Steps to Complete the AP 133 Texas Application for Fuels Tax License

Completing the AP 133 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about your business, including legal name, address, and federal employer identification number (EIN).

- Provide details about the types of fuel your business will be dealing with, such as gasoline, diesel, or alternative fuels.

- Complete all sections of the application, ensuring accuracy in your responses.

- Review the application for completeness and correctness before submission.

- Submit the application either online through the Texas Comptroller's website or by mailing it to the appropriate office.

Legal Use of the AP 133 Texas Application for Fuels Tax License

The legal use of the AP 133 is critical for compliance with Texas state law. Businesses must ensure that they are using the most current version of the application and that it is filled out accurately. Misrepresentation or incomplete information can lead to penalties or delays in obtaining the required license. Additionally, the application must be submitted within specified deadlines to avoid any legal repercussions.

Required Documents for the AP 133 Texas Application for Fuels Tax License

When preparing to submit the AP 133, certain documents are necessary to support your application. These may include:

- Proof of business registration in Texas.

- Federal Employer Identification Number (EIN).

- Financial statements or tax returns, if applicable.

- Any previous fuel licenses or permits held by the business.

Eligibility Criteria for the AP 133 Texas Application for Fuels Tax License

To be eligible for the AP 133, applicants must meet specific criteria set forth by the Texas Comptroller. These include:

- Operating a business that sells or distributes motor fuels.

- Having a valid Texas business registration.

- Complying with all local, state, and federal regulations regarding fuel sales.

Form Submission Methods for the AP 133 Texas Application for Fuels Tax License

The AP 133 can be submitted through various methods, providing flexibility for applicants. The available submission methods include:

- Online submission via the Texas Comptroller's official website.

- Mailing a physical copy of the application to the designated office.

- In-person submission at local Comptroller offices, if applicable.

Quick guide on how to complete ap 133 texas application for fuels tax license texas comptroller window state tx

Effortlessly Prepare AP 133 Texas Application For Fuels Tax License Texas Comptroller Window State Tx on Any Device

Managing documents online has become popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to generate, modify, and electronically sign your documents swiftly without delays. Handle AP 133 Texas Application For Fuels Tax License Texas Comptroller Window State Tx on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and Electronically Sign AP 133 Texas Application For Fuels Tax License Texas Comptroller Window State Tx

- Find AP 133 Texas Application For Fuels Tax License Texas Comptroller Window State Tx and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark important sections of the documents or conceal sensitive information with the tools airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Select how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign AP 133 Texas Application For Fuels Tax License Texas Comptroller Window State Tx to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ap 133 texas application for fuels tax license texas comptroller window state tx

Create this form in 5 minutes!

How to create an eSignature for the ap 133 texas application for fuels tax license texas comptroller window state tx

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a fuel license search and why is it important?

A fuel license search is a process that allows businesses to verify and retrieve information related to fuel licenses. This is crucial for compliance with regulations and ensuring that your business operates within legal boundaries. With airSlate SignNow, you can streamline your workflow while managing documents associated with your fuel license search efficiently.

-

How can airSlate SignNow assist with my fuel license search?

airSlate SignNow simplifies the fuel license search process by providing an easy-to-use platform for eSigning and managing related documents. You can quickly send, sign, and store all necessary papers securely, ensuring that your fuel license search is organized and accessible at all times.

-

What are the pricing plans available for airSlate SignNow when performing a fuel license search?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Whether you’re just starting or require advanced features, you’ll find a plan that fits your budget, especially for managing tasks like your fuel license search. Check our website for detailed pricing and feature comparisons.

-

Are there any features specifically for enhancing my fuel license search process?

Yes, airSlate SignNow includes features such as document templates, advanced search capabilities, and eSignature tools that directly enhance your fuel license search process. These features allow you to automate workflows, ensuring that you can complete your fuel license search quickly and efficiently.

-

Can I integrate airSlate SignNow with other software for my fuel license search needs?

Absolutely! airSlate SignNow offers integrations with various business applications, which can enhance your fuel license search. By integrating with CRM systems, accounting software, and more, you can ensure all your fuel license search-related documents and workflows are seamlessly connected.

-

What are the benefits of using airSlate SignNow for fuel license searches compared to traditional methods?

Using airSlate SignNow for fuel license searches provides many benefits over traditional methods, such as increased efficiency and reduced paperwork. You’ll save time by quickly sending and eSigning documents online, allowing your team to focus on core tasks rather than manual filing and handling.

-

Is it safe to store documents related to my fuel license search on airSlate SignNow?

Yes, airSlate SignNow prioritizes security, ensuring that all documents related to your fuel license search are stored safely. With encryption and secure access controls, you can trust that your sensitive information remains protected while being easily accessible when you need it.

Get more for AP 133 Texas Application For Fuels Tax License Texas Comptroller Window State Tx

Find out other AP 133 Texas Application For Fuels Tax License Texas Comptroller Window State Tx

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple