M99 Form 2018

What is the M99 Form

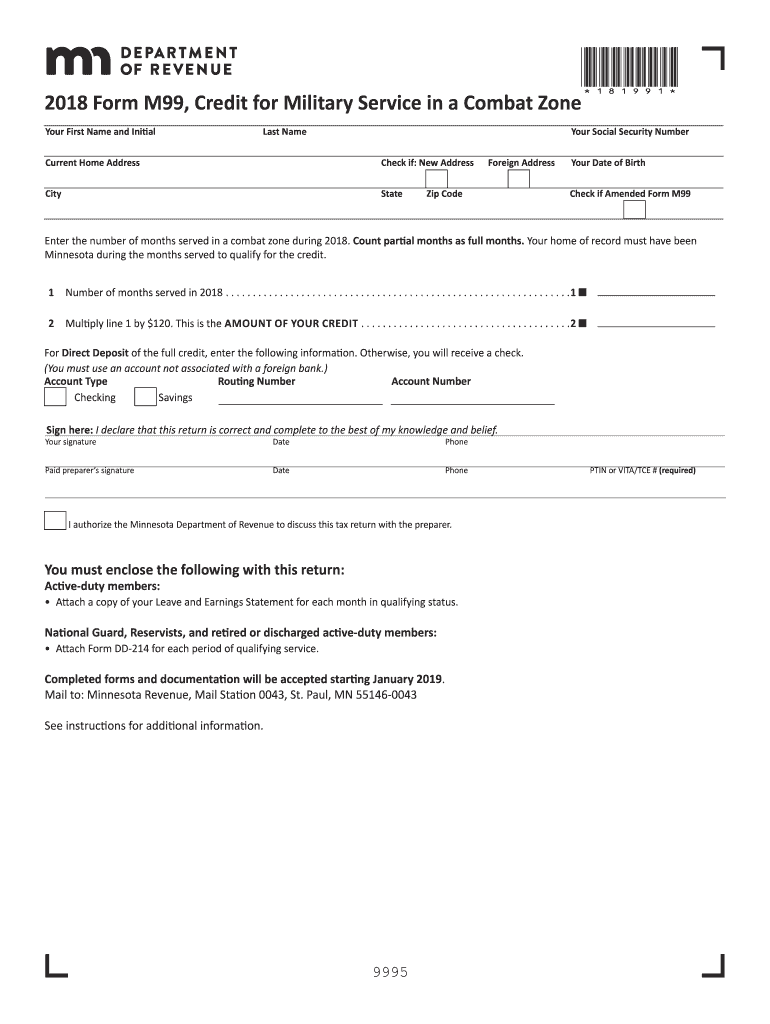

The M99 form, commonly referred to as the Minnesota Combat form, is a specific document used in Minnesota for various tax-related purposes. It is primarily utilized by individuals who are eligible for certain tax benefits or credits related to military service. This form plays a crucial role in ensuring that taxpayers can accurately report their income and claim any applicable deductions or credits.

How to use the M99 Form

Using the M99 form involves several key steps. First, you will need to gather all necessary information, including your personal details, income sources, and any relevant military service documentation. Once you have this information, you can begin filling out the form. It's important to follow the instructions carefully to ensure that all sections are completed accurately. After completing the form, you should review it for any errors before submitting it to the appropriate tax authority.

Steps to complete the M99 Form

Completing the M99 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and military service records.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring that you include all relevant sources.

- Claim any deductions or credits you are eligible for based on your military service.

- Review the completed form for accuracy and completeness.

- Submit the form according to the guidelines provided, either online or via mail.

Legal use of the M99 Form

The M99 form is legally recognized in Minnesota for tax purposes. To ensure its legal validity, it must be filled out accurately and submitted in accordance with state regulations. Compliance with the relevant tax laws is essential to avoid any penalties or issues with the tax authorities. Utilizing a reliable digital platform for e-signatures can enhance the legal standing of the form, ensuring that all signatures are authenticated and securely stored.

Filing Deadlines / Important Dates

Filing deadlines for the M99 form are typically aligned with the general tax filing deadlines in Minnesota. It is crucial to be aware of these dates to avoid late penalties. Generally, the deadline for submitting tax forms is April 15, unless it falls on a weekend or holiday, in which case it may be extended. Keeping track of any changes in tax legislation or filing requirements is also important for timely submission.

Who Issues the Form

The M99 form is issued by the Minnesota Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. If you have questions about the form or need assistance, contacting the Minnesota Department of Revenue can provide you with the necessary guidance and support.

Quick guide on how to complete credit for military service in a combat zone

Complete M99 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the correct template and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly and without delay. Handle M99 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to adjust and eSign M99 Form with ease

- Locate M99 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, tiring form searches, and errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign M99 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct credit for military service in a combat zone

Create this form in 5 minutes!

How to create an eSignature for the credit for military service in a combat zone

How to generate an eSignature for your Credit For Military Service In A Combat Zone online

How to generate an electronic signature for your Credit For Military Service In A Combat Zone in Google Chrome

How to generate an electronic signature for signing the Credit For Military Service In A Combat Zone in Gmail

How to generate an electronic signature for the Credit For Military Service In A Combat Zone from your smart phone

How to create an eSignature for the Credit For Military Service In A Combat Zone on iOS

How to make an eSignature for the Credit For Military Service In A Combat Zone on Android

People also ask

-

What is an m99 form and how is it used?

The m99 form is a specific document used for various purposes, including tax reporting and compliance in different sectors. It simplifies the process of submitting necessary information to relevant authorities. Using the m99 form ensures accuracy and helps in maintaining legislative compliance.

-

How can airSlate SignNow help with m99 form signing?

airSlate SignNow allows users to electronically sign m99 forms quickly and securely. With easy document tracking and cloud storage, you can ensure that your m99 forms are always accessible and organized. The platform provides an intuitive interface that simplifies the eSigning process.

-

Is there a cost associated with using airSlate SignNow for m99 forms?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, allowing you to manage m99 forms at an affordable price. Each plan includes eSigning capabilities as well as support features to ensure you can efficiently handle your document transactions. You can find a pricing plan that fits your budget.

-

What features does airSlate SignNow offer for m99 form management?

airSlate SignNow provides robust features such as automated workflows, document templates, and real-time notifications for m99 forms. These tools enhance productivity by streamlining the document process from creation to signing. Additionally, integration with popular applications ensures seamless management of your m99 forms.

-

Can I integrate airSlate SignNow with other applications for managing m99 forms?

Absolutely! airSlate SignNow offers integrations with various applications that help streamline your workflow when handling m99 forms. This includes CRM systems, cloud storage, and project management tools, allowing you to manage your documents more efficiently. Check the integration options to enhance your existing software ecosystem.

-

Are there any security measures in place for handling m99 forms?

Yes, airSlate SignNow prioritizes security for all forms, including the m99 form. The platform employs encryption and authentication protocols to protect sensitive data during transmission and storage. You can trust airSlate SignNow to safeguard your documents while they are being signed and shared.

-

How easy is it to track the status of my m99 forms in airSlate SignNow?

Tracking the status of your m99 forms is straightforward with airSlate SignNow. The platform provides a dashboard that displays the progress of each document, including who has signed it and what steps remain. This feature keeps you informed and helps manage deadlines effectively.

Get more for M99 Form

- Oda ag adm form 11

- Election inspector manual city of milwaukee city milwaukee form

- Application for circus carnival permit city of lubbock form

- Amortization debt form

- Application for licensure board of nursing home administrators nha state wy form

- Ga voter registration form

- I need a picture of a ga trip permit form

- Transmittal form 227

Find out other M99 Form

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form