M99 Form 2017

What is the M99 Form

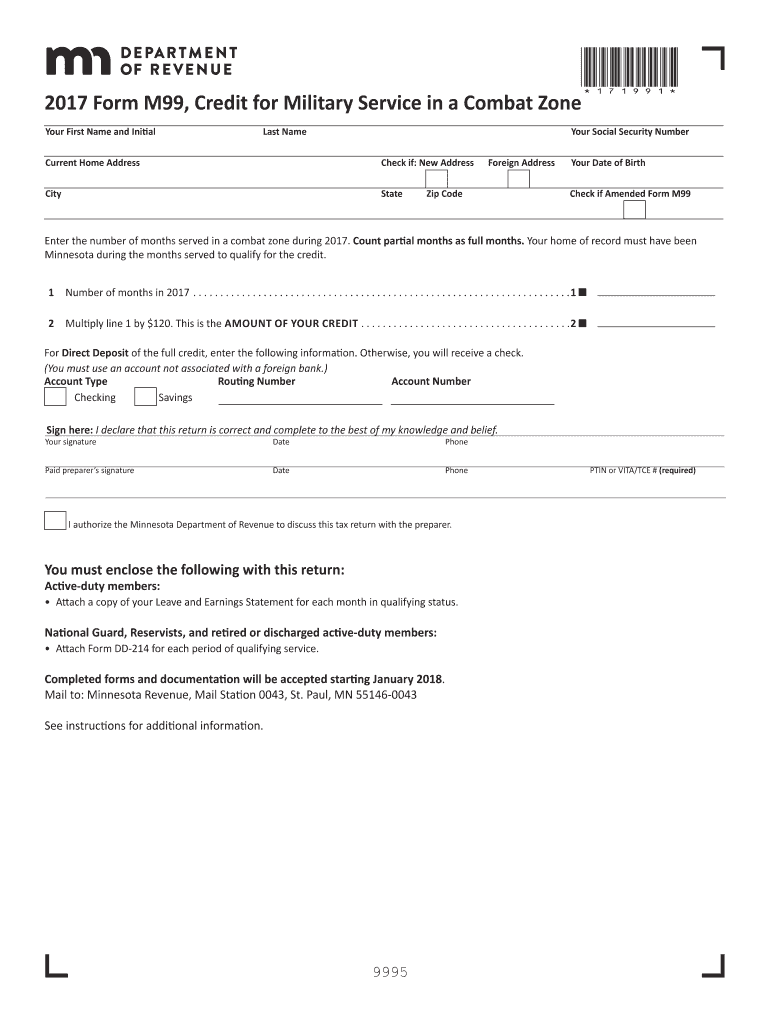

The M99 Form is a specific document used primarily for tax purposes in the United States. It serves as a declaration for individuals or entities to report certain financial information to the Internal Revenue Service (IRS). Understanding the M99 Form is crucial for ensuring compliance with tax regulations and for accurately reporting income or deductions. This form may be required for various situations, including self-employment or specific tax credits.

How to use the M99 Form

Using the M99 Form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and any supporting documentation for deductions. Next, fill out the form carefully, ensuring that all fields are completed as required. After completing the form, review it for accuracy before submitting it to the IRS. It is important to keep a copy of the submitted form for your records.

Steps to complete the M99 Form

Completing the M99 Form requires attention to detail. Here are the steps to follow:

- Gather necessary financial documents, such as W-2s or 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report income accurately, ensuring that all sources are included.

- Complete sections related to deductions or credits, if applicable.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the M99 Form

The M99 Form is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, the form must be filled out truthfully and accurately. Misrepresentation or failure to submit the form can lead to penalties or legal consequences. It is important to understand the implications of the information reported on this form and to comply with all relevant tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the M99 Form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for individuals. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check the IRS website or consult a tax professional for any updates on deadlines or changes to filing requirements.

Form Submission Methods (Online / Mail / In-Person)

The M99 Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system, which is fast and efficient.

- Mailing the completed form to the appropriate IRS address, depending on your state.

- In-person submission at designated IRS offices, which may be beneficial for those needing assistance.

Examples of using the M99 Form

There are several scenarios where the M99 Form may be applicable. For instance, self-employed individuals may use the form to report their income and expenses accurately. Additionally, businesses may need to file the M99 Form to claim specific tax credits or deductions. Understanding these examples can help users recognize when the form is necessary and how to utilize it effectively.

Quick guide on how to complete m99 form 2017

Complete M99 Form effortlessly on every device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage M99 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and eSign M99 Form with ease

- Find M99 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign M99 Form to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct m99 form 2017

Create this form in 5 minutes!

How to create an eSignature for the m99 form 2017

How to generate an eSignature for the M99 Form 2017 in the online mode

How to create an eSignature for your M99 Form 2017 in Google Chrome

How to make an eSignature for signing the M99 Form 2017 in Gmail

How to generate an eSignature for the M99 Form 2017 straight from your smart phone

How to create an electronic signature for the M99 Form 2017 on iOS

How to create an electronic signature for the M99 Form 2017 on Android

People also ask

-

What is an M99 Form and how can it be used with airSlate SignNow?

The M99 Form is a specific type of document often used in various industries. With airSlate SignNow, users can easily create, send, and eSign the M99 Form, streamlining the documentation process and ensuring compliance.

-

How much does it cost to use airSlate SignNow for M99 Forms?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on your needs for handling M99 Forms and other documents, you can choose a plan that fits your budget while benefiting from robust features.

-

What features does airSlate SignNow provide for managing M99 Forms?

AirSlate SignNow offers various features for managing M99 Forms, including customizable templates, automated workflows, and real-time tracking. These functionalities help enhance productivity and improve the user experience in document signing.

-

Can I integrate airSlate SignNow with other tools for M99 Form management?

Yes, airSlate SignNow seamlessly integrates with numerous applications and platforms. This makes it easy to manage M99 Forms alongside other tools your business already uses, ensuring a cohesive workflow.

-

What are the benefits of using airSlate SignNow for M99 Forms?

Using airSlate SignNow for M99 Forms offers signNow benefits such as time savings, reduced paperwork, and increased efficiency. The electronic signing process helps eliminate bottlenecks, allowing you to focus on what matters most.

-

Is airSlate SignNow secure for handling M99 Forms?

Absolutely! airSlate SignNow takes security very seriously, employing industry-standard encryption and compliance measures. This ensures that your M99 Forms and sensitive information are protected throughout the signing process.

-

How do I get started with airSlate SignNow for M99 Forms?

Getting started with airSlate SignNow is simple. Just sign up for an account, choose your pricing plan, and start creating M99 Forms using our easy-to-use platform. Our help resources will guide you through the initial setup.

Get more for M99 Form

Find out other M99 Form

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple