Maine Transfer Tax Declaration Form 2018

What is the Maine Transfer Tax Declaration Form

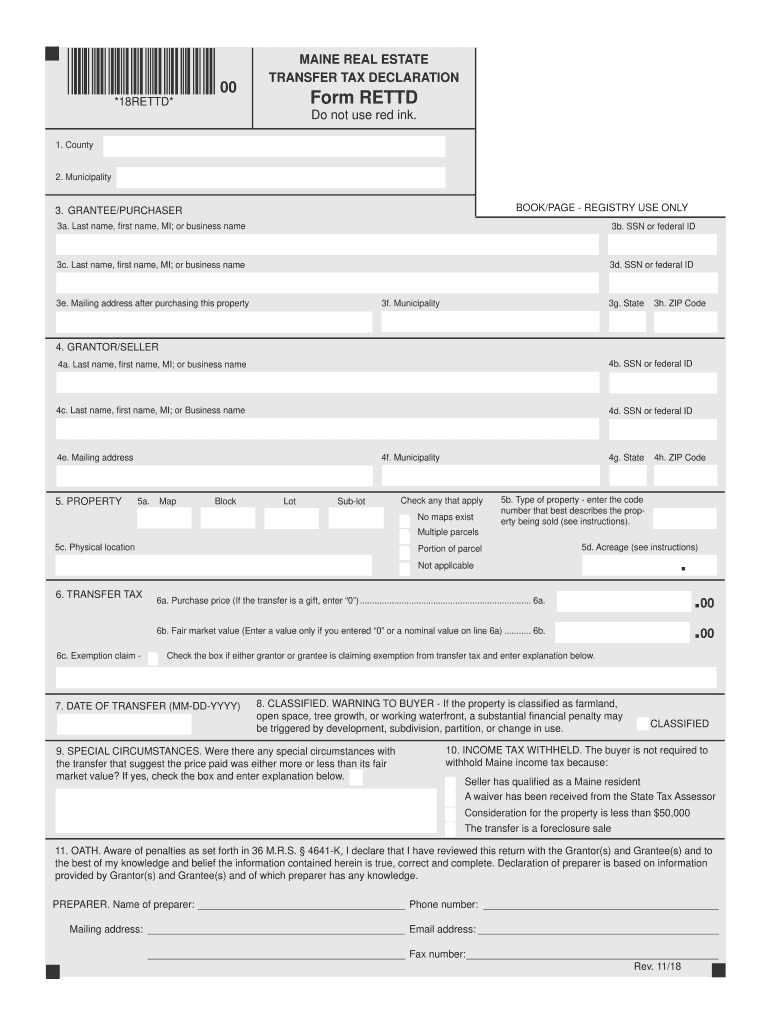

The Maine Transfer Tax Declaration Form, commonly referred to as the RETTD, is a crucial document used in real estate transactions within the state of Maine. This form serves to report the transfer of real property and is essential for calculating the transfer tax owed to the state. The information provided in the RETTD includes details about the property, the parties involved in the transaction, and the sale price. Accurate completion of this form is necessary to ensure compliance with state tax laws and to facilitate the legal transfer of property ownership.

Steps to complete the Maine Transfer Tax Declaration Form

Completing the Maine Transfer Tax Declaration Form involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding the property, including its address, the names of the buyer and seller, and the sale price. Next, accurately fill out each section of the form, ensuring that all required fields are completed. It is important to double-check the information for any errors or omissions. Once completed, the form must be signed by both parties. Finally, submit the RETTD to the appropriate state office, either online or via mail, along with any required payment for the transfer tax.

Legal use of the Maine Transfer Tax Declaration Form

The Maine Transfer Tax Declaration Form is legally binding once it is completed and submitted according to state regulations. To ensure its legal standing, the form must be filled out accurately and submitted in a timely manner, as specified by Maine law. This includes adhering to any deadlines for submission and payment of the transfer tax. Failure to comply with these requirements may result in penalties or delays in the property transfer process. Therefore, understanding the legal implications of the RETTD is essential for all parties involved in a real estate transaction.

Who Issues the Form

The Maine Transfer Tax Declaration Form is issued by the Maine Revenue Services (MRS). This state agency is responsible for overseeing the administration of tax laws in Maine, including those related to real estate transactions. The MRS provides the necessary forms and guidelines for completing the RETTD, ensuring that taxpayers have access to the information needed for compliance. It is advisable to consult the MRS for any updates or changes to the form or related regulations.

Form Submission Methods

The Maine Transfer Tax Declaration Form can be submitted through various methods to accommodate different preferences and needs. One option is to complete the form online using the Maine Revenue Services website, which allows for a streamlined submission process. Alternatively, individuals can print the form, fill it out manually, and submit it by mail. In-person submissions may also be possible at designated state offices. Each method has its own requirements, so it is important to choose the one that best suits your situation.

Key elements of the Maine Transfer Tax Declaration Form

Several key elements must be included in the Maine Transfer Tax Declaration Form to ensure its validity. These elements include the names and addresses of the buyer and seller, a detailed description of the property being transferred, and the sale price. Additionally, the form requires information regarding any exemptions that may apply to the transfer tax. It is essential to provide accurate and complete information in these sections to avoid delays or complications in the property transfer process.

Quick guide on how to complete the red pen rules how to prevent pharmacy errordrug topics

Complete Maine Transfer Tax Declaration Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents quickly without delays. Manage Maine Transfer Tax Declaration Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Maine Transfer Tax Declaration Form with ease

- Find Maine Transfer Tax Declaration Form and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Maine Transfer Tax Declaration Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the red pen rules how to prevent pharmacy errordrug topics

Create this form in 5 minutes!

How to create an eSignature for the the red pen rules how to prevent pharmacy errordrug topics

How to create an eSignature for your The Red Pen Rules How To Prevent Pharmacy Errordrug Topics in the online mode

How to generate an eSignature for the The Red Pen Rules How To Prevent Pharmacy Errordrug Topics in Chrome

How to create an electronic signature for signing the The Red Pen Rules How To Prevent Pharmacy Errordrug Topics in Gmail

How to create an electronic signature for the The Red Pen Rules How To Prevent Pharmacy Errordrug Topics right from your smart phone

How to make an electronic signature for the The Red Pen Rules How To Prevent Pharmacy Errordrug Topics on iOS

How to make an electronic signature for the The Red Pen Rules How To Prevent Pharmacy Errordrug Topics on Android OS

People also ask

-

What is rettd and how does it relate to airSlate SignNow?

Rettd serves as a pivotal feature within airSlate SignNow, simplifying the process of sending and eSigning documents. This functionality enhances user experience by making document management more intuitive and efficient. By using rettd, businesses can streamline their workflows and improve overall productivity.

-

How does the pricing for rettd compare to other eSigning solutions?

AirSlate SignNow offers competitive pricing for rettd, providing a cost-effective solution compared to other eSigning services. Users can choose from flexible pricing plans tailored to different business needs, ensuring you get the most value. This makes rettd an excellent choice for businesses looking for affordability without compromising on quality.

-

What key features does rettd offer?

Rettd includes several robust features such as customizable templates, multi-party signing, and automated workflows. These features make it easier to manage documents and ensure that all signing parties receive notifications in a timely manner. With rettd, businesses can enhance their document management processes efficiently.

-

Can rettd integrate with other software solutions?

Yes, rettd can seamlessly integrate with various software solutions, including CRMs, project management tools, and cloud storage services. This integration capability allows for a unified experience, helping businesses to streamline their operations and workflows. By utilizing rettd, users can enhance their existing systems and maximize efficiency.

-

How does rettd improve security in document signing?

Rettd prioritizes document security through advanced encryption and authentication technologies. This ensures that all signed documents are kept safe and are only accessible to authorized parties. With rettd, businesses can confidently manage sensitive documents without worrying about security bsignNowes.

-

What benefits can businesses expect from using rettd?

By implementing rettd, businesses can expect enhanced efficiency, cost savings, and improved compliance. The user-friendly interface allows for quick adoption, minimizing training time and increasing productivity. Overall, rettd helps businesses focus on their core operations while simplifying document management.

-

Is customer support available for rettd users?

Absolutely! AirSlate SignNow provides comprehensive customer support for rettd users, including live chat, email support, and extensive online resources. The dedicated support team is ready to assist with any questions or technical issues. This commitment to customer satisfaction ensures a smooth experience for all users.

Get more for Maine Transfer Tax Declaration Form

- I e a college of tafe application forms png

- Stage movement and acting rules fort bend isd homepage form

- Mc 703 application for order to vacate prefiling order cebcom form

- Gc 040 form

- Tr 205 fillable editable and saveable california judicial council forms

- Fl 103 form

- Residency license verification certification of form

- 4h craft information card 4h member namecounty4h 6

Find out other Maine Transfer Tax Declaration Form

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation