Form 1098 C Instructions 2018

What is the Form 1098 C Instructions

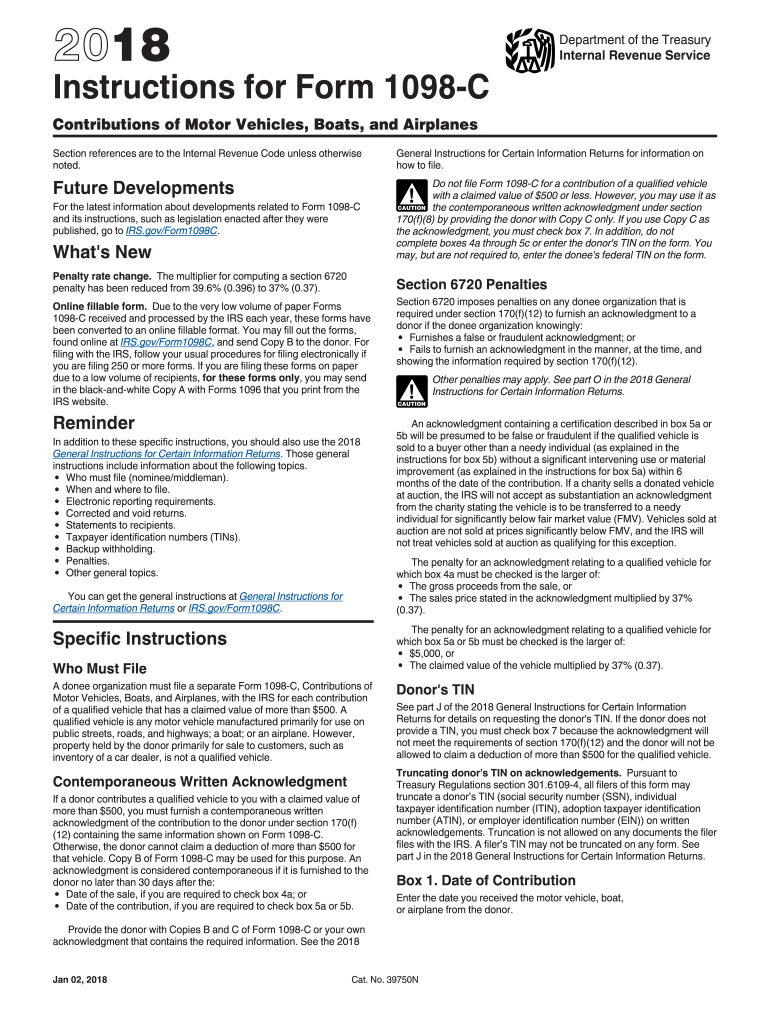

The Form 1098 C is an important document used by the Internal Revenue Service (IRS) for reporting contributions of vehicles, boats, and airplanes. This form provides essential information about the donation, including the vehicle identification number (VIN), the date of the contribution, and the fair market value of the donated item. It is primarily used by charities to inform donors about the value of their contributions for tax deduction purposes. Understanding the Form 1098 C instructions is crucial for both donors and charities to ensure compliance with IRS regulations.

How to use the Form 1098 C Instructions

Utilizing the Form 1098 C instructions involves several key steps. First, ensure you have the correct form, which can be obtained from the IRS website or through your tax preparation software. Next, carefully read the instructions provided with the form to understand the requirements for completing it accurately. Pay special attention to the sections detailing how to report the vehicle's details, the charity's information, and the donor's signature. Following these instructions will help ensure that the form is filled out correctly and submitted on time.

Steps to complete the Form 1098 C Instructions

Completing the Form 1098 C requires a systematic approach:

- Gather necessary documents, including the title of the vehicle and any relevant donation receipts.

- Fill in the donor's information, including name, address, and taxpayer identification number.

- Provide details about the donated vehicle, including the VIN, make, model, and year.

- Indicate the date of the contribution and the fair market value of the vehicle at the time of donation.

- Ensure the charity's information is accurate, including their name and address.

- Sign and date the form to validate the donation.

IRS Guidelines

The IRS has established specific guidelines for using Form 1098 C. According to the IRS, donors can claim a tax deduction for the fair market value of the vehicle donated, provided the charity sells the vehicle or uses it for its charitable purposes. It is essential to keep a copy of the completed form for your records and to provide the charity with a copy as well. Additionally, ensure that the form is submitted by the appropriate deadline to avoid any issues with tax deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1098 C are critical for ensuring compliance with IRS regulations. Typically, the form must be filed by the charity by the last day of February if filed by paper, or by March 31 if filed electronically. Donors should also be aware of their tax return deadlines, as the information on the Form 1098 C will be necessary for accurately reporting their charitable contributions. It is advisable to check the IRS website for any updates regarding deadlines each tax year.

Penalties for Non-Compliance

Failure to comply with the IRS requirements related to Form 1098 C can result in penalties for both the donor and the charity. Donors may lose the ability to claim a tax deduction for their contribution if the form is not completed correctly or submitted on time. Charities may face fines for failing to file the form or for providing incorrect information. Therefore, it is essential to adhere to all instructions and guidelines to avoid these potential penalties.

Quick guide on how to complete irs form 1098 c instructions 2018 2019

Complete Form 1098 C Instructions effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Form 1098 C Instructions on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric operation today.

The easiest way to modify and eSign Form 1098 C Instructions effortlessly

- Find Form 1098 C Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight essential sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1098 C Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1098 c instructions 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the irs form 1098 c instructions 2018 2019

How to generate an eSignature for the Irs Form 1098 C Instructions 2018 2019 in the online mode

How to create an eSignature for your Irs Form 1098 C Instructions 2018 2019 in Chrome

How to generate an electronic signature for signing the Irs Form 1098 C Instructions 2018 2019 in Gmail

How to create an electronic signature for the Irs Form 1098 C Instructions 2018 2019 from your smartphone

How to make an eSignature for the Irs Form 1098 C Instructions 2018 2019 on iOS

How to generate an eSignature for the Irs Form 1098 C Instructions 2018 2019 on Android

People also ask

-

What is the 2018 1098 C form PDF and why is it important?

The 2018 1098 C form PDF is a tax document required for reporting the amount of canceled debts. It's crucial for individuals and organizations to file this form accurately to ensure compliance with IRS regulations and avoid penalties.

-

How can I easily download the 2018 1098 C form PDF?

You can conveniently download the 2018 1098 C form PDF directly from the IRS website or through airSlate SignNow, which streamlines the document process. Our platform offers a user-friendly interface for accessing and managing your tax forms.

-

What features does airSlate SignNow offer for managing the 2018 1098 C form PDF?

airSlate SignNow provides features such as eSigning, templates, and document sharing, making it easier to manage your 2018 1098 C form PDF. With our secure platform, you can also track the status of your documents efficiently.

-

Is airSlate SignNow a cost-effective solution for handling the 2018 1098 C form PDF?

Yes, airSlate SignNow offers competitive pricing plans tailored to different business needs, making it a cost-effective solution for handling the 2018 1098 C form PDF. This efficiency helps you save both time and money on document processing.

-

Can I integrate airSlate SignNow with other software to manage the 2018 1098 C form PDF?

Absolutely! airSlate SignNow supports integration with various software applications, facilitating seamless management of your 2018 1098 C form PDF. This helps streamline your workflow and improves productivity across different platforms.

-

What are the benefits of using airSlate SignNow for the 2018 1098 C form PDF?

Using airSlate SignNow for your 2018 1098 C form PDF simplifies the signing and sharing process, ensuring documents are handled securely and quickly. This efficiency boosts your business's productivity and enhances client satisfaction.

-

How does airSlate SignNow ensure the security of the 2018 1098 C form PDF?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures for the protection of your 2018 1098 C form PDF. This means your sensitive information remains private and secure throughout the document signing process.

Get more for Form 1098 C Instructions

Find out other Form 1098 C Instructions

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure