Irs Form 1098 C Instructions 2012

What is the IRS Form 1098-C?

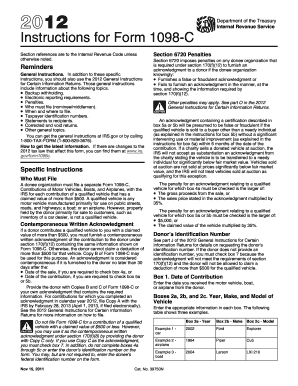

The IRS Form 1098-C is a tax document used by organizations to report contributions of motor vehicles, boats, and airplanes. This form is essential for donors who wish to claim a tax deduction for their charitable contributions. It provides the IRS with information about the donated property, including its fair market value and the date of the contribution. Understanding this form is crucial for ensuring compliance with IRS regulations and maximizing tax benefits related to charitable donations.

Steps to Complete the IRS Form 1098-C

Completing the IRS Form 1098-C involves several key steps:

- Gather necessary information about the donated vehicle, including the Vehicle Identification Number (VIN), make, model, and year.

- Determine the fair market value of the vehicle at the time of donation, which may require an appraisal.

- Fill out the form with accurate details, including the donor's name, address, and taxpayer identification number.

- Sign and date the form to certify the information provided is correct.

Once completed, the form must be provided to the donor and submitted to the IRS as required.

Legal Use of the IRS Form 1098-C

The IRS Form 1098-C is legally binding when completed accurately and submitted according to IRS guidelines. It serves as proof of the donation, allowing taxpayers to claim deductions on their income tax returns. To ensure legal compliance, organizations must provide this form to donors who contribute vehicles valued at more than five hundred dollars. Failure to provide the form or inaccuracies in the information can lead to penalties or disallowed deductions.

Filing Deadlines for the IRS Form 1098-C

Filing deadlines for the IRS Form 1098-C are crucial for both donors and organizations. The organization must provide the completed form to the donor by January thirty-first of the year following the donation. Additionally, the organization must file the form with the IRS by the last day of February if filing by paper, or March thirty-first if filing electronically. Adhering to these deadlines is essential to avoid penalties and ensure that donors can claim their deductions on time.

Who Issues the IRS Form 1098-C?

The IRS Form 1098-C is issued by qualified charitable organizations that receive vehicle donations. These organizations must be recognized by the IRS as tax-exempt under section 501(c)(3) of the Internal Revenue Code. When a donor contributes a vehicle, the organization is responsible for completing and providing the form to the donor, ensuring all necessary information is accurately reported.

Examples of Using the IRS Form 1098-C

Examples of using the IRS Form 1098-C include:

- A taxpayer donates a car valued at three thousand dollars to a local charity. The charity provides the donor with Form 1098-C, allowing the taxpayer to claim a deduction on their tax return.

- A nonprofit organization receives a boat as a donation. After appraising the boat's value, the organization completes Form 1098-C and submits it to the IRS while giving a copy to the donor.

These examples illustrate how the form facilitates the tax deduction process for both donors and charitable organizations.

Quick guide on how to complete irs form 1098 c instructions 2012

Effortlessly prepare Irs Form 1098 C Instructions on any device

The management of documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without waiting. Handle Irs Form 1098 C Instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Irs Form 1098 C Instructions with ease

- Obtain Irs Form 1098 C Instructions and hit Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your delivery method for the form—by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 1098 C Instructions and guarantee outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1098 c instructions 2012

Create this form in 5 minutes!

How to create an eSignature for the irs form 1098 c instructions 2012

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What are the Irs Form 1098 C Instructions?

The Irs Form 1098 C Instructions detail how to properly complete and submit the Form 1098-C, which is used for reporting contributions of motor vehicles, boats, and airplanes. This form is essential for both donors and charitable organizations to document the fair market value of contributions. For detailed guidance, refer to the official IRS publication or consult our resources.

-

How can airSlate SignNow assist with Irs Form 1098 C Instructions?

airSlate SignNow provides an efficient platform for handling Irs Form 1098 C Instructions by allowing users to upload, eSign, and send the form digitally. This streamlines the filing process and ensures that all necessary signatures are obtained promptly. Using our service can enhance compliance and reduce the risk of errors in submission.

-

Is there a cost associated with using airSlate SignNow for eSigning Irs Form 1098 C?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when handling documents like Irs Form 1098 C Instructions. Each plan includes features such as document templates, multiple user access, and integration capabilities. We ensure that our pricing remains transparent and competitive to accommodate all users.

-

What features does airSlate SignNow offer for handling IRS forms?

airSlate SignNow includes features like customizable templates, in-app notifications, and secure cloud storage, specifically designed to manage documents such as Irs Form 1098 C Instructions efficiently. Our advanced tracking features let users monitor the status of their submissions and ensure timely responses. The platform is designed for ease of use, making compliance straightforward.

-

Can I integrate airSlate SignNow with other software for IRS form submission?

Yes, airSlate SignNow supports integrations with various software tools, allowing seamless workflows for managing Irs Form 1098 C Instructions. Popular integrations include CRM systems, cloud storage solutions, and project management tools. This functionality enhances productivity and ensures that all documents are easily accessible and organized.

-

What benefits can I expect when using airSlate SignNow for IRS documents?

When using airSlate SignNow for managing IRS documents like Irs Form 1098 C Instructions, you can expect improved efficiency through digital signing, reduced paper usage, and fewer errors. Our platform also increases document security with encryption and audit trails, ensuring that sensitive information is protected. This streamlined approach saves time and enhances your organization’s productivity.

-

How does airSlate SignNow ensure the security of my IRS forms?

airSlate SignNow prioritizes security by implementing advanced encryption protocols and secure cloud storage for all documents, including Irs Form 1098 C Instructions. We also offer multi-factor authentication and detailed audit trails to track document access and modifications. This ensures that your sensitive information remains protected throughout the signing process.

Get more for Irs Form 1098 C Instructions

- Assignment of security deed corporate mortgage holder georgia form

- Property security deed form

- G a 44 497303764 form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property georgia form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497303767 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property georgia form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential georgia form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property georgia form

Find out other Irs Form 1098 C Instructions

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document