Irs Instructions Schedule R Form 2018

What is the IRS Instructions Schedule R Form

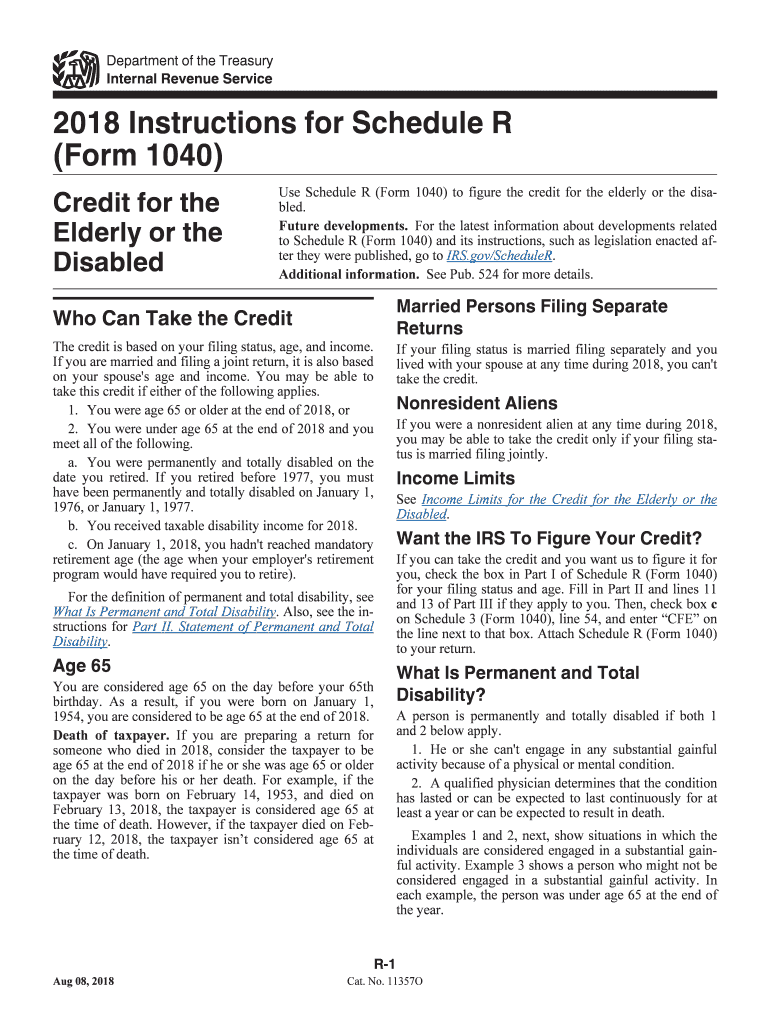

The IRS Instructions Schedule R form is a crucial document for taxpayers who are eligible for certain tax credits related to retirement income. This form assists individuals in calculating the amount of their pension and annuity income that may be exempt from taxation. Understanding the specifics of this form is essential for ensuring compliance with tax regulations and maximizing potential benefits.

Steps to Complete the IRS Instructions Schedule R Form

Completing the IRS Instructions Schedule R form involves several key steps:

- Gather necessary documentation, including details of your pension and annuity income.

- Review the eligibility criteria to ensure you qualify for the exemptions.

- Fill out the form accurately, following the provided instructions for each section.

- Double-check your calculations to confirm the amounts reported are correct.

- Submit the completed form along with your federal tax return.

Legal Use of the IRS Instructions Schedule R Form

The IRS Instructions Schedule R form is legally binding when filled out correctly and submitted as part of your tax return. To ensure its legal standing, it is important to adhere to the guidelines set forth by the IRS, including accurate reporting of income and compliance with submission deadlines. Any discrepancies or inaccuracies may lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Instructions Schedule R form typically align with the annual tax return deadline. For most taxpayers, this is April 15 of the following year. It is important to be aware of any extensions or changes to these dates, especially in light of special circumstances that may arise. Keeping track of these deadlines ensures timely submission and avoids potential penalties.

Required Documents

To complete the IRS Instructions Schedule R form, you will need several key documents:

- Your previous year’s tax return for reference.

- Documentation of all pension and annuity income received.

- Any relevant statements from retirement plans or annuities.

- Proof of eligibility for any exemptions claimed.

Eligibility Criteria

Eligibility for using the IRS Instructions Schedule R form typically includes being a taxpayer receiving pension or annuity income. Specific criteria may vary based on age, income level, and the source of retirement income. It is advisable to review the IRS guidelines to confirm your eligibility before proceeding with the form.

Quick guide on how to complete 2018 instructions for schedule rform 1040 2018 instructions for schedule r form 1040 credit for the elderly or the disabled

Prepare Irs Instructions Schedule R Form seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an exceptional eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents swiftly without delays. Manage Irs Instructions Schedule R Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Irs Instructions Schedule R Form effortlessly

- Locate Irs Instructions Schedule R Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Instructions Schedule R Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 instructions for schedule rform 1040 2018 instructions for schedule r form 1040 credit for the elderly or the disabled

Create this form in 5 minutes!

How to create an eSignature for the 2018 instructions for schedule rform 1040 2018 instructions for schedule r form 1040 credit for the elderly or the disabled

How to make an eSignature for the 2018 Instructions For Schedule Rform 1040 2018 Instructions For Schedule R Form 1040 Credit For The Elderly Or The Disabled in the online mode

How to generate an electronic signature for the 2018 Instructions For Schedule Rform 1040 2018 Instructions For Schedule R Form 1040 Credit For The Elderly Or The Disabled in Chrome

How to create an eSignature for putting it on the 2018 Instructions For Schedule Rform 1040 2018 Instructions For Schedule R Form 1040 Credit For The Elderly Or The Disabled in Gmail

How to generate an eSignature for the 2018 Instructions For Schedule Rform 1040 2018 Instructions For Schedule R Form 1040 Credit For The Elderly Or The Disabled straight from your mobile device

How to generate an eSignature for the 2018 Instructions For Schedule Rform 1040 2018 Instructions For Schedule R Form 1040 Credit For The Elderly Or The Disabled on iOS

How to create an electronic signature for the 2018 Instructions For Schedule Rform 1040 2018 Instructions For Schedule R Form 1040 Credit For The Elderly Or The Disabled on Android devices

People also ask

-

What are the key features of airSlate SignNow for managing 2018 Schedule R instructions?

AirSlate SignNow provides essential features for managing 2018 Schedule R instructions, including document creation, eSignature capabilities, and real-time collaboration. Users can easily customize templates specifically for tax purposes, ensuring they meet the requirements set forth in the 2018 Schedule R instructions. This user-friendly platform simplifies compliance while maintaining a secure environment for sensitive information.

-

How does airSlate SignNow help with compliance regarding 2018 Schedule R instructions?

Using airSlate SignNow ensures compliance with 2018 Schedule R instructions by providing legally binding eSignatures and a comprehensive audit trail. This platform allows users to track document status and obtain necessary approvals, reducing the risk of errors in tax filings. By adhering to the guidelines of the 2018 Schedule R instructions, businesses can confidently manage their tax documentation.

-

What pricing plans does airSlate SignNow offer for businesses needing 2018 Schedule R instructions?

AirSlate SignNow offers flexible pricing plans tailored to businesses of all sizes which need to handle 2018 Schedule R instructions effectively. These plans include various levels of access to features, such as document templates and integrations, with competitive pricing designed to suit different budgets. Users can choose from monthly or annual subscriptions depending on their specific needs.

-

Can I integrate airSlate SignNow with other software for handling 2018 Schedule R instructions?

Yes, airSlate SignNow provides integrations with a variety of popular business software applications, making it easier to manage your 2018 Schedule R instructions. Whether it's accounting software or customer management systems, users can streamline workflows and ensure all needed documents are accessible. This enhances productivity and supports efficient tax processing.

-

Is airSlate SignNow suitable for small businesses managing 2018 Schedule R instructions?

Absolutely! AirSlate SignNow is designed to be user-friendly and affordable, making it an excellent choice for small businesses managing 2018 Schedule R instructions. The platform's intuitive interface and comprehensive features allow small teams to easily prepare, sign, and send necessary documents without overwhelming costs or complexity.

-

What are the benefits of using airSlate SignNow for 2018 Schedule R instructions?

The benefits of using airSlate SignNow for 2018 Schedule R instructions include improved efficiency, cost savings, and enhanced security. With electronic signatures and quick document turnaround, businesses can avoid delays during tax season. Additionally, airSlate SignNow encrypts sensitive information, ensuring that your compliance with the 2018 Schedule R instructions remains secure.

-

How easy is it to use airSlate SignNow for the 2018 Schedule R instructions?

AirSlate SignNow is designed with users in mind, offering an easy-to-navigate interface that simplifies the process of managing 2018 Schedule R instructions. Users can quickly create, send, and sign documents with just a few clicks, even without prior experience in eSignature platforms. This ease of use reduces the learning curve, allowing businesses to focus more on their tasks.

Get more for Irs Instructions Schedule R Form

- Ejection form

- Form demlrdwq dwq demlr monitoring

- Iowa pre participation physical form 2012

- Congressional aide program application completed gscnc form

- Application for gas service line approval colorado springs utilities csu form

- Application form for approval as an iata passenger sales agent

- Job safety analysis form

- Vision screeening form

Find out other Irs Instructions Schedule R Form

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template