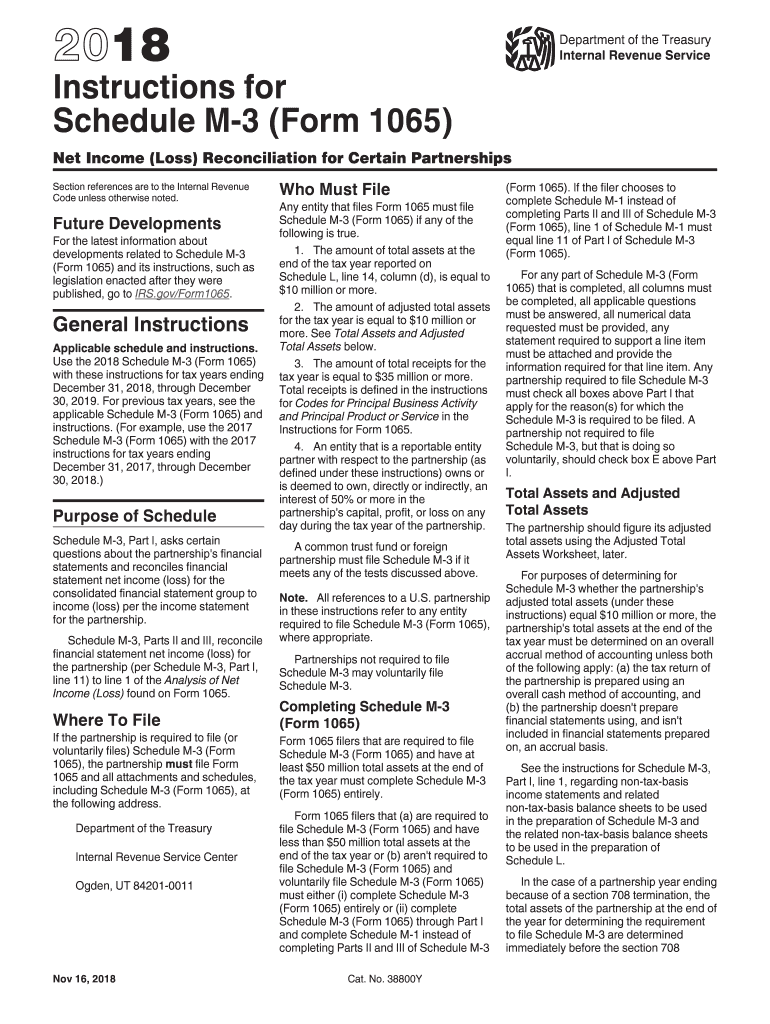

Irs Form 1065 Instructions 2018

What is the IRS Form 1065 Instructions?

The IRS Form 1065 instructions provide detailed guidance for partnerships on how to complete and file Form 1065, the U.S. Return of Partnership Income. This form is essential for reporting the income, deductions, gains, and losses from the operation of a partnership. The instructions clarify the information required, including how to report each partner's share of income and deductions. Understanding these instructions is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

Steps to Complete the IRS Form 1065 Instructions

Completing the IRS Form 1065 involves several key steps:

- Gather all necessary financial records, including income statements, expense receipts, and partner information.

- Fill out the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report income and deductions on the appropriate lines of the form, ensuring accuracy and completeness.

- Allocate income, deductions, and credits to each partner according to the partnership agreement.

- Review the completed form for accuracy before submission.

Legal Use of the IRS Form 1065 Instructions

The IRS Form 1065 instructions are legally binding documents that provide the framework for how partnerships must report their income and expenses. Following these instructions ensures compliance with federal tax laws. Partnerships must adhere to the guidelines outlined in the instructions to avoid issues with the IRS, including audits or penalties for incorrect filings. Proper use of the form and adherence to the instructions can also protect partnerships from legal complications related to tax reporting.

Filing Deadlines / Important Dates

Partnerships must file Form 1065 by the 15th day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the deadline is typically March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important for partnerships to be aware of these deadlines to avoid late filing penalties, which can accumulate quickly.

Required Documents

To complete the IRS Form 1065, partnerships must gather several key documents:

- Financial statements, including profit and loss statements.

- Records of all income and expenses for the tax year.

- Partnership agreement outlining the distribution of income and expenses among partners.

- Identification information for each partner, including Social Security Numbers or EINs.

Form Submission Methods (Online / Mail / In-Person)

Partnerships can submit Form 1065 through various methods. The form can be filed electronically using IRS e-file services, which is often faster and allows for immediate confirmation of receipt. Alternatively, partnerships may choose to mail a paper copy of the form to the appropriate IRS address based on their location. In-person submission is generally not available for Form 1065, making electronic filing or mail the primary options for compliance.

Quick guide on how to complete 2018 instructions for schedule m 3 form 1065 instructions for schedule m 3 form 1065 net income loss reconciliation for certain

Effortlessly prepare Irs Form 1065 Instructions on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 1065 Instructions on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign Irs Form 1065 Instructions with ease

- Obtain Irs Form 1065 Instructions and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and eSign Irs Form 1065 Instructions and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 instructions for schedule m 3 form 1065 instructions for schedule m 3 form 1065 net income loss reconciliation for certain

Create this form in 5 minutes!

How to create an eSignature for the 2018 instructions for schedule m 3 form 1065 instructions for schedule m 3 form 1065 net income loss reconciliation for certain

How to create an electronic signature for your 2018 Instructions For Schedule M 3 Form 1065 Instructions For Schedule M 3 Form 1065 Net Income Loss Reconciliation For Certain in the online mode

How to make an electronic signature for the 2018 Instructions For Schedule M 3 Form 1065 Instructions For Schedule M 3 Form 1065 Net Income Loss Reconciliation For Certain in Chrome

How to generate an electronic signature for signing the 2018 Instructions For Schedule M 3 Form 1065 Instructions For Schedule M 3 Form 1065 Net Income Loss Reconciliation For Certain in Gmail

How to create an eSignature for the 2018 Instructions For Schedule M 3 Form 1065 Instructions For Schedule M 3 Form 1065 Net Income Loss Reconciliation For Certain right from your smart phone

How to generate an eSignature for the 2018 Instructions For Schedule M 3 Form 1065 Instructions For Schedule M 3 Form 1065 Net Income Loss Reconciliation For Certain on iOS devices

How to create an electronic signature for the 2018 Instructions For Schedule M 3 Form 1065 Instructions For Schedule M 3 Form 1065 Net Income Loss Reconciliation For Certain on Android

People also ask

-

What are the 990 T Schedule M instructions 2018?

The 990 T Schedule M instructions 2018 provide detailed guidance on how to report unrelated business income for tax-exempt organizations. This schedule includes line-by-line instructions that help you accurately complete your tax filings. Understanding these instructions is crucial for compliance and to avoid potential penalties.

-

How does airSlate SignNow simplify the eSigning process for 990 T Schedule M instructions 2018?

airSlate SignNow offers an intuitive platform that streamlines the eSigning process for your 990 T Schedule M instructions 2018 documents. With automated workflows and templates, you can quickly prepare, send, and obtain signatures on important tax documents. This ensures your filings are completed efficiently and securely.

-

What are the pricing options for using airSlate SignNow for 990 T Schedule M instructions 2018?

AirSlate SignNow provides flexible pricing plans to accommodate various business needs, ensuring you can manage your 990 T Schedule M instructions 2018 without breaking your budget. Plans include features tailored for individual and team usage, making it cost-effective for organizations of any size. You can also try a free trial to explore the platform before committing.

-

Can airSlate SignNow integrate with other tools to manage 990 T Schedule M instructions 2018?

Yes, airSlate SignNow seamlessly integrates with a variety of applications that can help you manage the 990 T Schedule M instructions 2018. By connecting with platforms like Google Drive, Dropbox, and CRM systems, you can streamline document storage and enhance organizational efficiency. These integrations support a smooth workflow for handling important tax documents.

-

What benefits does airSlate SignNow offer when handling 990 T Schedule M instructions 2018?

Using airSlate SignNow for your 990 T Schedule M instructions 2018 documents provides numerous benefits, including enhanced security, compliance tracking, and improved collaboration among team members. The easy-to-use interface allows for quick modifications and electronic signatures, making the filing process faster and less error-prone. This can result in signNow time and cost savings for your organization.

-

Is airSlate SignNow compliant with legal requirements when signing 990 T Schedule M instructions 2018?

Absolutely! airSlate SignNow complies with all necessary legal standards for electronic signatures, ensuring that your signed 990 T Schedule M instructions 2018 documents are valid and enforceable. With features like audit trails and secure storage, you can have peace of mind knowing that your transactions are legally protected. This compliance is essential for maintaining the integrity of your tax filings.

-

How can I get support for using airSlate SignNow with 990 T Schedule M instructions 2018?

AirSlate SignNow offers robust customer support to assist you in using the platform for your 990 T Schedule M instructions 2018. You can access various resources including guides, FAQs, and direct support through chat or email. Their dedicated support team is ready to help you navigate any challenges you may encounter during your document management process.

Get more for Irs Form 1065 Instructions

- Scissor lift training certification form tntech

- Property inventory form greene county missouri greenecountymo

- Verification form v1 financial aid texas tech university

- Scatter plot assessment tool date name of person observed form

- Personal statement virginia military institute admissions form

- Swppp inspection form boonecountymo

- Schwab contribution transmittal form

- Minnesota notarized form

Find out other Irs Form 1065 Instructions

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free