CERTIFICATION of REASONS for WHICH the TAXPAYER is NOT Hacienda Pr 2015

What is the certification of reasons for which the taxpayer is not Hacienda Pr

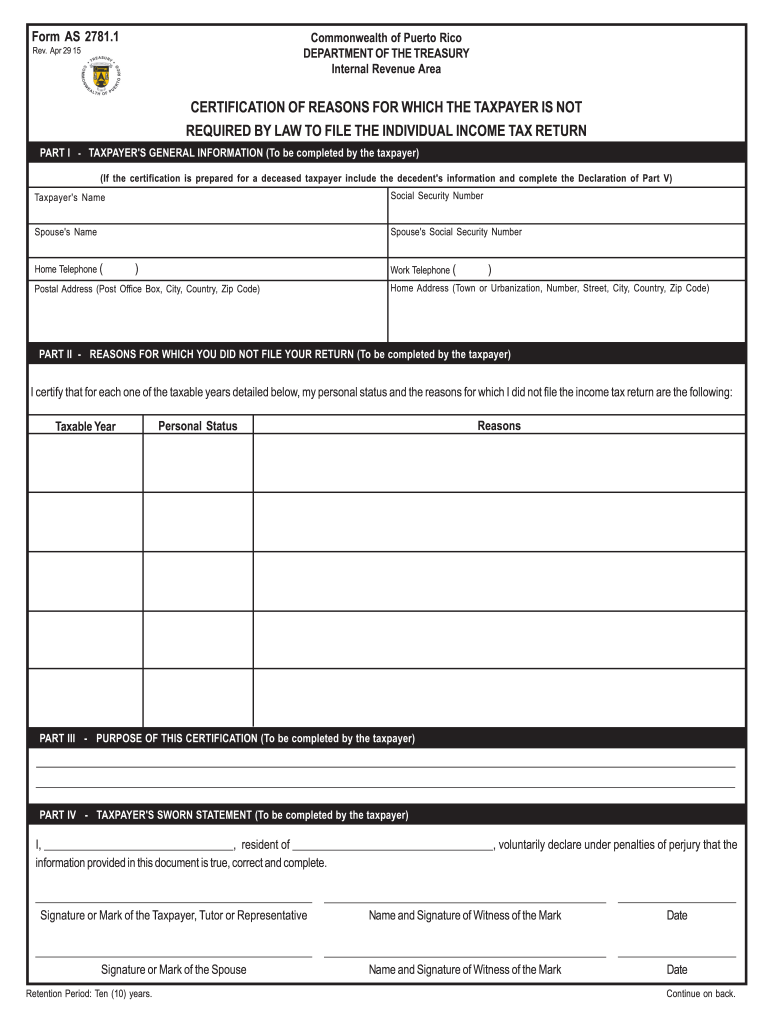

The certification of reasons for which the taxpayer is not Hacienda Pr is an official document used to explain why a taxpayer does not owe any taxes to the Hacienda, or tax authority. This form is essential for individuals or businesses who need to clarify their tax status, especially when engaging in financial transactions or applying for loans. It serves as a formal declaration that the taxpayer is not liable for specific tax obligations, which can be crucial for compliance and transparency in financial dealings.

How to use the certification of reasons for which the taxpayer is not Hacienda Pr

Using the certification of reasons for which the taxpayer is not Hacienda Pr involves several steps. First, the taxpayer should gather all necessary information regarding their tax situation, including any relevant documentation that supports their claim. Next, they must accurately fill out the form, ensuring all fields are completed to avoid delays. Once completed, the form can be submitted to the appropriate authority or used in financial transactions where proof of tax status is required. Utilizing electronic signature tools can streamline this process, making it easier to send and sign the document securely.

Steps to complete the certification of reasons for which the taxpayer is not Hacienda Pr

Completing the certification of reasons for which the taxpayer is not Hacienda Pr involves a systematic approach:

- Gather all necessary tax documents and information.

- Access the certification form through the appropriate channels.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign the form electronically or manually, depending on the submission method.

- Submit the form to the relevant tax authority or use it as needed in financial transactions.

Key elements of the certification of reasons for which the taxpayer is not Hacienda Pr

Several key elements are essential in the certification of reasons for which the taxpayer is not Hacienda Pr. These include:

- Taxpayer Information: Full name, address, and taxpayer identification number.

- Reason for Certification: A clear explanation of why the taxpayer is not liable for taxes.

- Supporting Documentation: Any relevant documents that substantiate the taxpayer's claims.

- Signature: The taxpayer's signature, confirming the accuracy of the information provided.

Legal use of the certification of reasons for which the taxpayer is not Hacienda Pr

The legal use of the certification of reasons for which the taxpayer is not Hacienda Pr is significant in various contexts. This document can be used as evidence in legal proceedings or financial transactions to demonstrate a taxpayer's compliance with tax laws. It may also be required when applying for loans or grants, where proof of tax status is necessary. Ensuring that the certification is completed accurately and submitted on time helps maintain legal standing and avoids potential penalties.

Filing deadlines and important dates

Filing deadlines for the certification of reasons for which the taxpayer is not Hacienda Pr can vary based on individual circumstances and the specific requirements of the tax authority. It is crucial for taxpayers to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or complications in financial transactions. Taxpayers should consult the relevant tax authority or a tax professional for specific dates and requirements related to their situation.

Quick guide on how to complete certification of reasons for which the taxpayer is not hacienda pr

Complete CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr across any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr without hassle

- Obtain CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Select important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Decide how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form retrieval, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr and guarantee outstanding communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct certification of reasons for which the taxpayer is not hacienda pr

Create this form in 5 minutes!

How to create an eSignature for the certification of reasons for which the taxpayer is not hacienda pr

How to make an eSignature for your Certification Of Reasons For Which The Taxpayer Is Not Hacienda Pr online

How to generate an eSignature for the Certification Of Reasons For Which The Taxpayer Is Not Hacienda Pr in Chrome

How to make an electronic signature for signing the Certification Of Reasons For Which The Taxpayer Is Not Hacienda Pr in Gmail

How to generate an eSignature for the Certification Of Reasons For Which The Taxpayer Is Not Hacienda Pr straight from your smart phone

How to make an electronic signature for the Certification Of Reasons For Which The Taxpayer Is Not Hacienda Pr on iOS

How to create an eSignature for the Certification Of Reasons For Which The Taxpayer Is Not Hacienda Pr on Android

People also ask

-

What is the CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr?

The CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr is an essential document that outlines the specific reasons a taxpayer may not be subject to local tax obligations. This certification can help clarify tax statuses and ensure compliance with regulations. It's crucial for individuals and businesses navigating tax exemptions in Puerto Rico.

-

How can airSlate SignNow assist with the certification process?

airSlate SignNow offers a streamlined solution for managing the CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr. You can easily prepare, send, and eSign necessary documents, all from one platform. This reduces hassle and helps ensure that all paperwork is completed efficiently and accurately.

-

Is there a cost associated with obtaining the CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr through airSlate SignNow?

While airSlate SignNow provides an affordable solution for document management, the cost associated with obtaining the CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr may vary based on the specific service packages. Ensure you review our pricing plans to find a cost-effective solution tailored to your needs.

-

What are the key features of airSlate SignNow for processing certifications?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time document tracking that are particularly useful for processing the CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr. These features simplify document management while ensuring that all certifications are legally binding and easily accessible.

-

Can airSlate SignNow integrate with other software for certification management?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for the CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr. By integrating with popular tools like CRM systems and cloud storage services, you can manage all your documentation processes without interruption.

-

What benefits does airSlate SignNow offer for businesses dealing with tax certifications?

Using airSlate SignNow for the CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr provides numerous benefits, including increased efficiency and reduced paperwork. The platform's user-friendly interface makes it easy to manage documents, leading to faster sign-offs and improved compliance. Additionally, the cost-saving features make it a viable choice for businesses of all sizes.

-

How does airSlate SignNow ensure the security of my certification documents?

airSlate SignNow prioritizes security by employing advanced encryption methods to protect your documents, including the CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr. We implement robust authentication measures and ensure compliance with data protection laws to maintain the confidentiality of your sensitive information.

Get more for CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr

Find out other CERTIFICATION OF REASONS FOR WHICH THE TAXPAYER IS NOT Hacienda Pr

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe