D400 2019-2026

What is the D400?

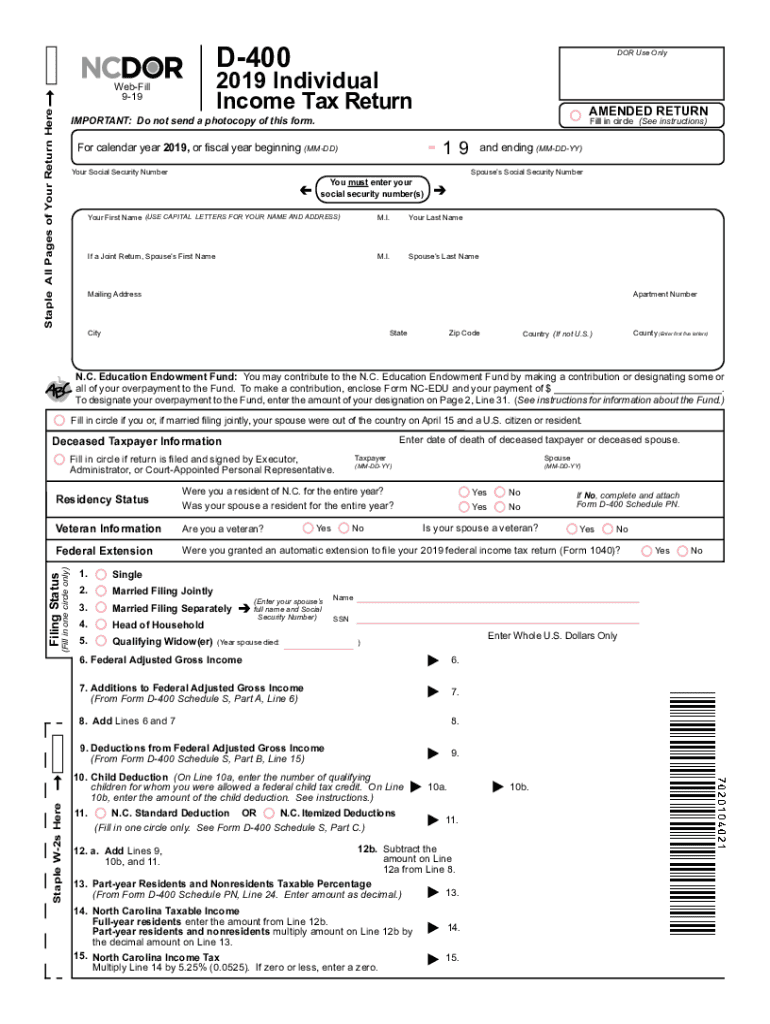

The D400 is a North Carolina state tax form used for filing individual income taxes. Specifically, it is designed for residents who need to report their income, calculate their tax liability, and claim any applicable credits or deductions. The form is essential for ensuring compliance with state tax regulations and is part of the broader set of 2016 NC state tax forms.

How to use the D400

To use the D400 effectively, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any records of deductions. The form requires detailed information about income sources, filing status, and any tax credits being claimed. It is crucial to fill out the form accurately to avoid delays in processing and potential penalties.

Steps to complete the D400

Completing the D400 involves several key steps:

- Gather all relevant financial documents.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Calculate your total income and determine your tax liability using the provided tax tables.

- Claim any deductions and credits for which you qualify.

- Review the form for accuracy before submitting.

Legal use of the D400

The D400 is legally binding when completed and submitted according to North Carolina tax laws. It must be signed and dated by the taxpayer to certify that the information provided is accurate and complete. Failure to file the D400 or inaccuracies in the form can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

For the 2016 tax year, the deadline to file the D400 was typically April 15, 2017. It is important for taxpayers to be aware of any extensions or changes to filing deadlines, as these can affect compliance and potential penalties. Keeping track of these dates ensures timely submission and avoids unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

The D400 can be submitted through various methods. Taxpayers have the option to file online using approved e-filing services, which can expedite the processing time. Alternatively, the form can be mailed to the appropriate state tax office or submitted in person at designated locations. Each method has its own advantages, such as convenience or immediate confirmation of receipt.

Quick guide on how to complete north carolina form d 400 individual income tax return

Effortlessly Prepare D400 on Any Device

Managing documents online has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Handle D400 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

Easily Modify and eSign D400

- Obtain D400 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes seconds and possesses the same legal force as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method of submitting your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign D400 to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct north carolina form d 400 individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the north carolina form d 400 individual income tax return

How to make an eSignature for the North Carolina Form D 400 Individual Income Tax Return in the online mode

How to generate an electronic signature for your North Carolina Form D 400 Individual Income Tax Return in Google Chrome

How to create an electronic signature for putting it on the North Carolina Form D 400 Individual Income Tax Return in Gmail

How to make an eSignature for the North Carolina Form D 400 Individual Income Tax Return straight from your mobile device

How to create an electronic signature for the North Carolina Form D 400 Individual Income Tax Return on iOS

How to generate an eSignature for the North Carolina Form D 400 Individual Income Tax Return on Android OS

People also ask

-

What is the nc d400 and how does it benefit my business?

The nc d400 is an advanced eSignature solution designed to streamline document signing processes. By using nc d400, businesses can enhance efficiency, reduce turnaround times, and ensure a seamless experience for clients and team members alike.

-

How much does the nc d400 service cost?

The pricing for the nc d400 service is competitive and offers various plans to suit different business needs. Depending on the features required, businesses can choose a plan that provides the best value while maximizing the benefits of electronic signatures.

-

What features are included with the nc d400?

The nc d400 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features allow businesses to easily manage their document workflows and ensure compliance with legal signing requirements.

-

Is the nc d400 easy to integrate with other software?

Yes, the nc d400 is designed to easily integrate with various software applications like CRM systems and document management tools. This capability enhances productivity as users can seamlessly incorporate the nc d400 into their existing workflows.

-

Can I use the nc d400 for mobile document signing?

Absolutely, the nc d400 supports mobile document signing, allowing users to sign documents anytime and anywhere. This feature is particularly beneficial for businesses with remote teams or clients who may not be at their desks.

-

What security measures does the nc d400 offer?

The nc d400 prioritizes security with advanced encryption and compliance with eSignature laws like ESIGN and UETA. This ensures that all documents signed using the nc d400 are safe and legally binding.

-

How can the nc d400 improve my document workflow?

The nc d400 can signNowly improve your document workflow by automating repetitive tasks and reducing the time spent on manual signatures. This leads to improved efficiency, allowing your team to focus on more strategic objectives.

Get more for D400

- Kettering student application job shadowing form

- Maryland higher education commission transcript request form aacc

- How to fill out education reimbursement form for nissan

- Gs1 membership subscription termination form gs1 australia gs1au

- Pptc 191 demande de document de voyage pour adultes demande de document de voyage pour adultes ca2008 voila form

- Energy transformations and conservation answer key

- National sunday school lesson form

- Unlawful activity addendum 24 power associates form

Find out other D400

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement