New Mexico Fyi 104 2020

What is the New Mexico FYI 104?

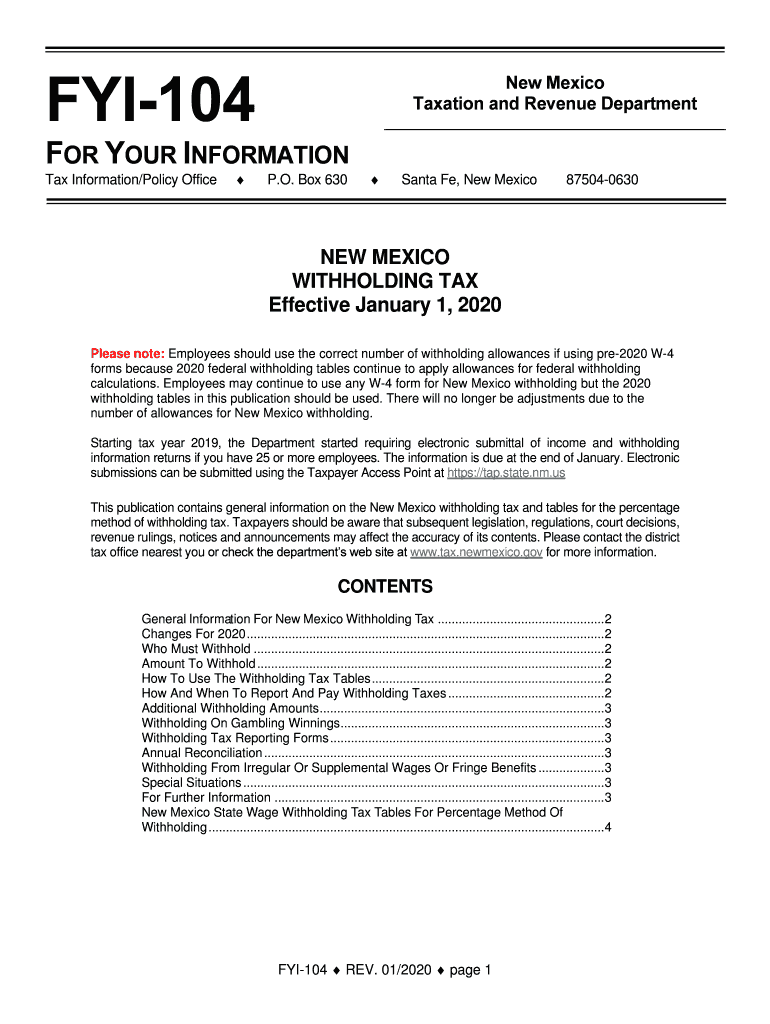

The New Mexico FYI 104 is a crucial document used for reporting state income tax withholding. This form is specifically designed for employers to report the amount of state income tax withheld from employees' wages during the tax year. It serves as an official record for both the employer and the state, ensuring compliance with New Mexico tax regulations. Understanding the purpose of the FYI 104 is essential for accurate tax reporting and maintaining proper payroll records.

How to use the New Mexico FYI 104

Using the New Mexico FYI 104 involves several steps to ensure accurate reporting of withheld taxes. Employers must first gather all necessary payroll information, including total wages paid and the amount of state tax withheld for each employee. Once this data is compiled, it can be entered into the FYI 104 form. It is important to double-check all entries for accuracy, as errors can lead to compliance issues. After completing the form, employers can submit it electronically or via mail, depending on their preference and the state’s guidelines.

Steps to complete the New Mexico FYI 104

Completing the New Mexico FYI 104 requires a systematic approach. Follow these steps:

- Gather employee payroll records for the tax year.

- Calculate the total state income tax withheld from each employee's wages.

- Fill out the FYI 104 form with the collected data, ensuring all fields are accurately completed.

- Review the form for any errors or omissions.

- Submit the completed form to the New Mexico Taxation and Revenue Department by the specified deadline.

Legal use of the New Mexico FYI 104

The New Mexico FYI 104 is legally binding when filled out and submitted according to state regulations. Employers must ensure that the information provided is truthful and accurate, as any discrepancies can result in penalties or audits. The form must be filed by the due date to avoid late fees. Additionally, maintaining copies of submitted forms is advisable for record-keeping and potential future reference.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the New Mexico FYI 104. Typically, the form is due on the last day of the month following the end of the tax year. For example, if the tax year ends on December 31, the FYI 104 must be filed by January 31 of the following year. It is essential to stay informed about any changes to these deadlines, as they can vary from year to year.

Form Submission Methods

The New Mexico FYI 104 can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online submission through the New Mexico Taxation and Revenue Department's website.

- Mailing a physical copy of the completed form to the appropriate state office.

- In-person submission at designated state tax offices.

Employers should choose the method that best suits their operational needs while ensuring compliance with state requirements.

Quick guide on how to complete fyi 104 nm trd

Effortlessly prepare New Mexico Fyi 104 on any device

Digital document management has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage New Mexico Fyi 104 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign New Mexico Fyi 104 with ease

- Find New Mexico Fyi 104 and click Get Form to begin.

- Utilize the resources we offer to finalize your document.

- Emphasize key sections of your documents or redact sensitive information with tools provided specifically by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to store your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign New Mexico Fyi 104 to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fyi 104 nm trd

Create this form in 5 minutes!

How to create an eSignature for the fyi 104 nm trd

How to make an electronic signature for your Fyi 104 Nm Trd online

How to make an electronic signature for your Fyi 104 Nm Trd in Chrome

How to generate an electronic signature for putting it on the Fyi 104 Nm Trd in Gmail

How to create an eSignature for the Fyi 104 Nm Trd from your smart phone

How to make an eSignature for the Fyi 104 Nm Trd on iOS devices

How to create an eSignature for the Fyi 104 Nm Trd on Android devices

People also ask

-

What are New Mexico state tax forms 2018?

New Mexico state tax forms 2018 are the official documents required by the New Mexico Taxation and Revenue Department for filing state income taxes. These forms are essential for individuals and businesses to report their income, claim deductions, and ensure compliance with state tax laws in New Mexico for the tax year 2018.

-

How can airSlate SignNow help with New Mexico state tax forms 2018?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send New Mexico state tax forms 2018. With its user-friendly interface, users can quickly prepare and manage their tax documents, ensuring a smooth filing process.

-

Are there any fees associated with using airSlate SignNow for New Mexico state tax forms 2018?

Yes, airSlate SignNow offers flexible pricing plans to meet various needs, including sending and signing New Mexico state tax forms 2018. Users can choose from different subscription levels, ensuring they find a cost-effective solution that suits their budget and requirements.

-

Can I integrate airSlate SignNow with other software for New Mexico state tax forms 2018?

AirSlate SignNow allows seamless integrations with numerous applications, enhancing your experience while working with New Mexico state tax forms 2018. You can connect it with accounting software and cloud storage platforms to streamline your document management process.

-

What are the key features of airSlate SignNow for managing New Mexico state tax forms 2018?

Key features of airSlate SignNow include customizable templates, an intuitive drag-and-drop editor, automated reminders, and secure storage. These functionalities make it easier to create, send, and sign New Mexico state tax forms 2018 efficiently and securely.

-

Is airSlate SignNow suitable for both individuals and businesses handling New Mexico state tax forms 2018?

Absolutely! AirSlate SignNow is designed to cater to both individuals and businesses dealing with New Mexico state tax forms 2018. Its scalable solutions ensure that different users can access the features they need regardless of size or complexity.

-

What benefits does airSlate SignNow offer for eSigning New Mexico state tax forms 2018?

Using airSlate SignNow to eSign New Mexico state tax forms 2018 offers signNow benefits such as time savings, enhanced security, and ease of use. Users can sign documents from anywhere, minimizing delays and improving collaboration during the tax filing process.

Get more for New Mexico Fyi 104

- Consumer math workbook answers form

- Dog license application the town of lysander new york form

- Prds real estate purchase contract wikidownload form

- Af form 709

- Income and expense statement hawaii state judiciary courts state hi form

- Sgfleet claim form

- Autism funding reimbursement form

- Year to date profit and loss statement form

Find out other New Mexico Fyi 104

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application