Quarterly Wage Report Unemployment Tax Form 2018-2026

What is the Quarterly Wage Report Unemployment Tax Form

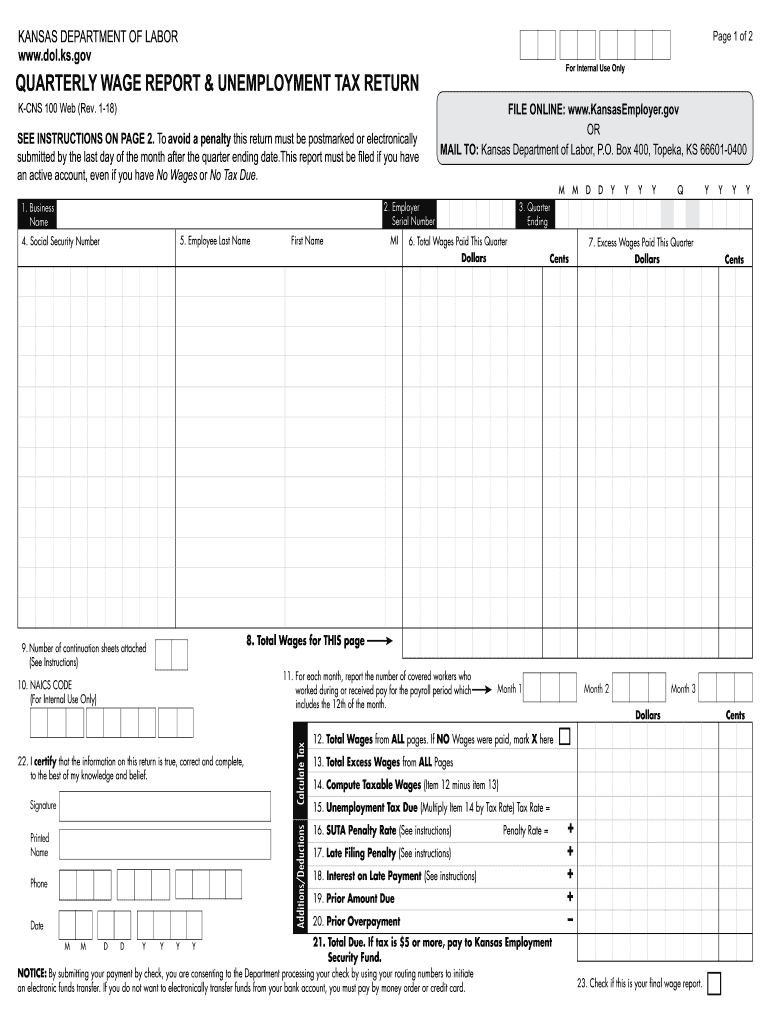

The Kansas Quarterly Wage Report Unemployment Tax Form is a crucial document for employers in Kansas. It is used to report wages paid to employees and calculate the unemployment tax owed to the Kansas Department of Labor. This form ensures that employers contribute to the Kansas Employment Security Fund, which provides unemployment benefits to eligible workers. Understanding this form is vital for maintaining compliance with state regulations and ensuring that employees receive the benefits they are entitled to during periods of unemployment.

Steps to Complete the Quarterly Wage Report Unemployment Tax Form

Completing the Kansas Quarterly Wage Report Unemployment Tax Form involves several key steps:

- Gather employee wage information for the reporting period.

- Calculate total wages paid, including any bonuses or commissions.

- Determine the unemployment tax rate applicable to your business.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

Following these steps can help prevent delays and ensure that your submission is processed smoothly.

How to Obtain the Quarterly Wage Report Unemployment Tax Form

The Kansas Quarterly Wage Report Unemployment Tax Form can be obtained directly from the Kansas Department of Labor website. Employers can access the form in a downloadable format, allowing for easy printing and completion. It is essential to use the most current version of the form to ensure compliance with state regulations.

Legal Use of the Quarterly Wage Report Unemployment Tax Form

The Kansas Quarterly Wage Report Unemployment Tax Form must be used in accordance with state laws governing unemployment insurance. This includes accurately reporting wages and ensuring that all information provided is truthful and complete. Failure to comply with these legal requirements can result in penalties and fines, as well as potential issues with employee benefits.

Form Submission Methods

Employers in Kansas have several options for submitting the Quarterly Wage Report Unemployment Tax Form:

- Online submission through the Kansas Department of Labor’s e-filing system.

- Mailing a completed paper form to the appropriate office.

- In-person submission at designated Kansas Department of Labor locations.

Choosing the right submission method can help ensure that your report is received on time and processed efficiently.

Penalties for Non-Compliance

Non-compliance with the requirements of the Kansas Quarterly Wage Report Unemployment Tax Form can lead to significant penalties. Employers may face fines for late submissions, inaccuracies, or failure to file altogether. Additionally, non-compliance can affect an employer's unemployment tax rate, potentially increasing costs in the future. It is crucial for employers to adhere to filing deadlines and ensure the accuracy of the information provided.

Quick guide on how to complete kansas form k cns 100

Easily prepare Quarterly Wage Report Unemployment Tax Form on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and store it securely online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents promptly without any holdups. Manage Quarterly Wage Report Unemployment Tax Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centered workflow today.

How to edit and eSign Quarterly Wage Report Unemployment Tax Form effortlessly

- Obtain Quarterly Wage Report Unemployment Tax Form and then click Get Form to initiate the process.

- Use the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or a shareable link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Edit and eSign Quarterly Wage Report Unemployment Tax Form to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas form k cns 100

Create this form in 5 minutes!

How to create an eSignature for the kansas form k cns 100

How to create an eSignature for the Kansas Form K Cns 100 online

How to create an electronic signature for your Kansas Form K Cns 100 in Google Chrome

How to generate an electronic signature for putting it on the Kansas Form K Cns 100 in Gmail

How to generate an electronic signature for the Kansas Form K Cns 100 from your smart phone

How to create an electronic signature for the Kansas Form K Cns 100 on iOS

How to create an electronic signature for the Kansas Form K Cns 100 on Android OS

People also ask

-

What is airSlate SignNow and how can it assist with Kansas unemployment documents?

airSlate SignNow is a powerful tool that allows users to electronically sign and send documents, including those related to Kansas unemployment. This solution streamlines the process, making it easier for individuals and businesses to handle unemployment claims efficiently and securely.

-

How much does airSlate SignNow cost for Kansas unemployment-related services?

airSlate SignNow offers competitive pricing tailored for various business needs, including those handling Kansas unemployment documents. Plans are available at different levels, ensuring that you can find a cost-effective solution that matches your requirements without overspending.

-

What features does airSlate SignNow offer that are beneficial for Kansas unemployment processing?

Features like customizable templates, cloud storage, and secure electronic signatures make airSlate SignNow particularly useful for Kansas unemployment processing. These tools enhance efficiency and ensure compliance, helping users manage their unemployment documentation with ease.

-

Is airSlate SignNow easy to integrate with other applications for Kansas unemployment paperwork?

Yes, airSlate SignNow integrates seamlessly with many popular applications and software. This capability is especially valuable for organizations dealing with Kansas unemployment, as it allows for a cohesive workflow without disrupting existing systems.

-

What benefits does airSlate SignNow provide for small businesses managing Kansas unemployment?

For small businesses, airSlate SignNow offers an affordable and intuitive platform to handle Kansas unemployment documents. This not only saves time and resources but also minimizes the risk of errors, ensuring that unemployment claims are filed promptly and accurately.

-

Can airSlate SignNow help with compliance and legal issues related to Kansas unemployment?

Absolutely! airSlate SignNow ensures compliance by using industry-standard security measures for Kansas unemployment documents. This reduces the legal risks associated with handling sensitive information while maintaining the integrity of your documents.

-

How does eSigning through airSlate SignNow work for Kansas unemployment forms?

eSigning through airSlate SignNow is straightforward and user-friendly. You simply upload your Kansas unemployment forms, add the necessary signature fields, and send them to the required parties, who can sign electronically from any device.

Get more for Quarterly Wage Report Unemployment Tax Form

- Fixed percentage option election franco signor form

- Commission rule 21911 form

- Apostillecertification arkansas secretary of state sos arkansas form

- Silent auction bid sheet template hcra form

- Cayman work permit form

- Jt 1 2015 form

- B2015b nh audubon summer camp registration bformb

- Builder project completion advice form

Find out other Quarterly Wage Report Unemployment Tax Form

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement