Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte

What is the Form W-7SP?

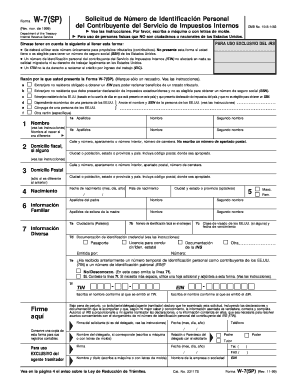

The Form W-7SP, officially known as the Solicitud de Número de Identificación Personal del Contribuyente, is used by individuals who are not eligible for a Social Security Number but need a taxpayer identification number for tax purposes in the United States. This form is primarily utilized by non-resident aliens and their dependents who are required to file a U.S. tax return or claim a tax benefit. The Internal Revenue Service (IRS) issues this form to facilitate proper identification of taxpayers and ensure compliance with U.S. tax laws.

Steps to Complete the Form W-7SP

Completing the Form W-7SP involves several important steps to ensure accuracy and compliance. Begin by gathering the necessary documentation, which includes proof of foreign status and identity. This can be achieved through documents such as a passport or national identification card. Next, fill out the form carefully, providing all required personal information, including your name, address, and the reason for applying for an Individual Taxpayer Identification Number (ITIN). It's crucial to review the form for any errors before submission. Once completed, you can submit the form along with your tax return or send it directly to the IRS.

Required Documents for Form W-7SP

When submitting the Form W-7SP, you must include specific documentation to support your application. Required documents typically include:

- A valid passport or another government-issued identification that includes your photo.

- Documents proving your foreign status, such as a birth certificate or national ID.

- Any additional documentation that supports your reason for needing an ITIN, such as a tax return or a letter from the IRS.

Ensure that all documents are original or certified copies, as the IRS does not accept photocopies.

Form Submission Methods

You can submit the Form W-7SP through various methods. The most common approach is to send it by mail to the IRS along with your tax return. Alternatively, you can submit the form in person at designated IRS Taxpayer Assistance Centers. If you are applying for an ITIN without filing a tax return, you may also mail the form directly to the IRS. For those who prefer digital solutions, utilizing services that allow secure electronic submission can streamline the process, ensuring compliance with IRS regulations.

Legal Use of the Form W-7SP

The Form W-7SP serves a critical legal function by allowing individuals who are ineligible for a Social Security Number to obtain an ITIN. This identification number is essential for fulfilling tax obligations in the U.S. and enables individuals to claim tax benefits and refunds. Understanding the legal implications of using the form is vital, as incorrect submissions can lead to delays, penalties, or denial of tax benefits. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal use of the form.

IRS Guidelines for Form W-7SP

The IRS provides specific guidelines for completing and submitting the Form W-7SP. These guidelines outline the eligibility criteria, required documents, and submission procedures. Familiarizing yourself with these guidelines is crucial for ensuring a successful application. The IRS updates its instructions periodically, so it is important to refer to the most current version of the guidelines to avoid any potential issues. Adhering to these instructions can help ensure that your application is processed efficiently and accurately.

Quick guide on how to complete form w 7sp rev november 1999 solicitud de numero de identicacion personal del contribuyente del servicio de impuestos internos

Complete Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte effortlessly on any device

Online document organization has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to alter and eSign Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte effortlessly

- Obtain Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize essential sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Alter and eSign Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 7sp rev november 1999 solicitud de numero de identicacion personal del contribuyente del servicio de impuestos internos

How to make an eSignature for your Form W 7sp Rev November 1999 Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Internos online

How to generate an electronic signature for your Form W 7sp Rev November 1999 Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Internos in Google Chrome

How to generate an eSignature for signing the Form W 7sp Rev November 1999 Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Internos in Gmail

How to create an electronic signature for the Form W 7sp Rev November 1999 Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Internos from your smart phone

How to create an eSignature for the Form W 7sp Rev November 1999 Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Internos on iOS

How to generate an eSignature for the Form W 7sp Rev November 1999 Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Internos on Android

People also ask

-

What is the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte.?

The Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte. is used to apply for an Individual Taxpayer Identification Number (ITIN) for non-resident aliens. This form is essential for those who need to comply with IRS regulations but are not eligible for a Social Security Number.

-

How does airSlate SignNow help with the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte.?

airSlate SignNow provides a seamless platform for electronically signing and managing documents like the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte. Its user-friendly interface makes it easy to fill out, sign, and send this important document securely.

-

What are the pricing options for using airSlate SignNow for Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte.?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes to handle documents such as the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte. You can choose from monthly or annual subscriptions, with discounts available for longer commitments.

-

What features does airSlate SignNow offer that are beneficial for completing the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte.?

airSlate SignNow includes vital features like customizable templates, multi-party signing, and real-time tracking which are beneficial for completing the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte. These tools enhance efficiency and ensure compliance throughout the signing process.

-

Can I integrate airSlate SignNow with other software for managing the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte.?

Yes, airSlate SignNow offers several integrations with popular software tools. This can be particularly useful for managing and automating tasks related to the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte., streamlining your workflow.

-

What are the benefits of using airSlate SignNow for signing the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte.?

Using airSlate SignNow for signing the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte. enhances security, speed, and convenience. You can securely sign the document from anywhere, track its status, and ensure that all parties are notified of completion.

-

Is airSlate SignNow compliant with the requirements for Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte.?

Absolutely, airSlate SignNow is designed to comply with various legal and regulatory requirements. When completing the Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte., you can trust that your documents are handled securely and in accordance with applicable laws.

Get more for Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte

Find out other Form W 7SP Rev November Solicitud De Numero De Identicacion Personal Del Contribuyente Del Servicio De Impuestos Inte

- Encrypt Electronic signature PDF Computer

- Encrypt Electronic signature PDF Now

- Encrypt Electronic signature PDF Simple

- How To Encrypt Electronic signature PDF

- Encrypt Electronic signature Form Fast

- Search Electronic signature Word Simple

- Sign PDF for HR Online

- Sign PDF for HR Now

- Sign PDF for HR Later

- Sign PDF for HR Fast

- Sign PDF for HR Simple

- Sign PDF for HR Easy

- Sign Word for HR Computer

- Sign Word for HR Online

- Sign Word for HR Mobile

- Sign Word for HR Later

- Sign Word for HR Now

- Sign Word for HR Secure

- Sign Word for HR Free

- Sign Word for HR Fast