Publication 3125 Rev 10 Form

What is the Publication 3125 Rev 10

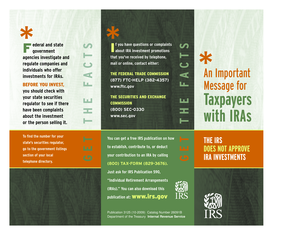

The Publication 3125 Rev 10 is an official document issued by the Internal Revenue Service (IRS) that provides guidance on various tax-related matters. This publication specifically addresses the rules and regulations surrounding certain tax forms, helping taxpayers understand their obligations and rights. It serves as a crucial resource for individuals and businesses navigating the complexities of tax compliance in the United States.

How to use the Publication 3125 Rev 10

Using the Publication 3125 Rev 10 effectively involves understanding its content and applying the information to your specific tax situation. Taxpayers should review the publication to identify relevant sections that pertain to their circumstances. This may include guidelines on filling out tax forms correctly, understanding deductions, and ensuring compliance with IRS requirements. It is advisable to keep the publication handy while preparing tax documents to reference as needed.

Steps to complete the Publication 3125 Rev 10

Completing the Publication 3125 Rev 10 involves several key steps:

- Review the publication thoroughly to understand its sections and requirements.

- Gather all necessary documents and information, such as income statements and previous tax returns.

- Follow the instructions provided in the publication for filling out any related tax forms.

- Double-check your entries for accuracy and completeness.

- Submit the completed forms as instructed, ensuring you meet any deadlines.

Legal use of the Publication 3125 Rev 10

The legal use of the Publication 3125 Rev 10 is essential for ensuring compliance with IRS regulations. This publication outlines the legal framework surrounding tax filings and provides clarity on how to meet legal obligations. By adhering to the guidelines set forth in the publication, taxpayers can protect themselves from potential penalties and ensure that their filings are valid and recognized by the IRS.

Key elements of the Publication 3125 Rev 10

Key elements of the Publication 3125 Rev 10 include:

- Detailed explanations of tax form requirements.

- Guidelines for specific taxpayer scenarios, including self-employed individuals and businesses.

- Information on compliance and legal obligations.

- Examples of common mistakes to avoid when filling out forms.

Filing Deadlines / Important Dates

Filing deadlines and important dates are crucial for taxpayers using the Publication 3125 Rev 10. The publication includes specific timelines for submitting tax forms and payments to avoid penalties. It is important to note these dates and plan accordingly to ensure timely compliance with IRS regulations.

Quick guide on how to complete publication 3125 rev 10 2009

Prepare Publication 3125 Rev 10 seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Publication 3125 Rev 10 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Publication 3125 Rev 10 effortlessly

- Locate Publication 3125 Rev 10 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Accent relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds precisely the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your PC.

Say goodbye to lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Publication 3125 Rev 10 and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 3125 rev 10 2009

How to make an electronic signature for your Publication 3125 Rev 10 2009 in the online mode

How to make an electronic signature for your Publication 3125 Rev 10 2009 in Chrome

How to make an electronic signature for signing the Publication 3125 Rev 10 2009 in Gmail

How to make an eSignature for the Publication 3125 Rev 10 2009 from your smartphone

How to make an electronic signature for the Publication 3125 Rev 10 2009 on iOS devices

How to create an electronic signature for the Publication 3125 Rev 10 2009 on Android devices

People also ask

-

What is Publication 3125 Rev 10?

Publication 3125 Rev 10 is an official IRS guidance document that provides important information about tax-related issues. This publication outlines specific rules and regulations that taxpayers must follow, ensuring compliance and accuracy in filings. Understanding its contents can signNowly aid in navigating tax complexities.

-

How can airSlate SignNow assist with Publication 3125 Rev 10 forms?

With airSlate SignNow, users can efficiently prepare, send, and eSign documents related to Publication 3125 Rev 10. The platform allows for smooth collaboration on tax forms, ensuring all parties can sign and submit documents promptly. This streamlines the process and helps in maintaining compliance with IRS standards.

-

Is airSlate SignNow cost-effective for handling Publication 3125 Rev 10-related documents?

Yes, airSlate SignNow offers a cost-effective solution for managing Publication 3125 Rev 10-related documents. The pricing plans are designed to accommodate businesses of all sizes, ensuring that effective eSignature solutions are accessible without breaking the bank. This enables organizations to stay compliant without overspending.

-

What features does airSlate SignNow offer for Publication 3125 Rev 10 compliance?

AirSlate SignNow provides various features such as secure eSigning, document templates, and automated workflows specifically beneficial for Publication 3125 Rev 10 compliance. These features enhance document accuracy, reduce turnaround times, and ensure that all necessary signatures are obtained efficiently. Additionally, audit trails help maintain thorough records.

-

Can I integrate airSlate SignNow with other tools for better handling of Publication 3125 Rev 10 forms?

Absolutely, airSlate SignNow offers seamless integrations with popular business applications that enhance the management of Publication 3125 Rev 10 forms. By connecting with tools like CRM systems, email platforms, and document storage services, users can streamline workflows and improve overall efficiency in document handling.

-

What are the benefits of using airSlate SignNow for Publication 3125 Rev 10 documentation?

Using airSlate SignNow for Publication 3125 Rev 10 documentation offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. The platform’s user-friendly interface ensures that all users, regardless of technical proficiency, can complete their tasks without hassle. Moreover, it supports remote work, allowing flexibility in document handling.

-

Is there a mobile app for airSlate SignNow to manage Publication 3125 Rev 10 documents on-the-go?

Yes, airSlate SignNow has a mobile app that allows users to manage Publication 3125 Rev 10 documents anytime, anywhere. This mobility ensures that users can send, sign, and track documents on-the-go, providing flexibility and convenience. The app mirrors the features of the desktop version, ensuring continuity in document management.

Get more for Publication 3125 Rev 10

- Transcript request form burlington county college bcc

- Urbana university transcript request urbana form

- Commission disbursement authorization brokers guild brokersguild form

- Tsc online transcript form

- Youth scholarship application west virginia grand chapter order form

- Btranscript requestb george bwashingtonb high school guam usa form

- Dependent verification form eastern washington university ewu

- With the henry foss enrollment packet tacoma public schools form

Find out other Publication 3125 Rev 10

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document