Ohio it 501 Form

What is the Ohio IT 501?

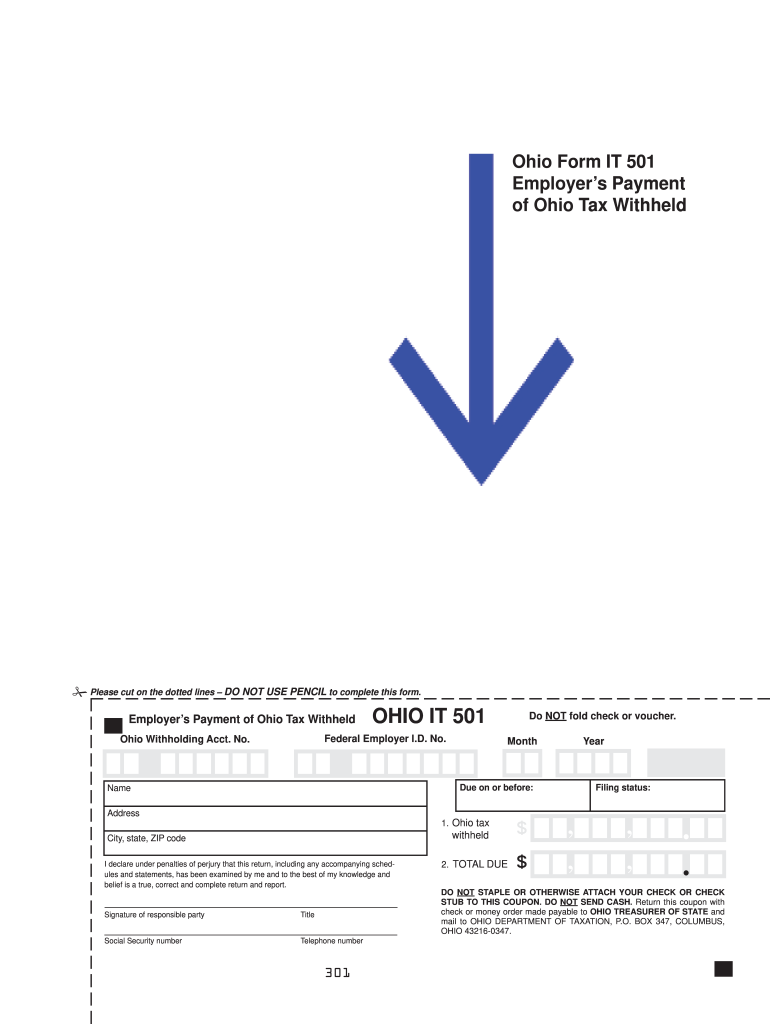

The Ohio IT 501 is a state-specific form used for reporting income tax withheld from employees in Ohio. This form is essential for employers who need to remit withheld income taxes to the Ohio Department of Taxation. It helps ensure compliance with state tax laws and provides a clear record of the amounts withheld from employee wages.

How to Use the Ohio IT 501

To effectively use the Ohio IT 501, employers must accurately complete the form with necessary details such as the employer's identification information, the total amount of income tax withheld, and the period for which the taxes are being reported. The form can be submitted electronically or via mail, depending on the employer's preference and compliance with state regulations.

Steps to Complete the Ohio IT 501

Completing the Ohio IT 501 involves several key steps:

- Gather all relevant payroll records for the reporting period.

- Fill in the employer's name, address, and identification number at the top of the form.

- Report the total amount of income tax withheld from employees' wages.

- Double-check all entries for accuracy to avoid penalties.

- Submit the completed form by the designated deadline.

Legal Use of the Ohio IT 501

The Ohio IT 501 is legally binding when completed accurately and submitted on time. It complies with state tax regulations, ensuring that employers fulfill their tax obligations. Using reliable digital tools for submission can enhance the security and validity of the form, aligning with legal standards for electronic signatures.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the Ohio IT 501 to avoid penalties. Typically, the form is due quarterly, with deadlines falling on the last day of the month following the end of each quarter. Keeping track of these dates is crucial for maintaining compliance with Ohio tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Ohio IT 501 can be submitted through various methods to accommodate employer preferences:

- Online: Employers can file the form electronically through the Ohio Department of Taxation's website.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Employers may also choose to deliver the form in person at designated tax offices.

Key Elements of the Ohio IT 501

Key elements of the Ohio IT 501 include:

- Employer identification information

- Total income tax withheld

- Reporting period

- Signature of the authorized representative

These components ensure that the form is complete and meets the requirements set forth by the Ohio Department of Taxation.

Quick guide on how to complete ohio form it 501

Effortlessly manage Ohio It 501 on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and without holdups. Manage Ohio It 501 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Ohio It 501 effortlessly

- Locate Ohio It 501 and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow provides for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal power as a standard handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign Ohio It 501, ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

I’d like to form a 501(c) (3) to open a non-profit cat sanctuary in Ohio. What’s the first step?

Go to this website: Charities Non-Profits | Internal Revenue ServiceIt tells you what forms you need to apply for a non-profit and the process. Good Luck!

Create this form in 5 minutes!

How to create an eSignature for the ohio form it 501

How to make an electronic signature for your Ohio Form It 501 in the online mode

How to create an electronic signature for the Ohio Form It 501 in Google Chrome

How to create an electronic signature for signing the Ohio Form It 501 in Gmail

How to generate an electronic signature for the Ohio Form It 501 right from your smartphone

How to generate an electronic signature for the Ohio Form It 501 on iOS

How to generate an electronic signature for the Ohio Form It 501 on Android OS

People also ask

-

What is Ohio IT 501 and how does it relate to airSlate SignNow?

Ohio IT 501 is a regulatory framework that can impact how businesses manage their electronic signatures and documents. airSlate SignNow is designed to help businesses in Ohio comply with such regulations by providing a secure and legally binding eSignature solution. This ensures that your document management aligns with Ohio IT 501 requirements.

-

How much does airSlate SignNow cost for Ohio businesses?

Pricing for airSlate SignNow varies based on the features and number of users needed, making it a cost-effective choice for Ohio businesses. We offer various plans designed to meet the specific needs of your organization while ensuring compliance with Ohio IT 501. Contact us for a personalized quote!

-

What features does airSlate SignNow offer for Ohio IT 501 compliance?

AirSlate SignNow includes advanced features such as secure eSignatures, document tracking, and audit trails, all of which are crucial for compliance with Ohio IT 501. These features ensure that your electronic documents are managed securely and transparently, meeting the standards required by Ohio regulations.

-

Can airSlate SignNow integrate with other software I use in Ohio?

Yes, airSlate SignNow offers a variety of integrations with popular software platforms used in Ohio, such as CRM systems and cloud storage services. This ensures that you can seamlessly incorporate our eSignature solution into your existing workflows while adhering to Ohio IT 501 guidelines.

-

How does airSlate SignNow enhance productivity for businesses in Ohio?

AirSlate SignNow streamlines the document signing process, allowing Ohio businesses to send and eSign documents quickly and efficiently. By reducing the time spent on paperwork, businesses can focus more on their core operations, all while ensuring compliance with Ohio IT 501.

-

Is airSlate SignNow secure for handling sensitive documents in Ohio?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your documents, making it compliant with Ohio IT 501. Our platform uses encryption and secure storage solutions to ensure that sensitive information remains confidential and secure.

-

What types of documents can I sign using airSlate SignNow in Ohio?

With airSlate SignNow, you can sign a wide range of documents, including contracts, agreements, and forms that are commonly used in Ohio. Our platform is versatile, allowing you to handle any document type while ensuring compliance with Ohio IT 501 regulations.

Get more for Ohio It 501

Find out other Ohio It 501

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free