Form 9465 SP Rev December Fill in Version Spanish

What is the Form 9465 SP Rev December Fill in Version Spanish

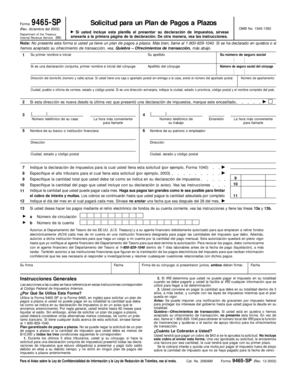

The Form 9465, also known as the Installment Agreement Request, is a crucial document for taxpayers in the United States seeking to pay their tax liabilities over time. The Spanish version, Form 9465 SP, caters specifically to Spanish-speaking individuals, ensuring accessibility and understanding of tax obligations. This form allows taxpayers to propose a payment plan to the IRS, making it easier to manage tax debts without facing immediate financial strain.

How to use the Form 9465 SP Rev December Fill in Version Spanish

Using Form 9465 SP involves several steps to ensure proper submission and acceptance by the IRS. First, taxpayers need to download the form from the IRS website or obtain it through authorized channels. After filling out the required information, including personal details and proposed payment amounts, it is essential to review the form for accuracy. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference and eligibility.

Steps to complete the Form 9465 SP Rev December Fill in Version Spanish

Completing Form 9465 SP requires careful attention to detail. Here are the steps to follow:

- Download the form from the IRS website or acquire it from a tax professional.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you owe and the proposed monthly payment you can afford.

- Provide information about your income and expenses to justify your payment plan.

- Sign and date the form to certify that the information provided is accurate.

After completing these steps, ensure that the form is submitted according to IRS guidelines.

Legal use of the Form 9465 SP Rev December Fill in Version Spanish

The legal use of Form 9465 SP is governed by IRS regulations, which stipulate that the form must be filled out accurately and submitted in a timely manner. When used correctly, this form becomes a binding agreement between the taxpayer and the IRS, allowing for structured payments over time. It is crucial to understand that failure to adhere to the terms of the installment agreement can result in penalties or collection actions by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 9465 SP are critical to avoid penalties and ensure compliance with IRS regulations. Generally, taxpayers should submit the form along with their tax return or as soon as they realize they cannot pay their tax bill in full. It is advisable to check the IRS website for specific deadlines, especially during tax season, as these dates can vary annually. Timely submission helps maintain good standing with the IRS and can prevent additional interest or penalties on unpaid taxes.

Eligibility Criteria

To qualify for using Form 9465 SP, taxpayers must meet specific eligibility criteria set by the IRS. Generally, individuals who owe less than $50,000 in combined tax, penalties, and interest may apply for an installment agreement. Additionally, taxpayers must have filed all required tax returns and cannot be in an open bankruptcy proceeding. Understanding these criteria is essential to ensure that the form is submitted correctly and that the proposed payment plan is likely to be accepted by the IRS.

Quick guide on how to complete form 9465 sp rev december 2003 fill in version spanish

Complete Form 9465 SP Rev December Fill in Version Spanish effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Form 9465 SP Rev December Fill in Version Spanish on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form 9465 SP Rev December Fill in Version Spanish with ease

- Obtain Form 9465 SP Rev December Fill in Version Spanish and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Form 9465 SP Rev December Fill in Version Spanish to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 9465 sp rev december 2003 fill in version spanish

How to make an eSignature for the Form 9465 Sp Rev December 2003 Fill In Version Spanish online

How to create an electronic signature for the Form 9465 Sp Rev December 2003 Fill In Version Spanish in Chrome

How to make an eSignature for putting it on the Form 9465 Sp Rev December 2003 Fill In Version Spanish in Gmail

How to make an eSignature for the Form 9465 Sp Rev December 2003 Fill In Version Spanish from your smart phone

How to make an electronic signature for the Form 9465 Sp Rev December 2003 Fill In Version Spanish on iOS devices

How to generate an eSignature for the Form 9465 Sp Rev December 2003 Fill In Version Spanish on Android

People also ask

-

What is the form 9465 Spanish, and how can I use it with airSlate SignNow?

The form 9465 Spanish is an IRS form that allows taxpayers to request a monthly installment plan for their tax bill. With airSlate SignNow, you can easily fill out, sign, and send the form 9465 Spanish electronically, streamlining the process of submitting your payment plan request.

-

Is there a cost associated with using airSlate SignNow for the form 9465 Spanish?

airSlate SignNow offers various pricing plans, including a free trial, allowing you to test the features before committing. The cost of using airSlate SignNow for the form 9465 Spanish depends on the plan you choose, but it remains an affordable solution for businesses and individuals alike.

-

How does airSlate SignNow ensure the security of my form 9465 Spanish?

airSlate SignNow takes security seriously, implementing industry-standard encryption and secure data storage to protect your documents, including the form 9465 Spanish. You can rest assured that your sensitive information is safe when using our eSigning platform.

-

Can I integrate airSlate SignNow with other applications while using the form 9465 Spanish?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and more. This allows you to easily access and manage your documents, including the form 9465 Spanish, without disrupting your workflow.

-

What features does airSlate SignNow offer for completing the form 9465 Spanish?

airSlate SignNow provides several features to facilitate the completion of the form 9465 Spanish, including drag-and-drop document upload, customizable templates, and in-app messaging for smooth communication. These features make it easy to manage your signing process efficiently.

-

Can I access my signed form 9465 Spanish after submitting it?

Absolutely! Once you’ve submitted your form 9465 Spanish using airSlate SignNow, you can access it anytime from your account. All completed documents are securely stored, allowing you to keep track of your IRS forms easily.

-

Is it easy to get started with airSlate SignNow for the form 9465 Spanish?

Yes, getting started with airSlate SignNow is quick and easy. Simply sign up for an account, upload your form 9465 Spanish, and you’ll be ready to eSign and send your document in minutes.

Get more for Form 9465 SP Rev December Fill in Version Spanish

- Cooplands application form

- Toastmasters proxy form

- Residential input form superior area association of realtors

- Dufferin peel flexible boundary form

- Mw506r maryland tax forms and instructions the comptroller of

- Cipa botswana forms

- Sta application for employment solano transportation authority sta ca form

- Delta pilot disability guide form

Find out other Form 9465 SP Rev December Fill in Version Spanish

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile