Form of Stock Grant Agreement for Stock Incentive SEC Gov

Key elements of the corporation transfer stock agreement

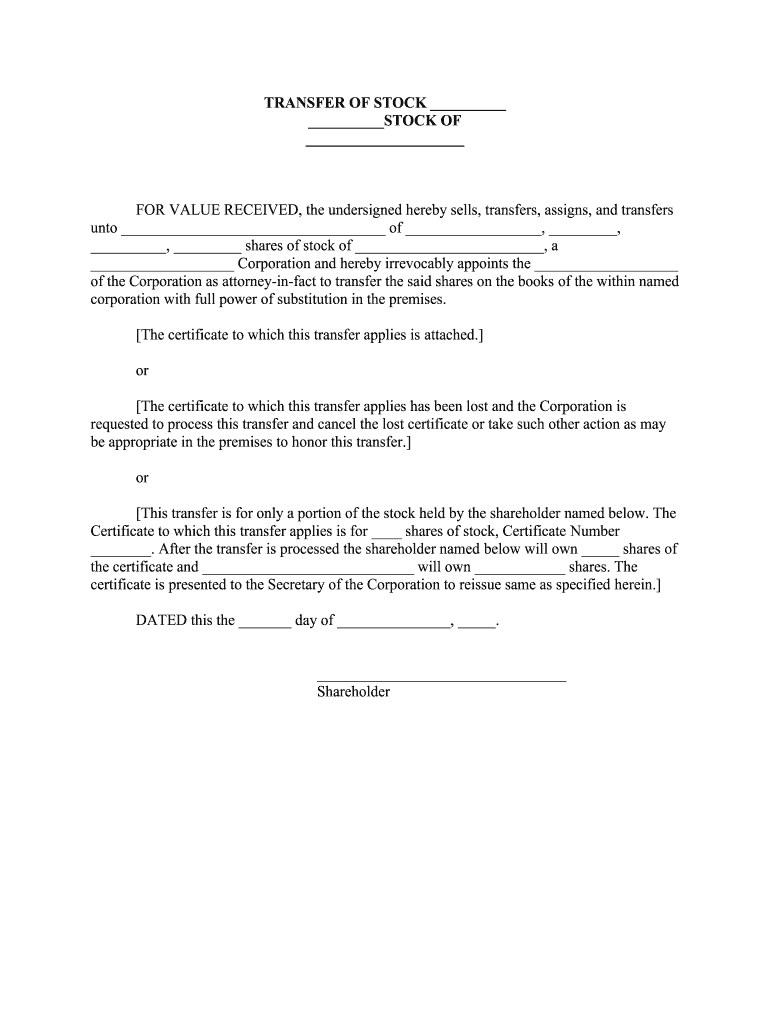

A corporation transfer stock agreement outlines the essential terms and conditions under which stock ownership is transferred from one party to another. Understanding these key elements is crucial for ensuring that the agreement is legally binding and effective. The main components typically include:

- Parties involved: Clearly identify the transferor (the current stockholder) and the transferee (the new stockholder).

- Number of shares: Specify the exact number of shares being transferred.

- Type of stock: Indicate whether the shares are common or preferred stock.

- Consideration: Detail any payment or compensation involved in the transfer.

- Effective date: State when the transfer will take effect.

- Signatures: Ensure that both parties sign the agreement to validate the transaction.

Steps to complete the corporation transfer stock agreement

Completing a corporation transfer stock agreement involves several important steps to ensure accuracy and compliance with legal standards. Follow these steps for a smooth process:

- Gather necessary information: Collect details about the stock, including the number of shares and the identities of the parties involved.

- Draft the agreement: Use a template or create a document that includes all key elements of the agreement.

- Review the document: Ensure that all information is accurate and that the terms are clear.

- Obtain signatures: Have both the transferor and transferee sign the document, either in person or electronically.

- File the agreement: Depending on state requirements, you may need to file the agreement with the appropriate state agency or maintain it in corporate records.

Legal use of the corporation transfer stock agreement

The legal use of a corporation transfer stock agreement is fundamental for protecting the rights of both parties involved in the transaction. This agreement serves as a formal record of the transfer, which can be crucial in case of disputes or regulatory inquiries. To ensure legal compliance:

- Confirm that the agreement adheres to state laws regarding stock transfers.

- Ensure that the document is signed by both parties to validate the transfer.

- Maintain accurate records of all stock transfers for corporate governance and tax purposes.

Examples of using the corporation transfer stock agreement

Understanding practical applications of the corporation transfer stock agreement can enhance comprehension of its importance. Here are a few examples:

- A shareholder decides to sell their shares to another investor, necessitating a formal transfer agreement.

- A corporation undergoes restructuring, leading to the transfer of stock between existing shareholders.

- A family-owned business transfers stock ownership to a family member as part of estate planning.

Required documents for the corporation transfer stock agreement

When preparing a corporation transfer stock agreement, certain documents may be required to ensure the transaction is valid and compliant. These can include:

- The original stock certificate, if applicable.

- Identification documents for both the transferor and transferee.

- Corporate resolutions or approvals if required by the corporation's bylaws.

Digital vs. paper version of the corporation transfer stock agreement

Choosing between a digital or paper version of the corporation transfer stock agreement has implications for convenience and legal compliance. Here are some considerations:

- Digital version: Offers ease of access, storage, and sharing. Electronic signatures can enhance the speed of the process.

- Paper version: May be required for certain legal filings or by specific corporations. Physical signatures can sometimes carry more weight in traditional settings.

Quick guide on how to complete form of stock grant agreement for 2009 stock incentive secgov

Effortlessly prepare Form Of Stock Grant Agreement For Stock Incentive SEC gov on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Handle Form Of Stock Grant Agreement For Stock Incentive SEC gov on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to modify and electronically sign Form Of Stock Grant Agreement For Stock Incentive SEC gov with ease

- Find Form Of Stock Grant Agreement For Stock Incentive SEC gov and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes just a few seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form retrieval, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form Of Stock Grant Agreement For Stock Incentive SEC gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form of stock grant agreement for 2009 stock incentive secgov

How to generate an eSignature for your Form Of Stock Grant Agreement For 2009 Stock Incentive Secgov in the online mode

How to make an electronic signature for your Form Of Stock Grant Agreement For 2009 Stock Incentive Secgov in Chrome

How to generate an eSignature for putting it on the Form Of Stock Grant Agreement For 2009 Stock Incentive Secgov in Gmail

How to make an electronic signature for the Form Of Stock Grant Agreement For 2009 Stock Incentive Secgov straight from your smart phone

How to generate an eSignature for the Form Of Stock Grant Agreement For 2009 Stock Incentive Secgov on iOS

How to make an electronic signature for the Form Of Stock Grant Agreement For 2009 Stock Incentive Secgov on Android OS

People also ask

-

What is a transfer stock sample and how can it benefit my business?

A transfer stock sample is a document that facilitates the transfer of ownership or rights of stocks. Using airSlate SignNow, businesses can create, sign, and manage transfer stock samples easily, ensuring legality and compliance. This streamlines the process, saving time and reducing paperwork.

-

How much does it cost to use airSlate SignNow for transfer stock samples?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost of using our platform for transfer stock samples is designed to be cost-effective, providing great value for comprehensive eSignature and document management solutions. You can choose a plan that fits your budget and volume of transactions.

-

Can I customize my transfer stock sample templates in airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize transfer stock sample templates according to your specific requirements. Our user-friendly interface lets you easily edit templates, add fields, and incorporate your branding. This ensures that each document meets your business standards.

-

Is it secure to use airSlate SignNow for eSigning transfer stock samples?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect your transfer stock samples. Our platform ensures that your signatures and documents remain confidential and are only accessible to authorized individuals.

-

What integrations does airSlate SignNow offer for managing transfer stock samples?

airSlate SignNow integrates seamlessly with various third-party applications that businesses commonly use. Whether it’s CRM systems, document storage, or accounting software, these integrations enhance the workflow process for managing transfer stock samples. This means you can automate notifications and document storage easily.

-

How does airSlate SignNow simplify the process of sending transfer stock samples?

With airSlate SignNow, sending transfer stock samples is straightforward and efficient. You can quickly upload documents, add recipients, and track the signing process in real-time. This eliminates the need for physical signatures and speeds up transactions signNowly.

-

What features does airSlate SignNow offer for tracking transfer stock samples?

airSlate SignNow includes advanced tracking features that let you monitor the status of your transfer stock samples at any time. You’ll receive notifications when documents are viewed and signed. This transparency ensures that you are always in control of your document workflow.

Get more for Form Of Stock Grant Agreement For Stock Incentive SEC gov

Find out other Form Of Stock Grant Agreement For Stock Incentive SEC gov

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now