U S Income Tax Return for an S Corporation Internal Revenue Form

What is the U.S. Income Tax Return for an S Corporation?

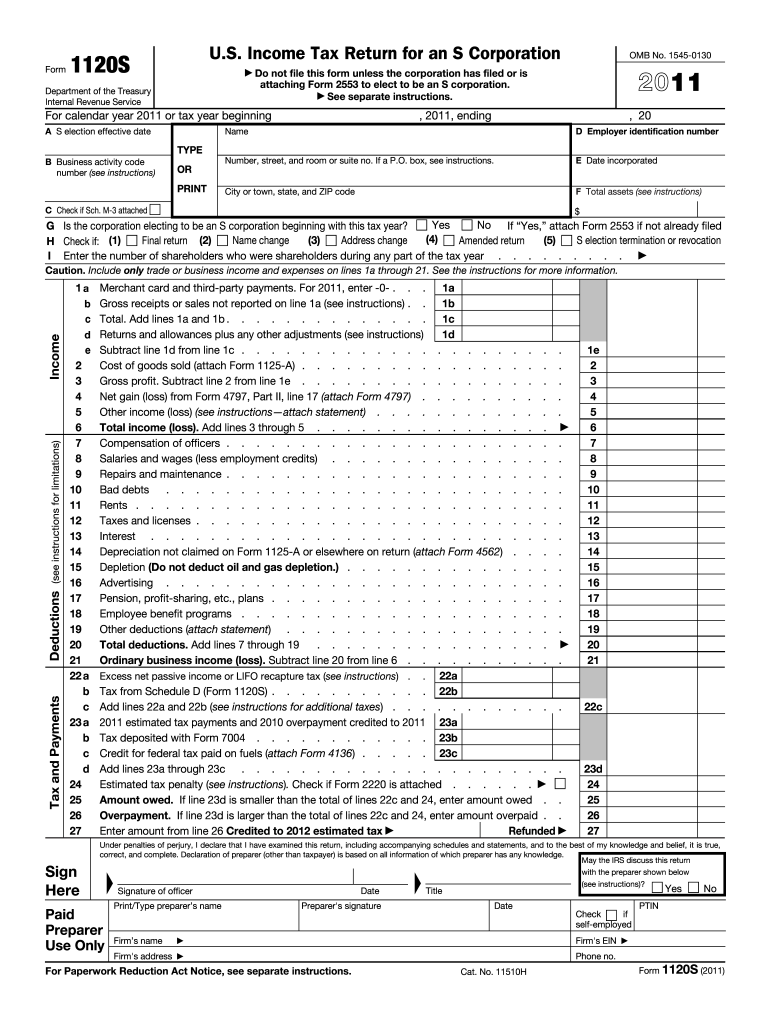

The U.S. Income Tax Return for an S Corporation is officially known as Form 1120-S. This form is used by S corporations to report income, deductions, gains, losses, and other tax-related information to the Internal Revenue Service (IRS). Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. This structure helps avoid double taxation, making it a popular choice for small businesses. Understanding the specifics of this tax form is crucial for compliance and for maximizing potential tax benefits.

Steps to Complete the U.S. Income Tax Return for an S Corporation

Completing Form 1120-S involves several key steps:

- Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and records of expenses.

- Complete the Form: Fill out the basic information, including the corporation's name, address, and Employer Identification Number (EIN).

- Report Income: Detail the corporation's income, including gross receipts and other income sources.

- Deduct Expenses: List all deductible expenses, such as salaries, rent, and utilities, to calculate the taxable income.

- Distribute K-1 Forms: Prepare Schedule K-1 for each shareholder, reporting their share of income, deductions, and credits.

- Review and Submit: Double-check all entries for accuracy before submitting the form to the IRS, either electronically or by mail.

Filing Deadlines / Important Dates

It is essential to adhere to specific deadlines when filing the U.S. Income Tax Return for an S Corporation. The due date for Form 1120-S is typically the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If additional time is needed, an extension can be requested, allowing for an additional six months to file the return. However, any taxes owed must still be paid by the original due date to avoid penalties.

Required Documents

To accurately complete Form 1120-S, several documents are required:

- Financial statements, including profit and loss statements.

- Balance sheets for the tax year.

- Records of all income sources and expenses.

- Shareholder information, including names, addresses, and Social Security numbers.

- Any prior year tax returns that may be relevant.

IRS Guidelines

The IRS provides comprehensive guidelines for completing Form 1120-S. These guidelines cover eligibility requirements for S corporation status, the types of income that must be reported, and the specific deductions that can be claimed. It is advisable for S corporations to familiarize themselves with these guidelines to ensure compliance and to take advantage of all available tax benefits. The IRS also offers resources and publications that can assist in understanding the nuances of S corporation taxation.

Penalties for Non-Compliance

Failure to file Form 1120-S on time or inaccuracies in reporting can result in penalties imposed by the IRS. These penalties can vary based on the severity of the non-compliance. For late filings, the penalty can be a specific amount per month the return is overdue, up to a maximum limit. Additionally, if the IRS determines that the corporation has underreported income or claimed improper deductions, further penalties may apply. It is crucial for S corporations to ensure timely and accurate filing to avoid these financial repercussions.

Quick guide on how to complete us income tax return for an s corporation internal revenue

Complete U S Income Tax Return For An S Corporation Internal Revenue effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle U S Income Tax Return For An S Corporation Internal Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign U S Income Tax Return For An S Corporation Internal Revenue without any hassle

- Locate U S Income Tax Return For An S Corporation Internal Revenue and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign U S Income Tax Return For An S Corporation Internal Revenue and ensure excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Recently I received intimation u/s 143(1) (a) of Income Tax Act, 1961. Though I filled IT Return within time and with correct information about my Income according to my Form 16. Now what should I do?

This shouldn't be much of of a problem. This is usually sent where there is a mismatch between the income tax department records and the return filed. You could follow the steps mentioned below:Go through your Form 16 thoroughly and compare the same with your return filedCheck whether you claimed any loss in that year but filed tour return after the due dateCheck whether you have offered all your income to tax including your FD interest income, if anyCheck if there are any airthmetical errorsOnce you have identified the error, you could rectify by filing a revised return.In case there is no error, you could file a reply to the department explaining the causes along with supportings and also specifying why your claim should be accepted.In case you need further help in this regard, please contact me at anr.invests@gmail.com and provide necessary documents to take this forward.Stay tuned and click on Follow for further updates and information regarding my upcoming blog on investing, taxes and policy review.Disclaimer: The above answer is a personal opinion of the author. This does not provide a binding or legal opinion on the issue and should not be construed to be a professional advice. Please contact a tax expert before taking any position on the above. The answer provided was only for information purposes.

-

Do foreign entrepreneurs that have Startup U.S. corporations need to fill an 83(b) election form?

Only if you have plans to move to the U.S and become an individual taxpayer.If you plan to continue in your country and pay taxes over capital gains in there, you as an individual are only subject to this kind of taxation in your country. If you plan to move to U.S. you should fill the 83b election. In case you dont have an SSN or ITIN, you should fill it with "awaiting ITIN" in the ITIN field.

Create this form in 5 minutes!

How to create an eSignature for the us income tax return for an s corporation internal revenue

How to make an electronic signature for the Us Income Tax Return For An S Corporation Internal Revenue in the online mode

How to make an eSignature for your Us Income Tax Return For An S Corporation Internal Revenue in Chrome

How to create an eSignature for putting it on the Us Income Tax Return For An S Corporation Internal Revenue in Gmail

How to generate an eSignature for the Us Income Tax Return For An S Corporation Internal Revenue straight from your smart phone

How to create an electronic signature for the Us Income Tax Return For An S Corporation Internal Revenue on iOS

How to generate an eSignature for the Us Income Tax Return For An S Corporation Internal Revenue on Android devices

People also ask

-

What is an S Corp tax form and why do I need it?

An S Corp tax form is a document that S corporations use to report income, deductions, and credits to the IRS. It's essential for meeting tax obligations and ensuring compliance. Proper handling of your S Corp tax form can help maximize tax benefits and streamline your filing process.

-

How can airSlate SignNow help me with my S Corp tax form?

airSlate SignNow simplifies the process of preparing and signing your S Corp tax form by allowing you to electronically send and eSign documents securely. This saves time and reduces errors associated with traditional paper methods. With its user-friendly interface, you can efficiently manage all your tax-related documents in one place.

-

Is airSlate SignNow cost-effective for filing S Corp tax forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage their S Corp tax forms. With various pricing plans, you can choose one that fits your budget while gaining access to powerful features. This affordability allows you to streamline your tax documentation process without breaking the bank.

-

What features does airSlate SignNow offer for managing S Corp tax forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, document tracking, and automated workflows specifically designed for S Corp tax forms. These features enhance efficiency and ensure that your tax forms are completed accurately and on time. Additionally, the platform’s integration capabilities allow for seamless data management.

-

Can I integrate airSlate SignNow with accounting software for my S Corp tax form needs?

Absolutely! airSlate SignNow easily integrates with popular accounting software, making it convenient to manage your S Corp tax forms alongside your financial records. This integration enhances collaboration between teams and ensures that all necessary information is accessible, streamlining your workflow during tax season.

-

What are the benefits of using airSlate SignNow for S Corp tax forms?

Using airSlate SignNow for your S Corp tax forms offers numerous benefits including enhanced security, faster turnaround times, and reduced paperwork. The platform's intuitive design facilitates easy document management, which can signNowly reduce the stress of tax filing. With airSlate SignNow, you can focus more on your business and less on administrative tasks.

-

How secure is airSlate SignNow for filing S Corp tax forms?

airSlate SignNow prioritizes security, implementing industry-standard encryption and authentication protocols to protect your sensitive information. When you use airSlate SignNow for your S Corp tax forms, you can confidently eSign documents knowing that your data is safeguarded. This commitment to security ensures compliance with regulatory standards.

Get more for U S Income Tax Return For An S Corporation Internal Revenue

- Application for death benefits omb number 3206 0172 federal form

- Navmc 10524 form

- Testimony of plaintiff alabama form

- There is there are exercises pdf form

- Gehs savings calculator form

- Motion to stop wage garnishment alabama form

- Semiconductor material and device characterization solution manual pdf form

- 6th grade science sol review packet form

Find out other U S Income Tax Return For An S Corporation Internal Revenue

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer