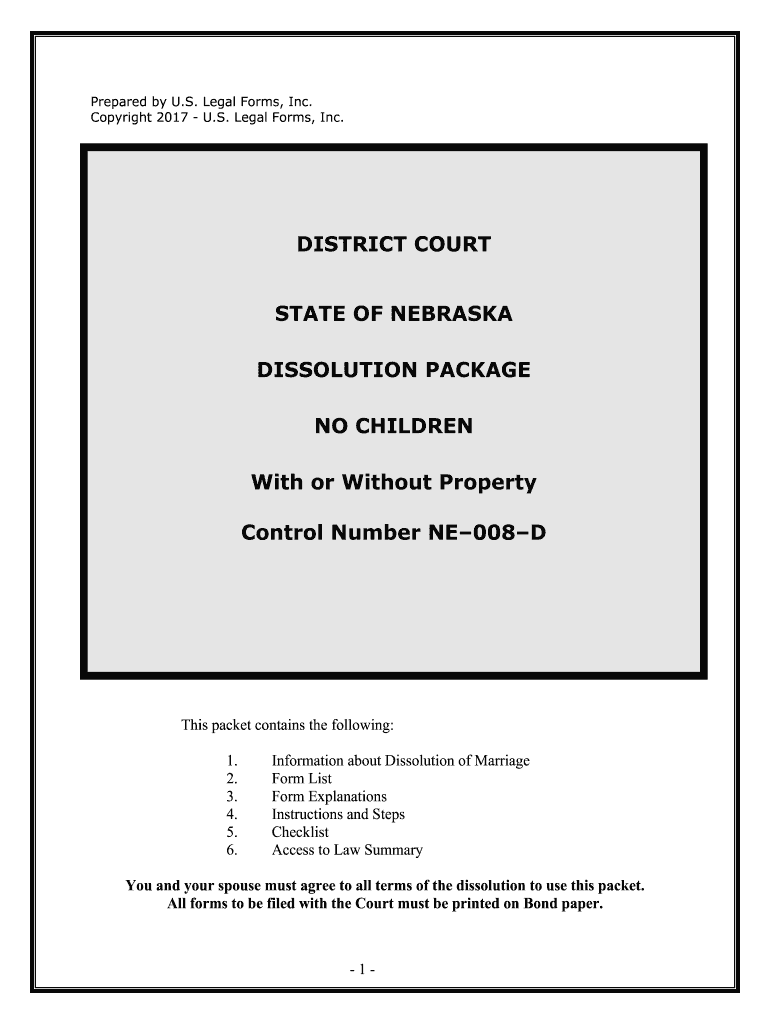

Control Number NE008D Form

What is the Control Number on the Randstad W-2 Form?

The control number on the Randstad W-2 form is a unique identifier assigned to each employee's W-2 document. This number helps employers and the IRS track and manage tax information efficiently. It is typically located in Box D of the W-2 form and is crucial for ensuring the accuracy of tax filings. Understanding the control number is essential for verifying your W-2 and ensuring that all information is correctly reported to the IRS.

How to Use the Control Number on the Randstad W-2 Form

To use the control number effectively, ensure that you include it when filing your taxes or when addressing any discrepancies with your employer or the IRS. When entering your W-2 information into tax software or forms, the control number should be accurately inputted to avoid errors. This number may also be required if you need to request a copy of your W-2 or if you are verifying your income with financial institutions.

Steps to Complete the Randstad W-2 Form

Completing the Randstad W-2 form involves several key steps:

- Gather necessary information, including your Social Security number, earnings, and tax withheld.

- Locate your control number in Box D and ensure it is correct.

- Fill out the required fields, including your personal information and income details.

- Review the completed form for accuracy before submission.

Legal Use of the Control Number on the Randstad W-2 Form

The control number on the Randstad W-2 form serves a legal purpose by linking your tax information to your identity. It is important for compliance with IRS regulations. If you need to amend your tax return or respond to an IRS inquiry, having the correct control number can facilitate the process. Ensure that you keep your W-2 form and its control number secure for future reference.

Filing Deadlines for the Randstad W-2 Form

Filing deadlines for the Randstad W-2 form are aligned with IRS regulations. Employers are required to provide W-2 forms to employees by January 31 of each year. Employees must file their tax returns by April 15, unless an extension is requested. It is important to keep these dates in mind to avoid penalties and ensure timely processing of your tax documents.

Required Documents for Filing with the Randstad W-2 Form

When filing your taxes using the Randstad W-2 form, you will need several key documents:

- Your Randstad W-2 form, including the control number.

- Any additional W-2s from other employers, if applicable.

- Supporting documents for deductions or credits, such as 1099 forms or receipts.

Quick guide on how to complete control number ne008d

Easily Create Control Number NE008D on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right format and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Control Number NE008D on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

How to Edit and eSign Control Number NE008D Effortlessly

- Find Control Number NE008D and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form navigation, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Control Number NE008D and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the control number ne008d

How to create an eSignature for the Control Number Ne008d online

How to generate an electronic signature for the Control Number Ne008d in Chrome

How to create an eSignature for signing the Control Number Ne008d in Gmail

How to generate an electronic signature for the Control Number Ne008d from your smartphone

How to generate an electronic signature for the Control Number Ne008d on iOS devices

How to create an eSignature for the Control Number Ne008d on Android devices

People also ask

-

What is a Randstad W2 form?

The Randstad W2 form is a tax document provided by Randstad that summarizes an employee's earnings and tax deductions for the year. It is essential for filing income taxes accurately, as it includes critical information such as wages earned and taxes withheld. Understanding your Randstad W2 form can help ensure your tax filings are correct and timely.

-

How can airSlate SignNow help with my Randstad W2 form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your Randstad W2 form securely. This streamlines the process of document management, allowing you to focus on essential tasks instead of paperwork. With SignNow, you can eSign your W2 forms from anywhere, increasing efficiency and convenience.

-

Is there a cost associated with using airSlate SignNow for Randstad W2 forms?

airSlate SignNow offers a variety of pricing plans tailored to fit the needs of different businesses, including options for handling Randstad W2 forms. The cost is competitive and often more economical compared to traditional signing methods. By using airSlate SignNow, you can save on printing and postage costs while improving your document workflow.

-

What features does airSlate SignNow offer for managing Randstad W2 forms?

airSlate SignNow includes several features for managing Randstad W2 forms, such as customizable workflows, automated notifications, and secure storage. You can create templates for your W2 forms to save time on future submissions. Furthermore, the platform ensures compliance with legal standards, making it a reliable choice for businesses.

-

Can I integrate airSlate SignNow with other tools for handling Randstad W2 forms?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and applications, enhancing your ability to manage Randstad W2 forms efficiently. Popular integrations include cloud storage services and CRM systems, allowing for a streamlined workflow. This connectivity ensures your W2 documents are easily accessible and properly archived.

-

What are the benefits of using airSlate SignNow for my Randstad W2 form?

Using airSlate SignNow for your Randstad W2 form offers numerous benefits, such as increased security, improved efficiency, and enhanced collaboration. The platform allows multiple parties to review and sign documents in real time, reducing turnaround times. Additionally, it provides a complete audit trail for tracking all actions taken with your W2 forms.

-

How secure is the electronic signing of Randstad W2 forms with airSlate SignNow?

The electronic signing of Randstad W2 forms with airSlate SignNow is highly secure, utilizing encryption and advanced authentication methods. This ensures that your sensitive information remains confidential and protected from unauthorized access. With SignNow's security measures, you can confidently manage your W2 forms online.

Get more for Control Number NE008D

Find out other Control Number NE008D

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free