State of Texas, Hereinafter Referred to as the Trustor, Whether One or More, and Form

What is the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And

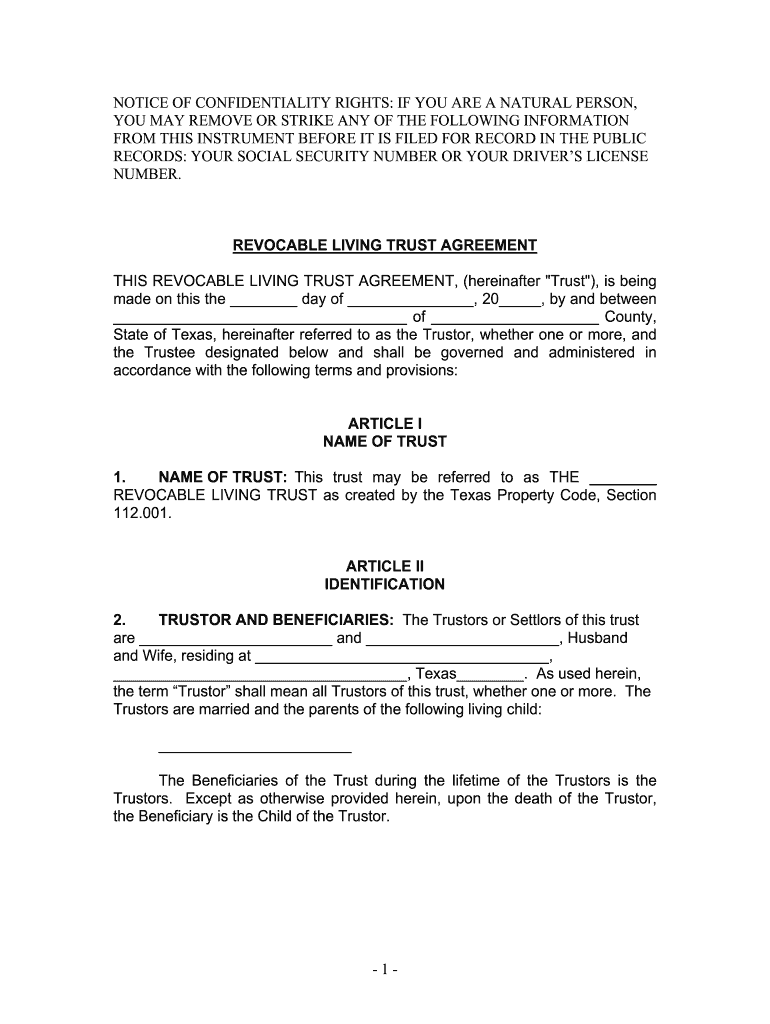

The State Of Texas, hereinafter referred to as the Trustor, whether one or more, is a legal designation used in various trust agreements and legal documents. This term signifies the individual or entity establishing a trust, responsible for transferring assets into the trust for the benefit of designated beneficiaries. Understanding this concept is crucial for anyone involved in estate planning, asset management, or legal contracts within Texas. The Trustor retains significant authority over the trust, including the ability to modify its terms or revoke it entirely, depending on the trust's structure.

How to use the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And

Utilizing the State Of Texas, hereinafter referred to as the Trustor, whether one or more, involves several key steps. First, it is essential to define the purpose of the trust and identify the beneficiaries. Next, the Trustor must select a trustee, who will manage the trust assets according to the established terms. The Trustor should then draft a trust agreement, ensuring that it complies with Texas laws. This document must clearly outline the Trustor's intentions, the management of assets, and the distribution of benefits to beneficiaries. Finally, the Trustor should execute the trust agreement, which may involve notarization and the transfer of assets into the trust.

Steps to complete the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And

Completing the State Of Texas, hereinafter referred to as the Trustor, whether one or more, requires a systematic approach. Begin by gathering necessary information about the assets to be included in the trust. Next, outline the specific terms of the trust, including the powers granted to the trustee and rights of the beneficiaries. Draft the trust document, ensuring it meets all legal requirements in Texas. After drafting, review the document for clarity and completeness. Once finalized, sign the trust agreement in the presence of a notary public to ensure its legal validity. Lastly, transfer the designated assets into the trust, completing the process.

Legal use of the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And

The legal use of the State Of Texas, hereinafter referred to as the Trustor, whether one or more, is governed by Texas trust law. This law outlines the rights and responsibilities of the Trustor, trustee, and beneficiaries. The Trustor must ensure that the trust complies with all relevant statutes to be enforceable in a court of law. It is advisable for the Trustor to consult with a legal professional experienced in estate planning to navigate complex legal requirements and ensure that the trust serves its intended purpose effectively.

Key elements of the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And

Key elements of the State Of Texas, hereinafter referred to as the Trustor, whether one or more, include the identification of the Trustor, the designation of beneficiaries, and the appointment of a trustee. Additionally, the trust document must specify the assets being transferred into the trust, the management and distribution instructions, and any conditions or restrictions placed on the beneficiaries. Clarity in these elements is vital to prevent disputes and ensure that the Trustor's intentions are honored.

State-specific rules for the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And

State-specific rules for the State Of Texas, hereinafter referred to as the Trustor, whether one or more, dictate how trusts are created, managed, and terminated. Texas law requires that trust agreements be in writing and signed by the Trustor. Additionally, certain types of trusts may have specific requirements regarding asset management and distribution. Understanding these rules is essential for compliance and effective trust administration. The Trustor should stay informed about any changes in Texas trust law that may impact their trust.

Quick guide on how to complete state of texas hereinafter referred to as the trustor whether one or more and

Complete State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And seamlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without any delays. Handle State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And across any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to amend and eSign State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And effortlessly

- Find State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of texas hereinafter referred to as the trustor whether one or more and

How to create an electronic signature for your State Of Texas Hereinafter Referred To As The Trustor Whether One Or More And online

How to generate an eSignature for the State Of Texas Hereinafter Referred To As The Trustor Whether One Or More And in Google Chrome

How to make an eSignature for putting it on the State Of Texas Hereinafter Referred To As The Trustor Whether One Or More And in Gmail

How to generate an electronic signature for the State Of Texas Hereinafter Referred To As The Trustor Whether One Or More And straight from your smart phone

How to create an electronic signature for the State Of Texas Hereinafter Referred To As The Trustor Whether One Or More And on iOS devices

How to make an electronic signature for the State Of Texas Hereinafter Referred To As The Trustor Whether One Or More And on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And?

airSlate SignNow is a digital solution designed to simplify the signing and management of documents online. It allows users in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And, to eSign important documents efficiently and securely. This tool enhances document workflow, improves compliance, and saves time for businesses.

-

What pricing plans does airSlate SignNow offer for users in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And?

airSlate SignNow provides various pricing plans tailored to meet the needs of different users in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And. These plans range from free to premium, offering features suitable for individuals and businesses alike. Each plan includes essential functionalities to help improve document management and eSigning processes.

-

What features does airSlate SignNow offer that benefit the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And?

airSlate SignNow boasts a range of features designed to streamline document workflows for users in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And. These include customizable templates, robust security options, and mobile compatibility that allow businesses to manage documents from anywhere. Additionally, the platform supports multiple document formats and integrates with popular applications.

-

How can airSlate SignNow improve document management for the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And?

By using airSlate SignNow, businesses in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And, can signNowly enhance their document management processes. The solution provides real-time tracking, secure storage, and easy access to signed documents, ensuring efficient management. This leads to increased productivity and reduced turnaround times for document-related tasks.

-

Does airSlate SignNow provide any integration options for businesses in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And?

Yes, airSlate SignNow offers various integrations with popular applications that are widely used by businesses in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And. This includes CRM systems, project management tools, and cloud storage services. These integrations enhance the functionality of airSlate SignNow, allowing for seamless workflows across platforms.

-

What are the benefits of using airSlate SignNow for companies located in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And?

Companies in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And, can benefit from airSlate SignNow by improving efficiency and reducing costs associated with manual document handling. The ease of use and accessibility of the platform enables teams to collaborate effectively. Furthermore, the secure nature of the platform ensures that sensitive information remains protected.

-

Is airSlate SignNow compliant with legal standards in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And?

Yes, airSlate SignNow is compliant with pertinent legal standards for electronic signatures in the State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And. It adheres to regulations such as ESIGN and UETA, providing users with the assurance that their electronically signed documents are legally binding and recognized. This compliance boosts confidence in using the digital solution for important transactions.

Get more for State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And

- 2016 schedule j form

- Soces field trip permission slip los angeles unified school bb form

- Sewanee and area the bailey house 277 kentucky avenue sewanee tn 37375 citystatezip 9315989811 asbailey sewanee form

- Bought sold note poems form

- Cpim accreditation guidelines revised 2011 ohio treasurer tos ohio form

- Non emergency form

- Reduced user fee 2017 form

- Ky 720s 2016 2019 form

Find out other State Of Texas, Hereinafter Referred To As The Trustor, Whether One Or More, And

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online