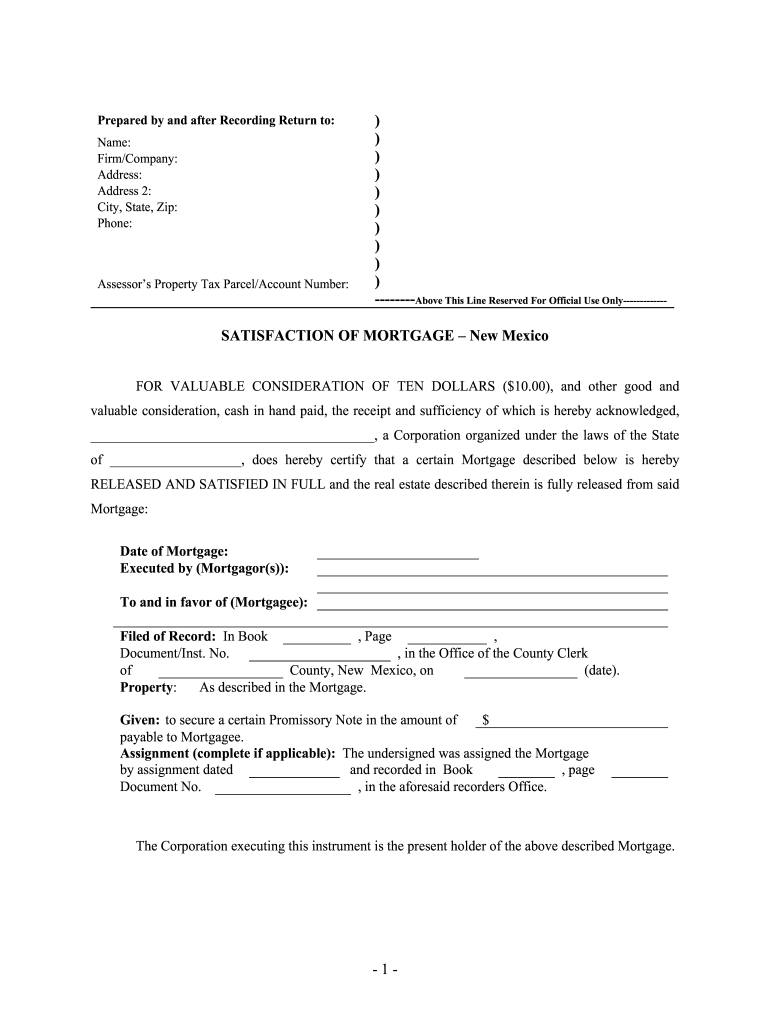

SATISFACTION of MORTGAGE New Mexico Form

What is the satisfaction of mortgage New Mexico?

The satisfaction of mortgage New Mexico is a legal document that signifies the completion of a mortgage obligation. When a borrower pays off their mortgage in full, this document is issued by the lender to confirm that the debt has been satisfied. It serves as proof that the lender no longer holds an interest in the property, allowing the borrower to clear the title and establish full ownership without any encumbrances. This form is essential for protecting the rights of the homeowner and ensuring that their property records accurately reflect their financial status.

How to obtain the satisfaction of mortgage New Mexico

To obtain the satisfaction of mortgage New Mexico, borrowers should first ensure that their mortgage has been paid in full. Once the payment is confirmed, the lender is responsible for preparing the satisfaction document. Borrowers can request this document directly from their lender, typically through a written request or by contacting their customer service department. It is important to verify that the lender processes the satisfaction promptly, as delays can lead to complications in property title records.

Steps to complete the satisfaction of mortgage New Mexico

Completing the satisfaction of mortgage New Mexico involves several key steps:

- Confirm that the mortgage balance is paid in full.

- Request the satisfaction document from the lender.

- Review the document for accuracy, ensuring all details are correct.

- Obtain the lender's signature on the satisfaction document.

- File the signed satisfaction of mortgage with the appropriate county clerk's office to update public records.

Following these steps ensures that the satisfaction of mortgage is legally recognized and that the property title is clear.

Legal use of the satisfaction of mortgage New Mexico

The satisfaction of mortgage New Mexico holds legal significance as it formally releases the lender's claim on the property. This document must be filed with the county clerk to be effective. Once recorded, it serves as public notice that the mortgage has been satisfied, protecting the homeowner from any future claims by the lender. It is crucial for homeowners to understand that failing to file this document can result in complications, such as difficulties in selling the property or obtaining new financing.

Key elements of the satisfaction of mortgage New Mexico

Several key elements must be included in the satisfaction of mortgage New Mexico for it to be legally binding:

- The names of the borrower and lender.

- The property description, including the address and legal description.

- The date of the original mortgage and the date it was paid off.

- A statement confirming that the mortgage has been satisfied.

- The signatures of the lender or their authorized representative.

These components ensure that the document is complete and can be properly recorded with the county clerk.

State-specific rules for the satisfaction of mortgage New Mexico

New Mexico has specific regulations regarding the satisfaction of mortgage that borrowers should be aware of. The state requires that the satisfaction document be filed within a certain timeframe after the mortgage has been paid off, typically within 30 days. Additionally, the document must be recorded with the county clerk to ensure it is recognized legally. Understanding these state-specific rules can help borrowers avoid potential legal issues and ensure their property records are accurate.

Quick guide on how to complete satisfaction of mortgage new mexico

Effortlessly Prepare SATISFACTION OF MORTGAGE New Mexico on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without any delays. Manage SATISFACTION OF MORTGAGE New Mexico on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign SATISFACTION OF MORTGAGE New Mexico with Ease

- Locate SATISFACTION OF MORTGAGE New Mexico and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, shared link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign SATISFACTION OF MORTGAGE New Mexico and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the satisfaction of mortgage new mexico

How to generate an eSignature for your Satisfaction Of Mortgage New Mexico online

How to make an electronic signature for your Satisfaction Of Mortgage New Mexico in Chrome

How to generate an electronic signature for signing the Satisfaction Of Mortgage New Mexico in Gmail

How to generate an electronic signature for the Satisfaction Of Mortgage New Mexico right from your smart phone

How to create an electronic signature for the Satisfaction Of Mortgage New Mexico on iOS devices

How to make an electronic signature for the Satisfaction Of Mortgage New Mexico on Android OS

People also ask

-

What is the nm satisfaction mortgage?

The nm satisfaction mortgage is a specific mortgage product designed to provide borrowers in New Mexico with better satisfaction by simplifying the signing process. Utilizing airSlate SignNow, the process of eSigning documents becomes straightforward and efficient, ensuring that clients can complete their transactions with ease.

-

How does airSlate SignNow enhance the nm satisfaction mortgage experience?

airSlate SignNow enhances the nm satisfaction mortgage experience by offering a seamless electronic signing platform that allows borrowers to easily sign and send documents. This not only reduces paperwork but also speeds up the closing process, leading to higher customer satisfaction.

-

What features does airSlate SignNow offer for nm satisfaction mortgage transactions?

For nm satisfaction mortgage transactions, airSlate SignNow offers features like document templates, real-time tracking, and secure cloud storage. These features ensure that the signing process is efficient, organized, and accessible from anywhere, making it ideal for both lenders and borrowers.

-

Is airSlate SignNow a cost-effective solution for nm satisfaction mortgage?

Yes, airSlate SignNow is a cost-effective solution for the nm satisfaction mortgage, designed to save money and time for businesses. With a variety of pricing plans available, you can choose the option that best fits your business needs without breaking the bank.

-

Can airSlate SignNow integrate with other software for nm satisfaction mortgage operations?

Absolutely! airSlate SignNow integrates seamlessly with various software applications used in managing nm satisfaction mortgage operations. This ensures that you can streamline your workflow and improve efficiency without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for nm satisfaction mortgage clients?

Using airSlate SignNow for nm satisfaction mortgage clients provides many benefits, including faster processing times, enhanced security, and improved user experience. Clients appreciate the ability to sign documents remotely, resulting in greater overall satisfaction with the mortgage process.

-

How secure is the airSlate SignNow platform for nm satisfaction mortgage documents?

The airSlate SignNow platform is highly secure, utilizing advanced encryption and regular security updates to protect nm satisfaction mortgage documents. Clients can rest assured that their sensitive information is safe while they eSign and send their necessary paperwork.

Get more for SATISFACTION OF MORTGAGE New Mexico

- Form gc 310 2016 2019

- Referral registration form

- Mini checklist c corporation income tax return 2014 form 1120

- El paso community college transcript request form epcc

- Interstate waters office elibrary dep state pa form

- Elon management rental application approval criteria rentlinx form

- Form sc 100a 2017 2019

- Kitti municipal government state of pohnpei audit bb opsa form

Find out other SATISFACTION OF MORTGAGE New Mexico

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online