Financial & Estate Planning Seminar the West Virginia State Bar Form

Understanding the Deed Gift Form

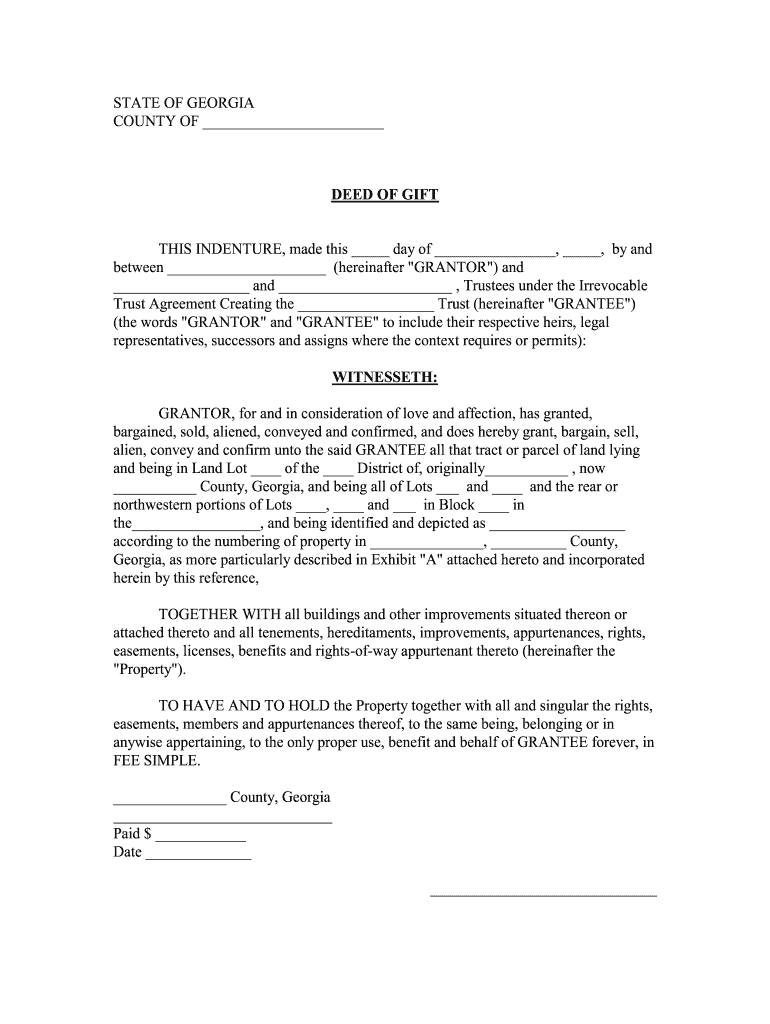

The deed gift form is a legal document used to transfer ownership of real property from one individual to another without any exchange of money. This form is particularly relevant in situations where a person wishes to gift property to a family member or friend. It is essential to ensure that the deed gift is executed correctly to avoid any future disputes regarding ownership. The document must clearly state the names of both the donor and the recipient, along with a detailed description of the property being transferred.

Key Elements of a Deed Gift

A valid deed gift must include several key elements to ensure its legality and enforceability. These include:

- Grantor and Grantee Information: Full names and addresses of both the person giving the gift (grantor) and the person receiving it (grantee).

- Property Description: A detailed description of the property, including its address and legal description.

- Intent to Gift: A clear statement indicating the grantor's intention to gift the property without any compensation.

- Signatures: Signatures of the grantor and, in some cases, the grantee, along with a witness signature if required by state law.

Steps to Complete the Deed Gift Form

Completing a deed gift form involves several important steps to ensure that the transfer is legally binding. Here is a step-by-step guide:

- Gather Necessary Information: Collect all relevant details about the property and the parties involved.

- Fill Out the Form: Complete the deed gift form by accurately entering the required information.

- Sign the Document: Ensure that the grantor signs the form in the presence of a notary public if required.

- Record the Deed: Submit the completed deed gift form to the appropriate county office for recording, which provides public notice of the transfer.

Legal Use of the Deed Gift

The legal use of a deed gift is crucial for ensuring that the transfer of property is recognized by law. In the United States, the deed must comply with state-specific regulations, which may vary. It is important to check local laws to confirm that all requirements are met, including witnessing and notarization. A properly executed deed gift can help avoid potential legal disputes and ensure that the recipient has clear ownership of the property.

State-Specific Rules for Deed Gifts

Each state in the U.S. has its own rules regarding the execution and recording of deed gifts. For example, some states may require the deed to be notarized, while others may not. Additionally, certain states may have specific tax implications for gifting property. It is advisable to consult with a legal professional or local government office to understand the specific requirements in your state before completing a deed gift.

Examples of Using the Deed Gift

Deed gifts can be used in various scenarios, such as:

- Transferring property to a child as part of estate planning.

- Gifting a vacation home to a family member.

- Conveying property to a charitable organization.

These examples illustrate the flexibility of the deed gift form in facilitating property transfers without financial transactions.

Quick guide on how to complete financial ampamp estate planning seminar the west virginia state bar

Complete Financial & Estate Planning Seminar The West Virginia State Bar seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Financial & Estate Planning Seminar The West Virginia State Bar on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Financial & Estate Planning Seminar The West Virginia State Bar effortlessly

- Find Financial & Estate Planning Seminar The West Virginia State Bar and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Financial & Estate Planning Seminar The West Virginia State Bar and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the financial ampamp estate planning seminar the west virginia state bar

How to make an eSignature for the Financial Ampamp Estate Planning Seminar The West Virginia State Bar in the online mode

How to create an eSignature for the Financial Ampamp Estate Planning Seminar The West Virginia State Bar in Chrome

How to create an electronic signature for signing the Financial Ampamp Estate Planning Seminar The West Virginia State Bar in Gmail

How to make an eSignature for the Financial Ampamp Estate Planning Seminar The West Virginia State Bar straight from your smart phone

How to generate an eSignature for the Financial Ampamp Estate Planning Seminar The West Virginia State Bar on iOS

How to make an electronic signature for the Financial Ampamp Estate Planning Seminar The West Virginia State Bar on Android OS

People also ask

-

What is a deed gift document and who needs it?

A deed gift document is a legal form used to transfer ownership of property or assets as a gift from one party to another. It is essential for individuals who wish to give signNow gifts, such as real estate or valuable items, ensuring the transfer is legally recognized. This document protects both the giver and the recipient during the transaction.

-

How can airSlate SignNow help me create a deed gift document?

airSlate SignNow provides a user-friendly platform to create, customize, and eSign your deed gift document with ease. Our robust features allow you to seamlessly fill out the necessary information, ensuring all legal requirements are met. You can create a professionally designed document in just minutes, saving you time and reducing stress.

-

Is there a cost associated with using airSlate SignNow for a deed gift document?

Yes, airSlate SignNow offers flexible pricing plans tailored to different business needs. Each plan includes access to create and manage documents, including your deed gift document. You can choose a plan that fits your budget while enjoying the benefits of high-quality electronic signature services.

-

Can I eSign my deed gift document on mobile devices?

Absolutely! airSlate SignNow allows you to eSign your deed gift document using mobile devices, providing flexibility and convenience. Whether you’re in the office or on the go, you can access your documents through our mobile-friendly interface and complete all signing processes with just a few taps.

-

What are the benefits of using airSlate SignNow for legal documents?

Using airSlate SignNow for legal documents like a deed gift document offers several benefits, including enhanced security, ease of use, and fast processing. You can securely store and manage your documents in the cloud, access templates, and collaborate with others remotely. This makes it easier for you to finalize important transactions efficiently.

-

Does airSlate SignNow support integrations with other applications?

Yes, airSlate SignNow supports various integrations with popular applications, streamlining your workflow. You can easily connect your account with tools such as Google Drive, Dropbox, and Microsoft Office to manage your deed gift document alongside your other vital documents effectively. This integration boosts productivity and keeps everything organized.

-

How do I ensure my deed gift document is legally binding?

To ensure that your deed gift document is legally binding, it must be properly drafted and signed by both parties. airSlate SignNow makes this process straightforward by providing options for electronic signatures that are legally recognized. You can also add witnesses if required by your local laws to further validate the document.

Get more for Financial & Estate Planning Seminar The West Virginia State Bar

- Cc dr 031 2016 2019 form

- Lyft tnc inspection form florida

- The new york state disclosure form for buyer and seller

- Fannie mae hardship affidavit form 194 pdf emma

- 2013baparentformspdf ocean institute

- Form 10 7959f 1

- Arizona aids drug assistance program new applicant eligibility form azdhs

- Complaint to enforce a foreign decreejudgment bristol county form

Find out other Financial & Estate Planning Seminar The West Virginia State Bar

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT