Treaty Annuity Payment Form 2012

What is the Treaty Annuity Payment Form

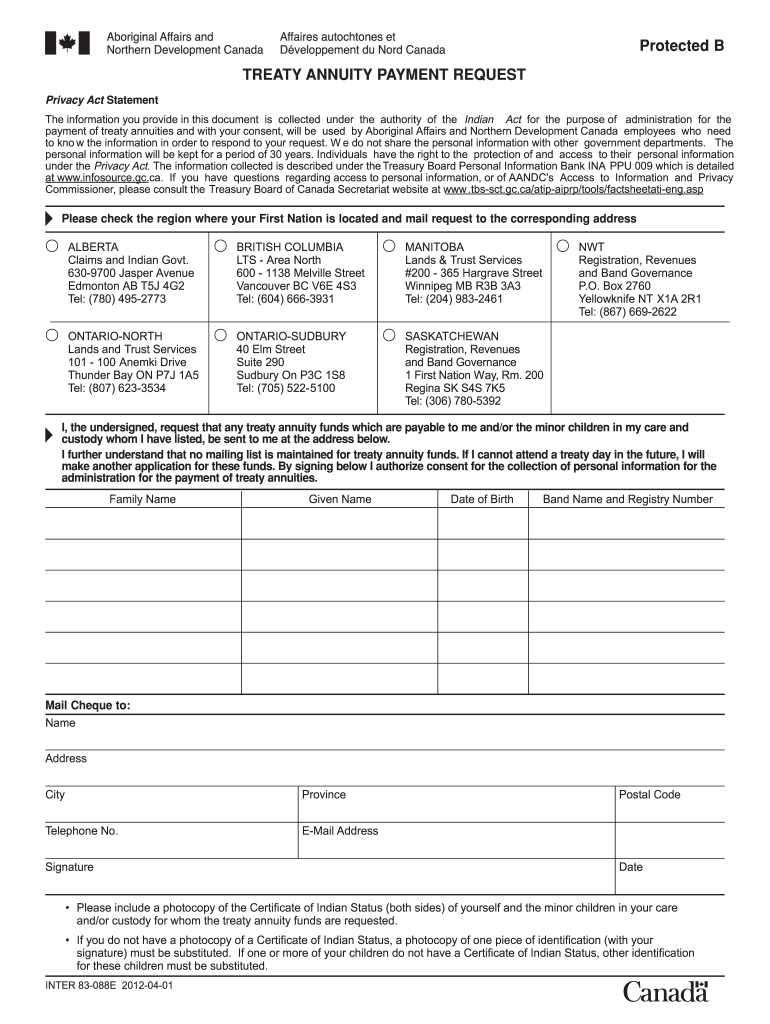

The Treaty Annuity Payment Form is a document used by individuals who are eligible to receive annuity payments under various treaties. This form is essential for ensuring that recipients can claim their payments correctly and in compliance with applicable regulations. The form typically includes personal information, treaty details, and payment preferences, making it a crucial component for those receiving treaty benefits.

How to use the Treaty Annuity Payment Form

Using the Treaty Annuity Payment Form involves several steps to ensure accurate completion and submission. First, gather all necessary personal information and documents related to the treaty benefits. Next, fill out the form meticulously, ensuring that all sections are completed with accurate data. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person, to ensure timely processing of your payment.

Steps to complete the Treaty Annuity Payment Form

Completing the Treaty Annuity Payment Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the relevant authority.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the treaty under which you are claiming benefits.

- Specify your payment preferences, including how you would like to receive your payments.

- Review the form for accuracy and completeness.

- Submit the completed form as directed.

Required Documents

When completing the Treaty Annuity Payment Form, certain documents may be required to support your application. These may include:

- Proof of identity, such as a government-issued ID.

- Documentation of treaty eligibility.

- Any previous correspondence related to your treaty payments.

- Bank details for direct deposit, if applicable.

Form Submission Methods

The Treaty Annuity Payment Form can typically be submitted through various methods, depending on the guidelines provided by the issuing authority. Common submission methods include:

- Online submission through the official website.

- Mailing the completed form to the designated address.

- In-person submission at a local office or agency.

Eligibility Criteria

To use the Treaty Annuity Payment Form, individuals must meet specific eligibility criteria set forth by the relevant treaty agreements. Generally, eligibility may depend on factors such as:

- Your nationality or residency status.

- Your age or specific circumstances, such as retirement status.

- Compliance with any treaty requirements regarding the timing and nature of the annuity payments.

Quick guide on how to complete tready payment request online 2012 2019 form

A concise manual on how to create your Treaty Annuity Payment Form

Finding the appropriate template can turn into a difficulty when you need to supply formal international paperwork. Even if you possess the necessary form, it might be cumbersome to swiftly assemble it according to all the specifications if you are using printed versions rather than managing everything digitally. airSlate SignNow is the online eSignature platform that assists you in overcoming all of that. It allows you to obtain your Treaty Annuity Payment Form and rapidly complete and sign it on-site without the need to reprint documents in the event of a typo.

Here are the procedures you need to follow to prepare your Treaty Annuity Payment Form with airSlate SignNow:

- Press the Get Form button to upload your file to our editor immediately.

- Begin with the initial empty field, provide information, and continue with the Next tool.

- Complete the empty spaces using the Cross and Check features from the toolbar above.

- Choose the Highlight or Line options to emphasize the most crucial information.

- Select Image and upload one if your Treaty Annuity Payment Form necessitates it.

- Utilize the right-side pane to add additional fields for you or others to fill out if needed.

- Review your responses and approve the document by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete editing by pressing the Done button and choosing your file-sharing options.

Once your Treaty Annuity Payment Form is prepared, you can distribute it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your finalized documents in your account, organized in folders based on your preferences. Don’t squander time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct tready payment request online 2012 2019 form

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

I have successfully filled the online admission form of NIOS stream 1 April exam 2019 and made the payment .do I need to do something else like sending the same form by post to NIOS?

If you have made online payment then you have to do nothing…. now just wait and relax…. if your all documents are correct and real then your admission will be confirmed within 2 months….for any other query or doubt related to NIOS inbox me…..HAPPY QUORAing…..

Create this form in 5 minutes!

How to create an eSignature for the tready payment request online 2012 2019 form

How to make an eSignature for the Tready Payment Request Online 2012 2019 Form in the online mode

How to generate an electronic signature for your Tready Payment Request Online 2012 2019 Form in Chrome

How to generate an eSignature for putting it on the Tready Payment Request Online 2012 2019 Form in Gmail

How to create an electronic signature for the Tready Payment Request Online 2012 2019 Form straight from your mobile device

How to make an electronic signature for the Tready Payment Request Online 2012 2019 Form on iOS devices

How to generate an eSignature for the Tready Payment Request Online 2012 2019 Form on Android devices

People also ask

-

What is a Treaty Annuity Payment Form?

A Treaty Annuity Payment Form is a document used to request payment for annuities under a treaty agreement. This form simplifies the process of receiving payments and ensures that all necessary information is provided. By using a Treaty Annuity Payment Form, you can streamline your payment requests and reduce potential delays.

-

How can airSlate SignNow help with Treaty Annuity Payment Forms?

airSlate SignNow offers a seamless solution for managing Treaty Annuity Payment Forms by allowing you to create, send, and eSign documents easily. Our platform ensures that your forms are securely stored and easily accessible, which simplifies tracking and management of your annuity payments. Plus, our user-friendly interface makes it easy for anyone to navigate and utilize the features.

-

What features does airSlate SignNow provide for Treaty Annuity Payment Forms?

With airSlate SignNow, you can customize your Treaty Annuity Payment Forms with templates, add fields for signatures, and automate reminders for signers. Additionally, our platform allows you to integrate with other applications, ensuring that your workflow remains efficient and organized. These features collectively enhance the overall experience of managing your annuity payment requests.

-

Is there a cost associated with using airSlate SignNow for Treaty Annuity Payment Forms?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs. Each plan provides various features to facilitate the management of Treaty Annuity Payment Forms and other document needs. You can choose a plan that fits your budget and requirements, ensuring you get the best value for your investment.

-

Can I track the status of my Treaty Annuity Payment Form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Treaty Annuity Payment Forms in real-time. You can see when your forms are sent, viewed, and signed, which helps you manage your documents more effectively and ensures timely processing of your annuity payments.

-

What integrations does airSlate SignNow support for Treaty Annuity Payment Forms?

airSlate SignNow supports integrations with various applications such as Google Drive, Dropbox, and CRM systems, which can enhance the management of your Treaty Annuity Payment Forms. These integrations allow you to easily pull in data, automate workflows, and store your signed documents securely. This flexibility helps streamline your business processes.

-

How secure is my information when using airSlate SignNow for Treaty Annuity Payment Forms?

Security is a top priority for airSlate SignNow. We implement advanced encryption protocols and comply with industry standards to ensure that your information, including Treaty Annuity Payment Forms, is protected at all times. You can trust that your sensitive data is safe with us.

Get more for Treaty Annuity Payment Form

- Enrollment form for sipuleucel t and patient

- My beach is shrinking answer key form

- Electrical lineman mv online application from download form

- Instructor candidate application georgiahealth form

- Backflow prevention device test maintenance report static arvada form

- Missouri eye examination form

- Request to amend information on a form wc 14 wc 14a

- 7a authorization sba form

Find out other Treaty Annuity Payment Form

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form