State of Illinois, Hereinafter Referred to as the Trustor, Whether One or More, and Form

Understanding the Illinois Trust

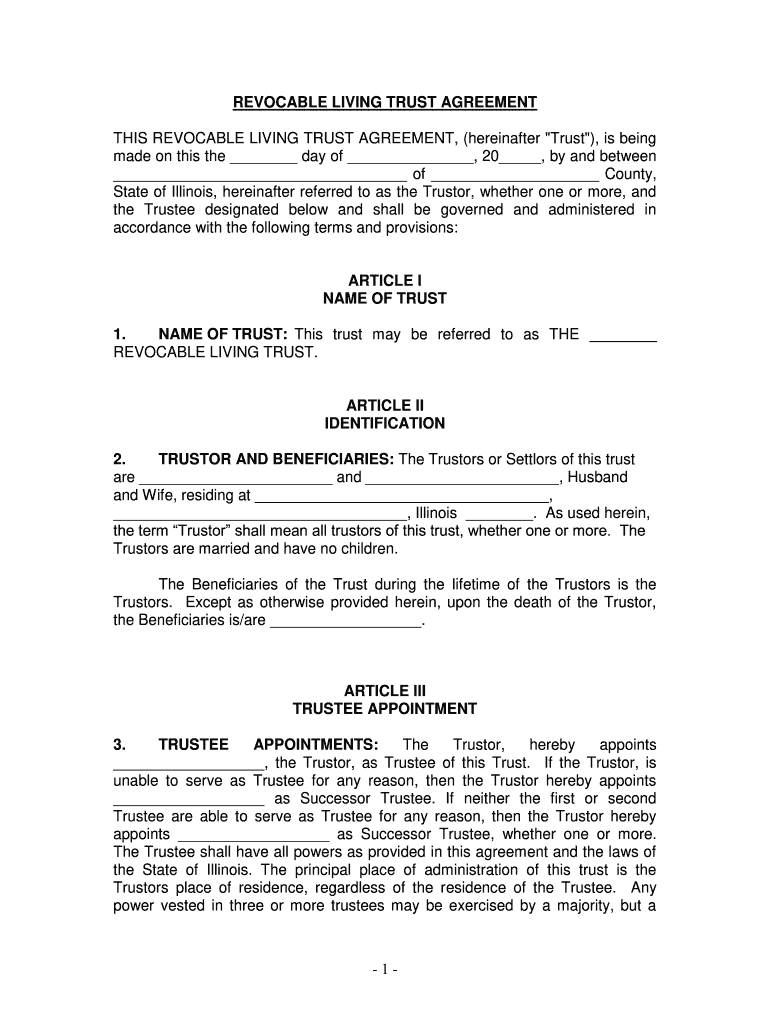

The Illinois trust, often referred to as a living trust revocable, is a legal arrangement allowing individuals to manage their assets during their lifetime and dictate the distribution of those assets upon death. This type of trust provides flexibility, as the trustor can modify or revoke it at any time while they are alive. Establishing an Illinois trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries.

Key Elements of the Illinois Trust

Several critical components define the Illinois trust:

- Trustor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets and ensuring the terms of the trust are followed.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the trustor's death.

- Assets: Property, investments, and other valuables placed into the trust for management and distribution.

Steps to Complete the Illinois Trust

Creating an Illinois trust involves several essential steps:

- Determine your assets: Assess what you want to include in the trust.

- Select a trustee: Choose a reliable person or institution to manage the trust.

- Draft the trust document: Outline the terms, including how assets will be managed and distributed.

- Fund the trust: Transfer ownership of your assets to the trust, ensuring they are legally part of it.

- Review and update: Regularly check the trust to ensure it reflects your current wishes and circumstances.

Legal Use of the Illinois Trust

The Illinois trust is legally recognized, provided it meets specific requirements under state law. It must be created voluntarily, with the trustor having the capacity to understand the implications of establishing the trust. The document should be signed and dated, and while notarization is not mandatory, it can enhance the trust's validity.

State-Specific Rules for the Illinois Trust

Illinois law governs the creation and management of trusts, including the Illinois trust. Key regulations include:

- Trusts must comply with the Illinois Trust Code, which outlines the rights and responsibilities of trustees and beneficiaries.

- Trustors must be of sound mind and at least eighteen years old to create a trust.

- Specific tax implications may apply, and it's advisable to consult with a legal professional regarding estate taxes and other financial considerations.

Examples of Using the Illinois Trust

Utilizing an Illinois trust can serve various purposes, such as:

- Providing for minor children by designating a guardian and outlining how assets should be managed until they reach adulthood.

- Protecting assets from creditors or legal claims by placing them in a trust.

- Ensuring specific charitable donations are fulfilled after the trustor's passing.

Quick guide on how to complete state of illinois hereinafter referred to as the trustor whether one or more and

Complete State Of Illinois, Hereinafter Referred To As The Trustor, Whether One Or More, And seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the required form and securely keep it online. airSlate SignNow supplies you with all the resources necessary to create, amend, and eSign your documents promptly without delays. Handle State Of Illinois, Hereinafter Referred To As The Trustor, Whether One Or More, And on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign State Of Illinois, Hereinafter Referred To As The Trustor, Whether One Or More, And effortlessly

- Locate State Of Illinois, Hereinafter Referred To As The Trustor, Whether One Or More, And and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Edit and eSign State Of Illinois, Hereinafter Referred To As The Trustor, Whether One Or More, And and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of illinois hereinafter referred to as the trustor whether one or more and

How to generate an eSignature for your State Of Illinois Hereinafter Referred To As The Trustor Whether One Or More And online

How to generate an electronic signature for your State Of Illinois Hereinafter Referred To As The Trustor Whether One Or More And in Google Chrome

How to generate an electronic signature for putting it on the State Of Illinois Hereinafter Referred To As The Trustor Whether One Or More And in Gmail

How to create an eSignature for the State Of Illinois Hereinafter Referred To As The Trustor Whether One Or More And from your smart phone

How to create an eSignature for the State Of Illinois Hereinafter Referred To As The Trustor Whether One Or More And on iOS

How to create an electronic signature for the State Of Illinois Hereinafter Referred To As The Trustor Whether One Or More And on Android OS

People also ask

-

What is an Illinois trust?

An Illinois trust is a legal arrangement that allows individuals to manage and protect their assets. It provides tax advantages and helps with estate planning, making it a popular choice for residents in Illinois. Understanding the specifics of an Illinois trust can help you make informed decisions regarding your asset management.

-

How can airSlate SignNow assist with Illinois trust documents?

airSlate SignNow streamlines the process of signing and managing Illinois trust documents electronically. Our platform allows users to easily create, send, and eSign these important legal documents securely. This helps ensure that your Illinois trust documentation is handled efficiently and legally compliant.

-

What are the costs associated with using airSlate SignNow for Illinois trust management?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including those managing Illinois trust documents. You can choose a plan that suits your budget while enjoying the benefits of secure eSignature and document management. Our cost-effective solution ensures you receive great value for your trust-related documentation.

-

Are there any specific features in airSlate SignNow beneficial for managing an Illinois trust?

Yes, airSlate SignNow includes features like customizable templates, document tracking, and secure storage, all of which are beneficial for managing an Illinois trust. These tools simplify the entire workflow, ensuring that all parties involved can easily review and sign necessary documents. With airSlate SignNow, managing your Illinois trust becomes a seamless experience.

-

Can I integrate airSlate SignNow with other tools for managing Illinois trust?

Absolutely! airSlate SignNow offers integrations with popular tools that streamline document management for Illinois trust. Whether you use CRM systems, cloud storage, or other applications, you can seamlessly connect airSlate SignNow to enhance your document workflow. This flexibility is essential for efficient management of your Illinois trust.

-

What are the benefits of using airSlate SignNow for my Illinois trust?

Using airSlate SignNow for your Illinois trust offers numerous benefits such as increased efficiency, cost savings, and enhanced security. Our electronic signature solution eliminates the need for physical paperwork, which can reduce delays and improve the overall process. Additionally, keeping your documents secure and easily accessible ensures peace of mind when managing your Illinois trust.

-

How does eSigning work for Illinois trust documents with airSlate SignNow?

eSigning with airSlate SignNow for Illinois trust documents is incredibly straightforward. Users can upload their documents, add the necessary eSignature fields, and send them to signers via email. Once signed, all parties receive a copy, making it easy to keep track of important agreements related to your Illinois trust.

Get more for State Of Illinois, Hereinafter Referred To As The Trustor, Whether One Or More, And

- Pvq manual payment voucher transmittal comptroller alabama form

- The criminal justice solutions organization form

- East pottwawattamie 4 h extension iastate form

- Building permit application form city of fayetteville

- Bowling tournament registration form northern california demolay

- Form ui 3 r

- Notification of contest winner toastmasters form

- Subpoena lake county clerk of the circuit court form

Find out other State Of Illinois, Hereinafter Referred To As The Trustor, Whether One Or More, And

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile