How to Form an LLC in MarylandNolo

Understanding the Maryland Single Member LLC

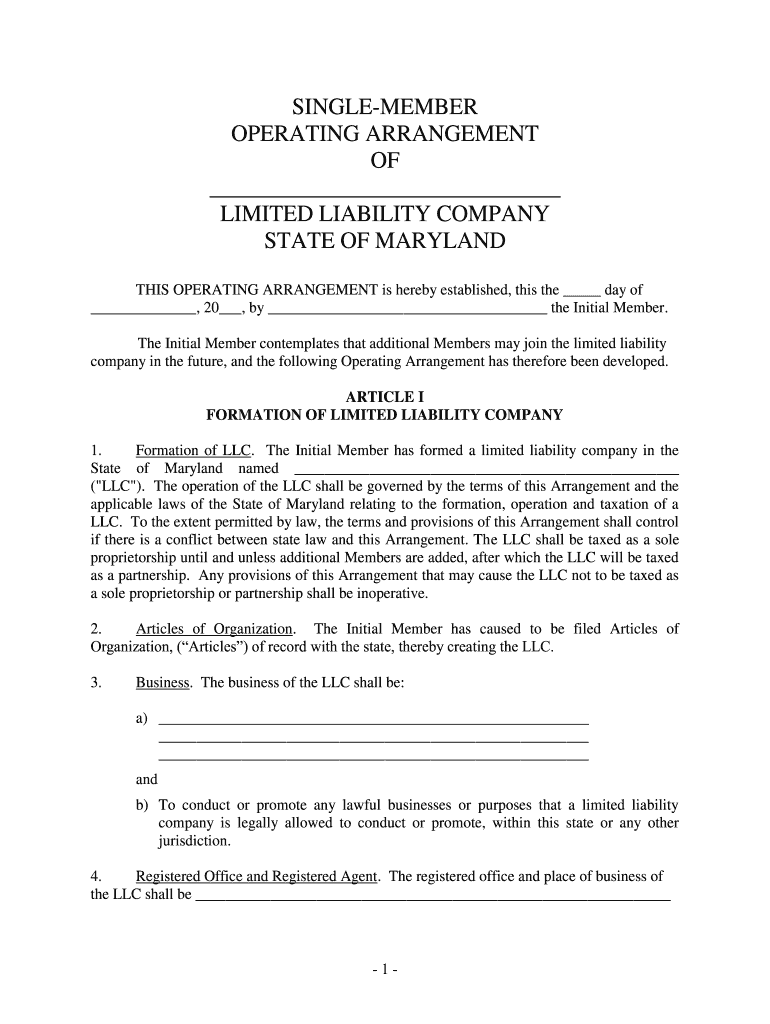

A Maryland single member LLC is a limited liability company with only one owner. This structure provides the owner with personal liability protection, meaning personal assets are generally protected from business debts and liabilities. Forming a single member LLC in Maryland allows for flexibility in management and taxation, as the owner can choose to be taxed as a sole proprietor or as a corporation.

Steps to Form a Single Member LLC in Maryland

Creating a Maryland single member LLC involves several key steps:

- Choose a Name: The name must be unique and include "Limited Liability Company" or abbreviations like "LLC" or "L.L.C."

- Designate a Registered Agent: This person or entity will receive legal documents on behalf of the LLC.

- File Articles of Organization: Submit the Articles of Organization to the Maryland State Department of Assessments and Taxation (SDAT).

- Create an Operating Agreement: Although not required, it is advisable to outline the management structure and operational procedures.

- Obtain an EIN: An Employer Identification Number (EIN) from the IRS is necessary for tax purposes, even if the LLC has no employees.

Required Documents for Maryland Single Member LLC

To successfully form a single member LLC in Maryland, the following documents are typically required:

- Articles of Organization

- Operating Agreement (optional but recommended)

- Employer Identification Number (EIN) application

Legal Considerations for Maryland Single Member LLC

Establishing a single member LLC in Maryland offers legal benefits, including:

- Limited Liability Protection: Protects personal assets from business liabilities.

- Pass-Through Taxation: Income is reported on the owner's personal tax return, avoiding double taxation.

- Simplified Management: The owner has full control over the business operations.

Filing Deadlines for Maryland LLCs

It is important to be aware of the filing deadlines to maintain compliance. Key deadlines include:

- Annual Reports: Due by April 15 each year.

- Initial Filing: Articles of Organization should be filed before commencing business operations.

IRS Guidelines for Single Member LLCs

The IRS treats single member LLCs as disregarded entities for tax purposes unless the owner elects to be taxed as a corporation. This means:

- Income and expenses are reported on Schedule C of the owner's personal tax return.

- The LLC itself does not pay federal income tax.

Quick guide on how to complete how to form an llc in marylandnolo

Complete How To Form An LLC In MarylandNolo effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without complications. Manage How To Form An LLC In MarylandNolo on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign How To Form An LLC In MarylandNolo without hassle

- Locate How To Form An LLC In MarylandNolo and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign How To Form An LLC In MarylandNolo and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to form an llc in marylandnolo

How to make an eSignature for the How To Form An Llc In Marylandnolo in the online mode

How to generate an electronic signature for the How To Form An Llc In Marylandnolo in Chrome

How to make an eSignature for putting it on the How To Form An Llc In Marylandnolo in Gmail

How to create an electronic signature for the How To Form An Llc In Marylandnolo straight from your mobile device

How to create an eSignature for the How To Form An Llc In Marylandnolo on iOS devices

How to create an electronic signature for the How To Form An Llc In Marylandnolo on Android

People also ask

-

What is Maryland liability in the context of e-signatures?

Maryland liability pertains to the legal responsibilities associated with electronic signatures in Maryland. Understanding Maryland liability is crucial for businesses that want to ensure compliance with state regulations while using e-signature solutions such as airSlate SignNow. It helps to mitigate risks associated with document signing.

-

How does airSlate SignNow ensure compliance with Maryland liability laws?

AirSlate SignNow maintains compliance with Maryland liability laws by implementing robust security features and adhering to the ESIGN Act and UETA. These measures ensure that all e-signed documents are legally binding and enforceable within Maryland. Our platform regularly updates to reflect any changes in local regulations.

-

What are the pricing options for airSlate SignNow regarding Maryland liability?

AirSlate SignNow offers various pricing plans that cater to different business needs, ensuring affordability while managing Maryland liability. Each plan includes essential features that help businesses send and e-sign documents securely and efficiently. We also provide tailored solutions for larger enterprises.

-

What features does airSlate SignNow offer to manage Maryland liability effectively?

AirSlate SignNow provides features such as document templates, audit trails, and authentication options that help businesses manage Maryland liability. These tools ensure accountability and transparency in the signing process, simplifying compliance with legal standards. Additionally, our platform allows easy customization to meet specific business requirements.

-

How can airSlate SignNow benefit my business concerning Maryland liability?

Using airSlate SignNow helps your business reduce the risks associated with Maryland liability while streamlining the document signing process. By ensuring compliance with legal requirements, you can enhance trust among your clients and partners. This leads to improved business operations and customer satisfaction.

-

Does airSlate SignNow integrate with other applications to help with Maryland liability?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage Maryland liability. Integrations with platforms like CRM systems, project management tools, and cloud storage services allow for efficient document handling. This connectivity simplifies workflows while ensuring compliance.

-

What support does airSlate SignNow provide concerning Maryland liability issues?

AirSlate SignNow offers dedicated customer support to assist with any Maryland liability concerns you may have. Our expert team is available to address compliance questions and guide you through the e-signing process, helping you make informed decisions. Resources such as FAQs and tutorials are also provided to further assist you.

Get more for How To Form An LLC In MarylandNolo

- F18 pex cardholder training form

- 2017 form 40

- Form flood insurance application 2015 2019

- Ldss 2291 rev form

- Premium flight club pty ltd abn 92 618 527 530 form

- Custodianship declaration parentsguardians for minors studying in canada form

- Complete your etrade wire request form in four easy

- Latte straight a nursing form

Find out other How To Form An LLC In MarylandNolo

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast