20, by , County, State of Form

Understanding the Texas Transfer Trust

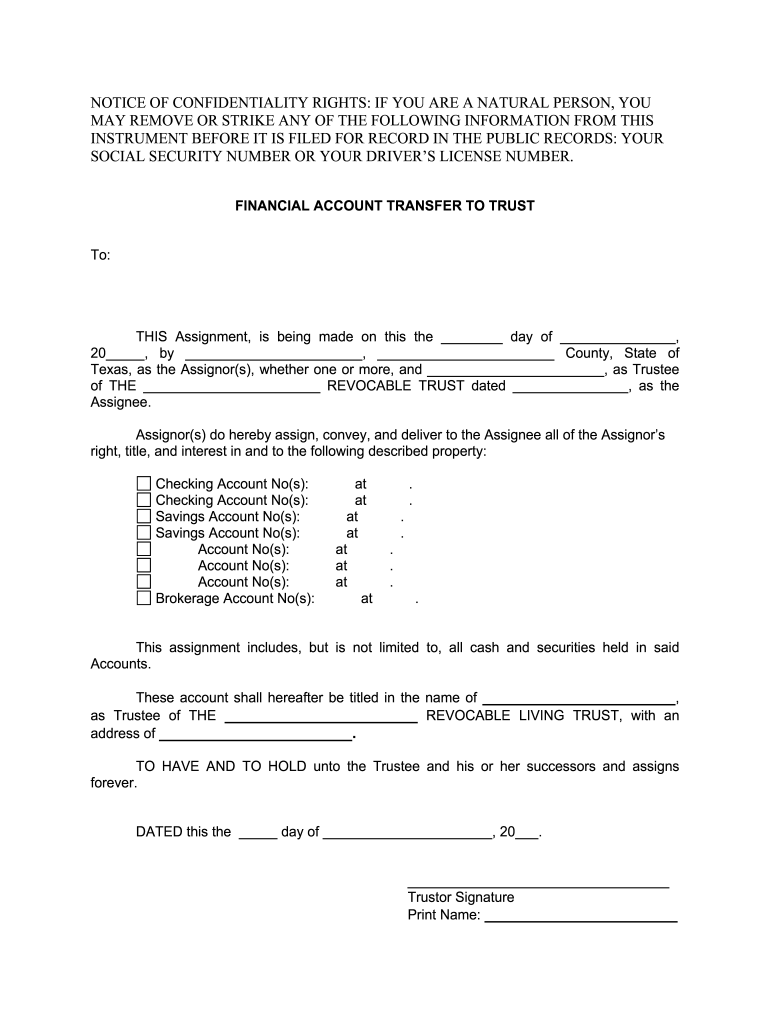

The Texas transfer trust is a legal instrument that allows individuals to manage and distribute their assets while avoiding probate. This type of trust is particularly beneficial for estate planning, as it provides a clear framework for asset distribution according to the grantor's wishes. The trust can hold various types of assets, including real estate, bank accounts, and investments. By utilizing a transfer trust, individuals can ensure that their assets are transferred smoothly to their beneficiaries upon their passing, without the delays and costs associated with probate court proceedings.

Key Elements of the Texas Transfer Trust

Several key elements define the Texas transfer trust. First, the grantor, or creator of the trust, must clearly outline the terms of the trust, including the beneficiaries and how the assets will be managed. The trust must be funded with assets, which can occur during the grantor's lifetime or upon their death. Additionally, the trust should comply with Texas laws regarding trusts to ensure its validity. Important components include the designation of a trustee, who will manage the trust, and the specific instructions for asset distribution. Understanding these elements is crucial for effective estate planning.

Steps to Complete the Texas Transfer Trust Form

Completing the Texas transfer trust form involves several important steps. Begin by gathering all necessary information about the assets you wish to include in the trust. Next, clearly define the beneficiaries and their respective shares. After that, select a trustworthy individual or institution to act as the trustee. Once you have this information, fill out the transfer trust form, ensuring that all details are accurate and complete. Finally, sign the document in the presence of a notary public to ensure its legal validity. This process helps to establish a legally binding trust that meets your estate planning needs.

Legal Use of the Texas Transfer Trust

The legal use of the Texas transfer trust is governed by state laws that outline how trusts should be created and managed. This type of trust is recognized as a valid estate planning tool, provided it meets the necessary legal requirements. The trust must be in writing and signed by the grantor. Additionally, it must be funded with assets to be effective. Compliance with these legal standards ensures that the trust will be upheld in court, should any disputes arise regarding its validity or the distribution of assets.

Required Documents for Establishing a Texas Transfer Trust

To establish a Texas transfer trust, several documents are required. These typically include the completed transfer trust form, a list of assets to be included in the trust, and identification for both the grantor and the trustee. If real estate is involved, a property deed may also be necessary. It is advisable to consult with a legal professional to ensure that all required documentation is accurate and complies with Texas laws. Proper documentation is essential for the trust to function as intended and to avoid potential legal challenges.

Eligibility Criteria for the Texas Transfer Trust

Eligibility for creating a Texas transfer trust generally requires that the grantor be of sound mind and at least eighteen years old. The grantor must also have legal ownership of the assets they wish to place in the trust. There are no restrictions on the types of assets that can be included, allowing for flexibility in estate planning. Additionally, the grantor should consider the implications of transferring assets into the trust, including potential tax consequences. Understanding these eligibility criteria is crucial for effective trust establishment and management.

Quick guide on how to complete 20 by county state of

Prepare 20, By , County, State Of easily on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage 20, By , County, State Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign 20, By , County, State Of with ease

- Obtain 20, By , County, State Of and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 20, By , County, State Of and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 20 by county state of

How to generate an eSignature for the 20 By County State Of in the online mode

How to create an electronic signature for your 20 By County State Of in Chrome

How to create an electronic signature for signing the 20 By County State Of in Gmail

How to generate an electronic signature for the 20 By County State Of straight from your mobile device

How to create an electronic signature for the 20 By County State Of on iOS

How to generate an eSignature for the 20 By County State Of on Android OS

People also ask

-

What is a Texas transfer trust?

A Texas transfer trust is a legal arrangement designed to hold and manage assets for the benefit of beneficiaries while potentially minimizing taxes. This type of trust is particularly beneficial for estate planning in Texas, ensuring a smooth transfer of assets without the complexities of probate.

-

How can airSlate SignNow assist with Texas transfer trust documentation?

airSlate SignNow simplifies the creation and signing of documents related to Texas transfer trusts. Our platform enables users to securely send, eSign, and manage trust documents efficiently, making the process straightforward and compliant with Texas laws.

-

What are the benefits of using airSlate SignNow for Texas transfer trusts?

Utilizing airSlate SignNow for Texas transfer trusts streamlines the document management process, reducing the time and effort involved in traditional methods. Our solution enhances security, ensures compliance, and provides an easy-to-use interface that caters to both individuals and legal professionals.

-

Are there any costs associated with using airSlate SignNow for Texas transfer trust services?

airSlate SignNow offers various pricing plans tailored to meet the needs of users managing Texas transfer trusts. We provide transparent pricing options that include essential features without hidden fees, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for managing Texas transfer trusts?

Yes, airSlate SignNow supports integrations with a variety of software applications that can help manage Texas transfer trusts more effectively. Our platform allows for seamless connectivity with tools such as CRM systems, Dropbox, and Google Drive, enhancing your workflow.

-

Is eSigning documents related to Texas transfer trusts legally binding?

Absolutely! Electronic signatures on documents associated with Texas transfer trusts are legally binding under both state and federal laws. airSlate SignNow ensures that all eSigned documents are compliant, providing legal protection and security for all parties involved.

-

How long does it take to set up a Texas transfer trust with airSlate SignNow?

Setting up a Texas transfer trust with airSlate SignNow can be completed in a matter of minutes. Our user-friendly platform guides you through the necessary steps, allowing you to draft, send, and obtain signatures quickly and efficiently.

Get more for 20, By , County, State Of

- Alarm application pg 1 the city of san antonio form

- City of lubbock block party permit 2015 2019 form

- Authorization to charge feeamp39s city of dallas form

- Dps cch 2015 2019 form

- Oregon claim form 2015 2019

- Individual well conditional permit application bernalillo county bernco form

- Request water analysis 2016 2018 form

- Get cochise county toilet rebates form

Find out other 20, By , County, State Of

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online