Form 433 Sp 2013

What is the Form 433 SP?

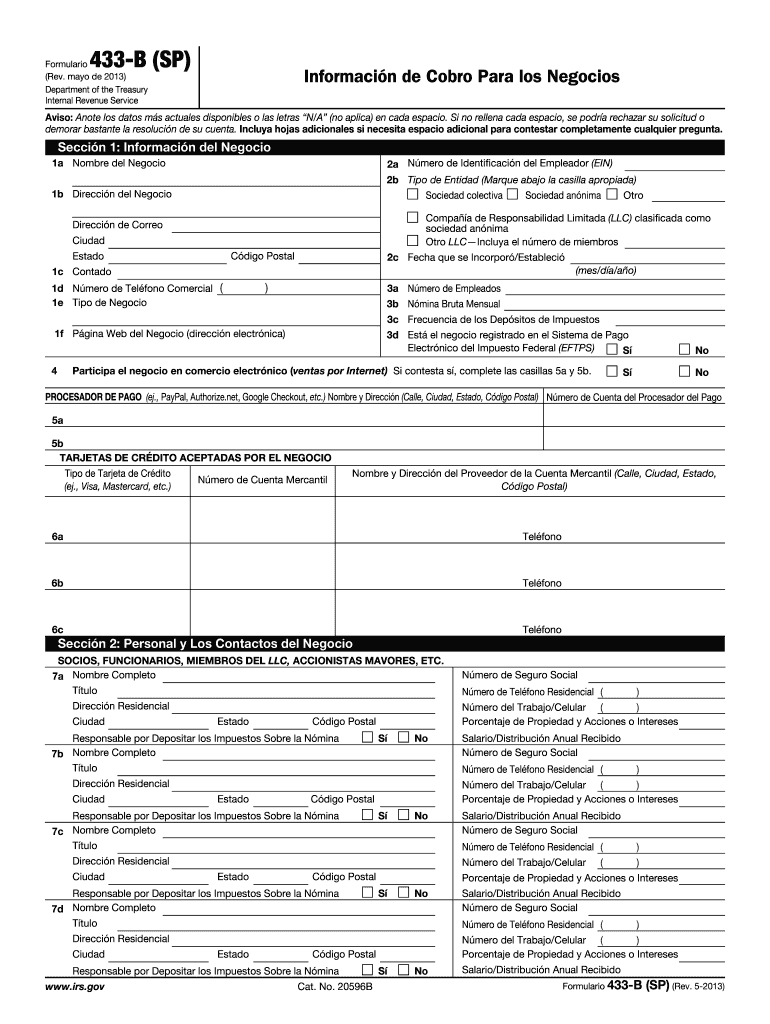

The Form 433 SP, officially known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a document used by the Internal Revenue Service (IRS) to collect financial information from taxpayers. This form is essential for those who are unable to pay their tax liabilities and are seeking to establish a payment plan or settle their debts with the IRS. By providing detailed financial information, including income, expenses, and assets, taxpayers can demonstrate their financial situation to the IRS, which can influence the agency's decisions regarding payment options.

How to Use the Form 433 SP

Using the Form 433 SP involves several steps to ensure that it is completed accurately and submitted correctly. Taxpayers should start by gathering all necessary financial documents, such as pay stubs, bank statements, and records of monthly expenses. Once the required information is collected, individuals can begin filling out the form, providing details about their income, expenses, and assets. After completing the form, it is crucial to review all entries for accuracy before submitting it to the IRS, either online or via mail, depending on the specific instructions provided by the agency.

Steps to Complete the Form 433 SP

Completing the Form 433 SP requires careful attention to detail. Follow these steps for a smooth process:

- Gather financial documents, including income statements, bank statements, and expense records.

- Fill out the personal information section, including your name, address, and Social Security number.

- Provide detailed information about your income, including wages, self-employment income, and any other sources.

- List all monthly expenses, such as housing costs, utilities, and other necessary living expenses.

- Detail your assets, including bank accounts, real estate, and vehicles.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS as instructed.

Legal Use of the Form 433 SP

The legal use of the Form 433 SP is governed by IRS guidelines, which outline the circumstances under which the form can be submitted. It is primarily used when a taxpayer is facing financial hardship and needs to negotiate payment terms with the IRS. To ensure that the form is legally binding, it must be filled out truthfully and accurately. Misrepresentation of financial information can lead to penalties, including fines or further legal action. Therefore, it is essential to provide honest and complete information when using the form.

Required Documents

When completing the Form 433 SP, several documents are required to support the financial information provided. These documents may include:

- Recent pay stubs or proof of income.

- Bank statements for the last few months.

- Documentation of monthly expenses, such as utility bills and rent or mortgage statements.

- Records of any assets, including property deeds and vehicle titles.

- Tax returns for the previous years, if applicable.

Form Submission Methods

The Form 433 SP can be submitted to the IRS through various methods. Taxpayers may choose to file the form online through the IRS website or submit it via mail. If mailing the form, it is important to send it to the correct address specified by the IRS for processing. Additionally, some taxpayers may opt to deliver the form in person at their local IRS office. Each submission method has its own processing times, so individuals should consider their circumstances when choosing how to submit the form.

Quick guide on how to complete form 433 sp

Effortlessly Prepare Form 433 Sp on Any Device

Virtual document management has gained increasing popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can conveniently locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Form 433 Sp across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign Form 433 Sp with Ease

- Find Form 433 Sp and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form 433 Sp and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 sp

Create this form in 5 minutes!

How to create an eSignature for the form 433 sp

How to make an eSignature for the Form 433 Sp in the online mode

How to create an electronic signature for your Form 433 Sp in Google Chrome

How to create an eSignature for signing the Form 433 Sp in Gmail

How to generate an electronic signature for the Form 433 Sp straight from your smart phone

How to generate an electronic signature for the Form 433 Sp on iOS

How to create an electronic signature for the Form 433 Sp on Android devices

People also ask

-

What is Form 433 Sp and how is it used?

Form 433 Sp is a financial statement used by the IRS to collect information about an individual's financial status. It is essential for individuals seeking to negotiate a payment plan or settle tax debts. With airSlate SignNow, you can easily complete and eSign Form 433 Sp, streamlining the submission process.

-

How does airSlate SignNow simplify the completion of Form 433 Sp?

airSlate SignNow simplifies the completion of Form 433 Sp by providing an intuitive interface that guides you through each section of the form. Users can fill out required fields, add digital signatures, and save their progress. This ensures that your Form 433 Sp is completed accurately and efficiently.

-

What features does airSlate SignNow offer for managing Form 433 Sp?

airSlate SignNow includes features such as document templates, automated reminders, and secure cloud storage, all tailored for managing Form 433 Sp. These tools help users stay organized and ensure that their financial documents are accessible whenever needed. Plus, the platform's eSignature functionality allows for quick approvals.

-

Is airSlate SignNow affordable for individuals needing Form 433 Sp?

Yes, airSlate SignNow offers competitive pricing plans suitable for individuals and businesses who need to eSign Form 433 Sp. With a variety of options, users can choose a plan that fits their budget while gaining access to essential features that facilitate document management.

-

Can I integrate airSlate SignNow with other applications for Form 433 Sp?

Absolutely! airSlate SignNow can be integrated with various applications to streamline the process of handling Form 433 Sp. This includes CRM systems, cloud storage services, and productivity tools, ensuring that your workflow remains seamless and efficient.

-

What security measures does airSlate SignNow have for Form 433 Sp?

airSlate SignNow prioritizes the security of your documents, including Form 433 Sp, by utilizing encryption and secure cloud storage. Additionally, the platform complies with industry standards to ensure that your sensitive financial information remains protected throughout the signing process.

-

How can I track the status of my Form 433 Sp using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Form 433 Sp through the dashboard. The platform provides real-time updates on document progress, allowing you to see when the form has been viewed or signed. This feature keeps you informed and helps you follow up efficiently.

Get more for Form 433 Sp

- Real property acquisition handbook gsa form

- Top email signature contact details dos ampamp dontsexclaimer form

- Certificate of inspection of pressure vessels this gsa form

- 12420 reporting vehicle thefts and related offenses city of form

- Money market fund times and how they will bny mellon form

- Title 24 cfrcode of federal regulations annual edition form

- Notice of release of tobacco products cigarette papers ttb form

- S 1554 uniform code of public school building inspections

Find out other Form 433 Sp

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form