Completed Form Should Be Returned to the Employer and Retained for the Employers Records 2019

IRS Guidelines

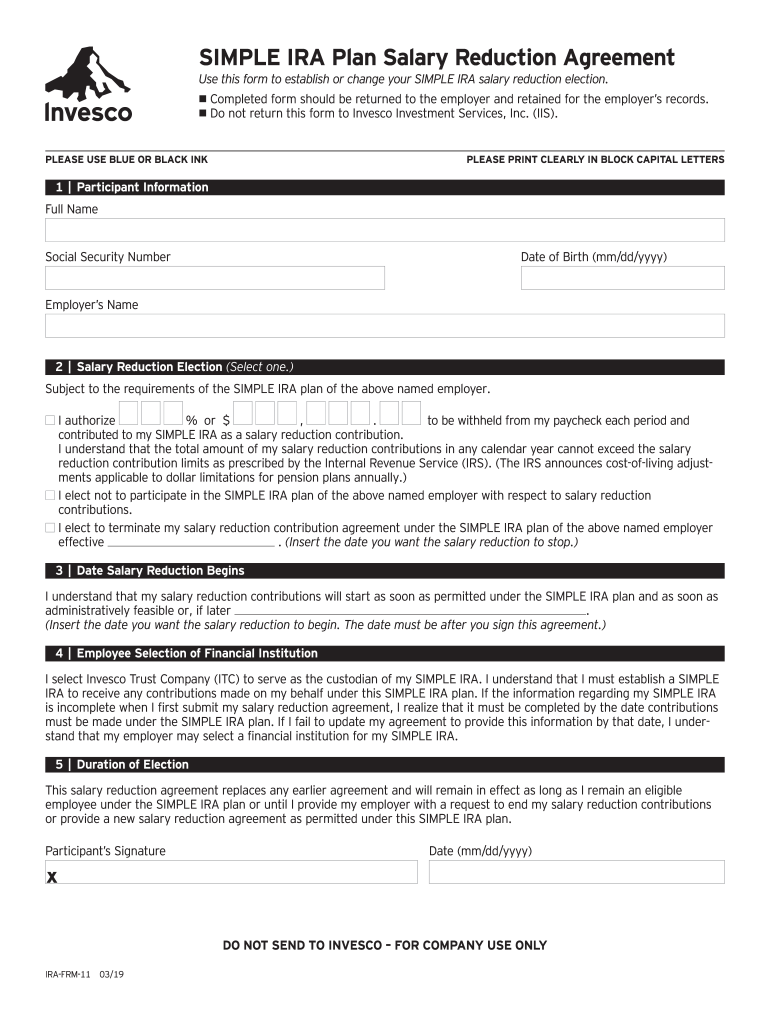

The IRS provides specific guidelines for the simple IRA form to ensure compliance with federal regulations. This form is essential for employees who wish to participate in a SIMPLE IRA plan, allowing them to make salary deferrals into their retirement accounts. The IRS outlines the requirements for both employers and employees, including the maximum contribution limits and eligibility criteria. It is crucial for employers to understand these guidelines to facilitate the correct implementation of the SIMPLE IRA plan and to ensure that all necessary documentation is completed accurately.

Required Documents

To complete the simple IRA salary reduction agreement form, certain documents are necessary. Employees must provide their personal identification information, such as Social Security numbers, and any relevant employment details. Employers should also have their business identification information ready, including the Employer Identification Number (EIN). Additionally, any prior agreements related to retirement plans should be reviewed to ensure compliance with existing policies. Having these documents on hand can streamline the process and help avoid delays.

Steps to Complete the Form

Completing the simple IRA form involves several key steps. First, employees should carefully read the instructions provided with the form. Next, they need to fill in their personal information accurately, including the amount they wish to defer from their salary. Afterward, the employee must sign and date the form to validate their agreement. Finally, the completed form should be submitted to the employer for processing. Employers should retain a copy for their records, ensuring compliance with IRS regulations.

Form Submission Methods

The simple IRA form can be submitted through various methods, depending on the employer's preferences. Common submission methods include online submission through a secure portal, mailing a hard copy to the employer's office, or delivering it in person. Each method has its advantages, such as immediate processing for online submissions or physical confirmation for in-person deliveries. Employers should communicate their preferred submission method to ensure that all forms are received and processed efficiently.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the simple IRA form can result in penalties for both employers and employees. If an employer does not properly implement the SIMPLE IRA plan or fails to submit the necessary forms, they may face fines or other legal repercussions. Employees who do not adhere to contribution limits may also incur tax penalties. Understanding these potential consequences emphasizes the importance of accurately completing and submitting the simple IRA form.

Eligibility Criteria

Eligibility for participating in a SIMPLE IRA plan is defined by specific criteria set forth by the IRS. Generally, employees must have received at least $5,000 in compensation during any two preceding years and expect to earn at least that amount in the current year. Employers must also meet certain requirements, including having no more than one hundred employees who earned $5,000 or more in the preceding calendar year. Understanding these eligibility criteria is essential for both employees and employers to ensure compliance with the plan's regulations.

Quick guide on how to complete completed form should be returned to the employer and retained for the employers records

Accomplish Completed Form Should Be Returned To The Employer And Retained For The Employers Records effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Completed Form Should Be Returned To The Employer And Retained For The Employers Records on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to alter and eSign Completed Form Should Be Returned To The Employer And Retained For The Employers Records with ease

- Obtain Completed Form Should Be Returned To The Employer And Retained For The Employers Records and click on Get Form to initiate.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Disregard the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Completed Form Should Be Returned To The Employer And Retained For The Employers Records and guarantee effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct completed form should be returned to the employer and retained for the employers records

Create this form in 5 minutes!

How to create an eSignature for the completed form should be returned to the employer and retained for the employers records

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is a simple IRA form and why is it important?

A simple IRA form is a document used to establish a Simplified Employee Pension Plan, allowing employees to contribute to their retirement. It is important because it provides tax advantages and encourages long-term saving for retirement. Using the simple IRA form correctly helps ensure compliance with IRS regulations.

-

How can airSlate SignNow help with my simple IRA form?

airSlate SignNow streamlines the process of completing and signing a simple IRA form by providing a user-friendly platform for electronic signatures. Our solution allows for easy document sharing and tracking, ensuring that all parties can execute the simple IRA form quickly and securely. This feature helps businesses manage their paperwork efficiently.

-

Is there a cost associated with using airSlate SignNow for my simple IRA form?

Yes, there is a cost associated with using airSlate SignNow, but we offer a range of affordable plans to meet different business needs. Investing in our service for your simple IRA form can save time and enhance productivity by reducing paperwork hassles. Check our pricing page for detailed information about subscription plans.

-

What features does airSlate SignNow offer for managing the simple IRA form?

airSlate SignNow offers various features that enhance the management of the simple IRA form, including customizable templates, secure eSigning, and real-time notifications. Our platform ensures that you can easily track the status of your documents and keep everyone in the loop. This enhances workflow efficiency and document security.

-

Can I integrate airSlate SignNow with other software for my simple IRA form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, allowing you to manage your simple IRA form alongside your existing tools. Whether it's accounting software or HR platforms, integrations help streamline your processes and consolidate your business operations. This ensures a cohesive workflow across your organization.

-

What are the benefits of using airSlate SignNow for my simple IRA form?

Using airSlate SignNow for your simple IRA form provides numerous benefits, including faster turnaround times, enhanced document security, and ease of use. Our digital platform eliminates the need for physical paperwork, which not only saves time but also reduces the environmental impact. This way, you can focus more on strategic planning for your retirement.

-

Is it easy to get started with a simple IRA form using airSlate SignNow?

Yes, getting started with a simple IRA form on airSlate SignNow is straightforward. Our user-friendly interface guides you through the process, making it easy for anyone to set up their documents quickly. Plus, our support team is always available to assist you if you have any questions or need help during the setup.

Get more for Completed Form Should Be Returned To The Employer And Retained For The Employers Records

Find out other Completed Form Should Be Returned To The Employer And Retained For The Employers Records

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document