26 US Code6103 Confidentiality and Disclosure of Returns 2020

Understanding the 26 US Code 6103: Confidentiality and Disclosure of Returns

The 26 US Code 6103 outlines the rules regarding the confidentiality and disclosure of tax returns and return information. This legal framework is essential for protecting taxpayer privacy while ensuring that the Internal Revenue Service (IRS) can carry out its duties effectively. Under this code, tax returns are generally considered confidential, and unauthorized disclosure of this information can lead to significant penalties.

Steps to Complete the 26 US Code 6103 Requirements

To comply with the requirements of 26 US Code 6103, individuals and organizations must follow specific steps:

- Understand what constitutes tax return information and the limitations on its disclosure.

- Ensure that any request for disclosure is legitimate and falls within the allowable exceptions outlined in the code.

- Maintain proper records of any disclosures made to ensure compliance with legal standards.

IRS Guidelines on Confidentiality and Disclosure

The IRS provides guidelines to help taxpayers and tax professionals navigate the complexities of 26 US Code 6103. These guidelines clarify what information can be disclosed, under what circumstances, and to whom. It's crucial to familiarize yourself with these guidelines to avoid unintended violations that could lead to penalties.

Penalties for Non-Compliance with 26 US Code 6103

Failure to comply with the provisions of 26 US Code 6103 can result in severe penalties. Individuals or entities that improperly disclose tax return information may face fines, and in some cases, criminal charges. Understanding the potential consequences of non-compliance is essential for anyone handling tax returns.

Eligibility Criteria for Disclosure under 26 US Code 6103

Eligibility for disclosing tax return information under 26 US Code 6103 is limited to specific circumstances. Generally, disclosures are permitted only to authorized personnel or entities, such as government agencies or under court orders. It is vital to verify eligibility before proceeding with any disclosure to ensure compliance with the law.

Form Submission Methods for 26 US Code 6103 Compliance

When submitting forms related to 26 US Code 6103, individuals have several options. Forms can typically be submitted online, by mail, or in person, depending on the specific requirements of the IRS. Understanding the submission methods and their respective guidelines can streamline the compliance process.

Examples of Using 26 US Code 6103 in Practice

Practical examples of 26 US Code 6103 in action include scenarios where tax professionals must disclose information to comply with legal requests or when taxpayers authorize the release of their information to third parties. These examples illustrate the importance of understanding the code to navigate complex situations effectively.

Quick guide on how to complete 26 us code6103 confidentiality and disclosure of returns

Complete 26 US Code6103 Confidentiality And Disclosure Of Returns effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your papers rapidly without any hold-ups. Manage 26 US Code6103 Confidentiality And Disclosure Of Returns on any device with airSlate SignNow's Android or iOS applications and streamline your document-centered tasks today.

The easiest way to modify and eSign 26 US Code6103 Confidentiality And Disclosure Of Returns with ease

- Obtain 26 US Code6103 Confidentiality And Disclosure Of Returns and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Amend and eSign 26 US Code6103 Confidentiality And Disclosure Of Returns while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 26 us code6103 confidentiality and disclosure of returns

Create this form in 5 minutes!

How to create an eSignature for the 26 us code6103 confidentiality and disclosure of returns

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

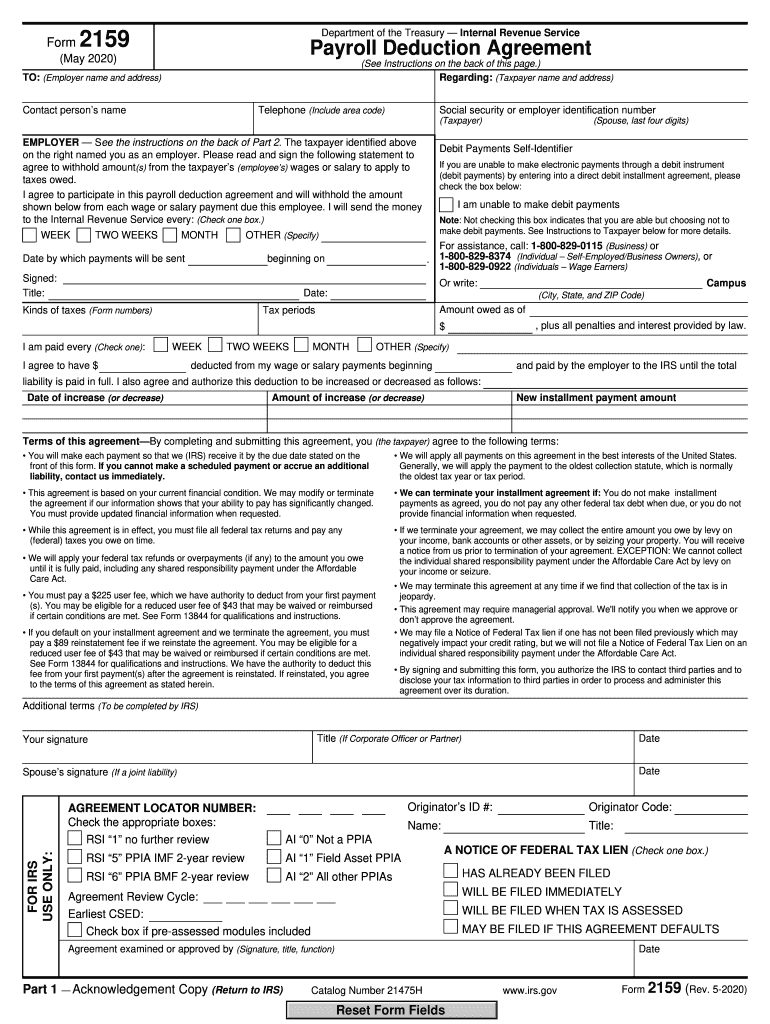

What are form 2159 instructions?

Form 2159 instructions provide detailed guidance on how to correctly complete and file the form. These instructions are essential for ensuring compliance and accuracy when submitting documents related to electronic signatures. By following the form 2159 instructions, users can avoid common mistakes and streamline their documentation process.

-

How can airSlate SignNow help with form 2159 instructions?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing form 2159 instructions. Our solution provides templates and step-by-step assistance, making it easier for businesses to manage their eSigning needs. This ensures that users can efficiently navigate the complexities of the form while maintaining compliance.

-

What features does airSlate SignNow provide for managing form 2159 instructions?

airSlate SignNow includes a variety of features that assist users in following form 2159 instructions, such as customizable templates, document routing, and real-time collaboration. These tools help users create and share documents efficiently while ensuring that they adhere to the required guidelines. Additionally, our platform supports secure storage and tracking of documents.

-

Is there a cost associated with using airSlate SignNow for form 2159 instructions?

Yes, there are various pricing plans available for airSlate SignNow, designed to accommodate different business needs. Each plan offers specific features that can enhance the process of following form 2159 instructions. It's advisable to review our pricing page to select the most suitable option for your organization.

-

Can I integrate airSlate SignNow with other applications for form 2159 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRMs and project management tools, to enhance the workflow around form 2159 instructions. This connectivity allows users to manage documents efficiently and ensures that all stakeholders can access the necessary information in one place.

-

What are the benefits of using airSlate SignNow for form 2159 instructions?

Using airSlate SignNow enhances the efficiency of handling form 2159 instructions by providing a streamlined eSignature process. Users benefit from reduced turnaround times and improved accuracy, which are key when dealing with important documentation. Furthermore, our solution is cost-effective, making it accessible for businesses of all sizes.

-

How secure is the process of handling form 2159 instructions with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs robust encryption and compliance measures that protect sensitive data throughout the process of managing form 2159 instructions. Users can confidently use our solution, knowing that their documents are secure and their privacy is safeguarded.

Get more for 26 US Code6103 Confidentiality And Disclosure Of Returns

- Indiana motor vehicle bill of sale form 44237

- Certification of sales under special conditions tngov form

- Certification of reasons for which the taxpayer is not required by law form

- Fl 676 info information sheet for request for judicial determination of support arrearages or adjustment of arrearages due to

- Fin 506 2014 2019 form

- 8700 191 form

- Dcjs complaint form

- Application agency license 2014 2019 form

Find out other 26 US Code6103 Confidentiality And Disclosure Of Returns

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation