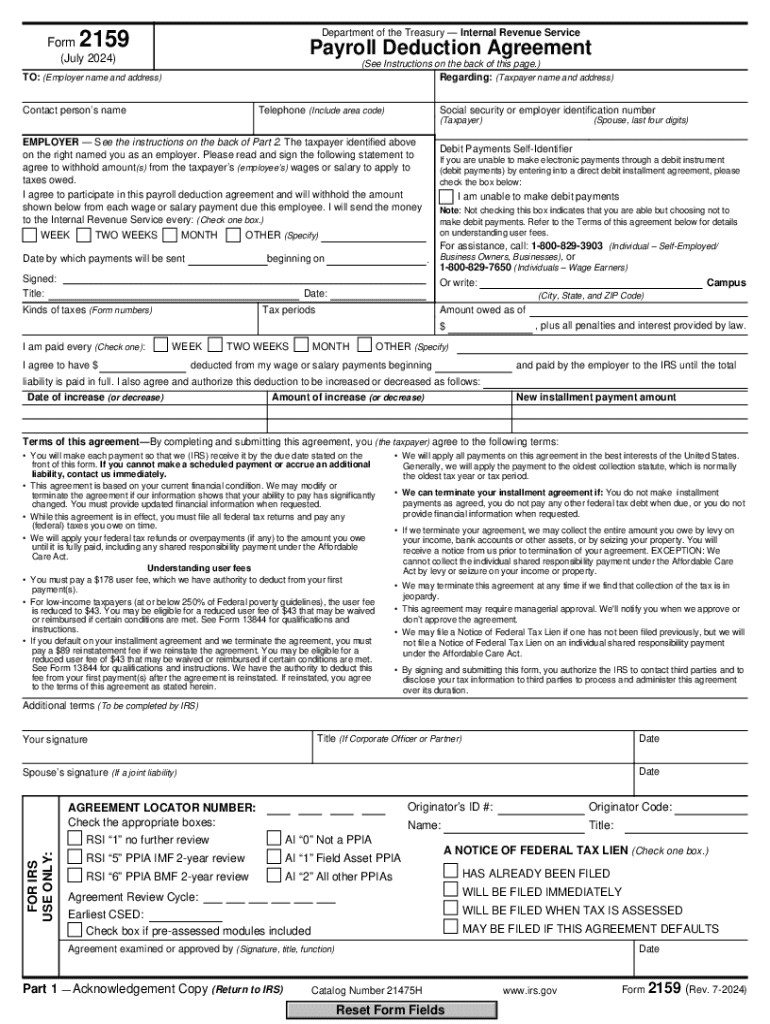

IRS Form 2159 Walkthrough Setting Up a Payroll Deduction 2024-2026

What is the FTC Fraud Report Form?

The FTC fraud report form is a crucial document used to report instances of fraud and scams to the Federal Trade Commission (FTC). This form allows individuals to provide detailed information about the fraudulent activity they have encountered, which can help the FTC in its efforts to combat fraud and protect consumers. By submitting this report, individuals contribute to a larger database that assists in identifying patterns of fraud and developing strategies to prevent it.

Steps to Complete the FTC Fraud Report Form

Completing the FTC fraud report form involves several key steps to ensure that all necessary information is accurately provided. Begin by gathering relevant details about the fraud, including the nature of the scam, the individuals or organizations involved, and any financial losses incurred. Next, access the form through the FTC's official website. Fill out the required fields, which typically include personal information, a description of the incident, and any supporting documentation. Review the information for accuracy before submitting the form electronically or via mail.

Legal Use of the FTC Fraud Report Form

The FTC fraud report form is designed to be used by individuals who have experienced or witnessed fraud. It is important to use the form legally and ethically, providing truthful and accurate information. Misuse of the form, such as submitting false claims, can lead to legal repercussions. The information collected through the form is used by the FTC to investigate fraud cases and inform the public about ongoing scams, making its proper use essential for consumer protection.

Who Issues the FTC Fraud Report Form?

The FTC fraud report form is issued by the Federal Trade Commission, an independent agency of the United States government. The FTC is responsible for protecting consumers from deceptive and unfair business practices. By providing this form, the FTC enables consumers to report fraud, thereby enhancing its ability to monitor and respond to fraudulent activities across the nation.

Form Submission Methods

The FTC fraud report form can be submitted through various methods to accommodate different preferences. The most efficient way to submit the form is online via the FTC's official website, where users can fill out the form and submit it electronically. Alternatively, individuals may choose to print the form and mail it to the FTC. It is important to follow the submission guidelines provided by the FTC to ensure that the report is processed correctly.

Required Documents for the FTC Fraud Report Form

When filling out the FTC fraud report form, certain documents may be required to support the claim. These can include copies of receipts, bank statements, or any correspondence related to the fraud. Having these documents ready can help provide a clearer picture of the situation and assist the FTC in its investigation. It is advisable to keep copies of all submitted documents for personal records.

Eligibility Criteria for Submitting the FTC Fraud Report Form

Any individual who has experienced fraud or witnessed fraudulent activity is eligible to submit the FTC fraud report form. This includes consumers who have fallen victim to scams, as well as those who may have information about ongoing fraudulent practices. There are no specific restrictions on who can report fraud, making it accessible for all consumers to contribute to the fight against fraud.

Create this form in 5 minutes or less

Find and fill out the correct irs form 2159 walkthrough setting up a payroll deduction

Create this form in 5 minutes!

How to create an eSignature for the irs form 2159 walkthrough setting up a payroll deduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FTC fraud report form?

The FTC fraud report form is a document that allows individuals to report fraudulent activities to the Federal Trade Commission. By using this form, you can help the FTC track and combat fraud, ensuring that your concerns are addressed effectively.

-

How can airSlate SignNow help with the FTC fraud report form?

airSlate SignNow provides a seamless way to complete and eSign the FTC fraud report form online. Our platform simplifies the process, allowing you to fill out the form quickly and securely, ensuring that your report is submitted without hassle.

-

Is there a cost associated with using airSlate SignNow for the FTC fraud report form?

airSlate SignNow offers a cost-effective solution for managing documents, including the FTC fraud report form. We provide various pricing plans to suit different business needs, ensuring you can access our features without breaking the bank.

-

What features does airSlate SignNow offer for the FTC fraud report form?

With airSlate SignNow, you can easily create, edit, and eSign the FTC fraud report form. Our platform includes features like document templates, real-time collaboration, and secure storage, making it an ideal choice for managing important documents.

-

Can I integrate airSlate SignNow with other applications for the FTC fraud report form?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the FTC fraud report form. You can connect with tools like Google Drive, Dropbox, and more to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the FTC fraud report form?

Using airSlate SignNow for the FTC fraud report form provides numerous benefits, including increased efficiency and reduced paperwork. Our user-friendly interface ensures that you can complete and submit your report quickly, helping you focus on what matters most.

-

Is airSlate SignNow secure for submitting the FTC fraud report form?

Absolutely! airSlate SignNow prioritizes security, ensuring that your FTC fraud report form and personal information are protected. We use advanced encryption and compliance measures to safeguard your data throughout the signing process.

Get more for IRS Form 2159 Walkthrough Setting Up A Payroll Deduction

Find out other IRS Form 2159 Walkthrough Setting Up A Payroll Deduction

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors