Links to State Incorporation Websites IRS Gov 2017-2026

Understanding the Annual Filing Requirements in Kansas

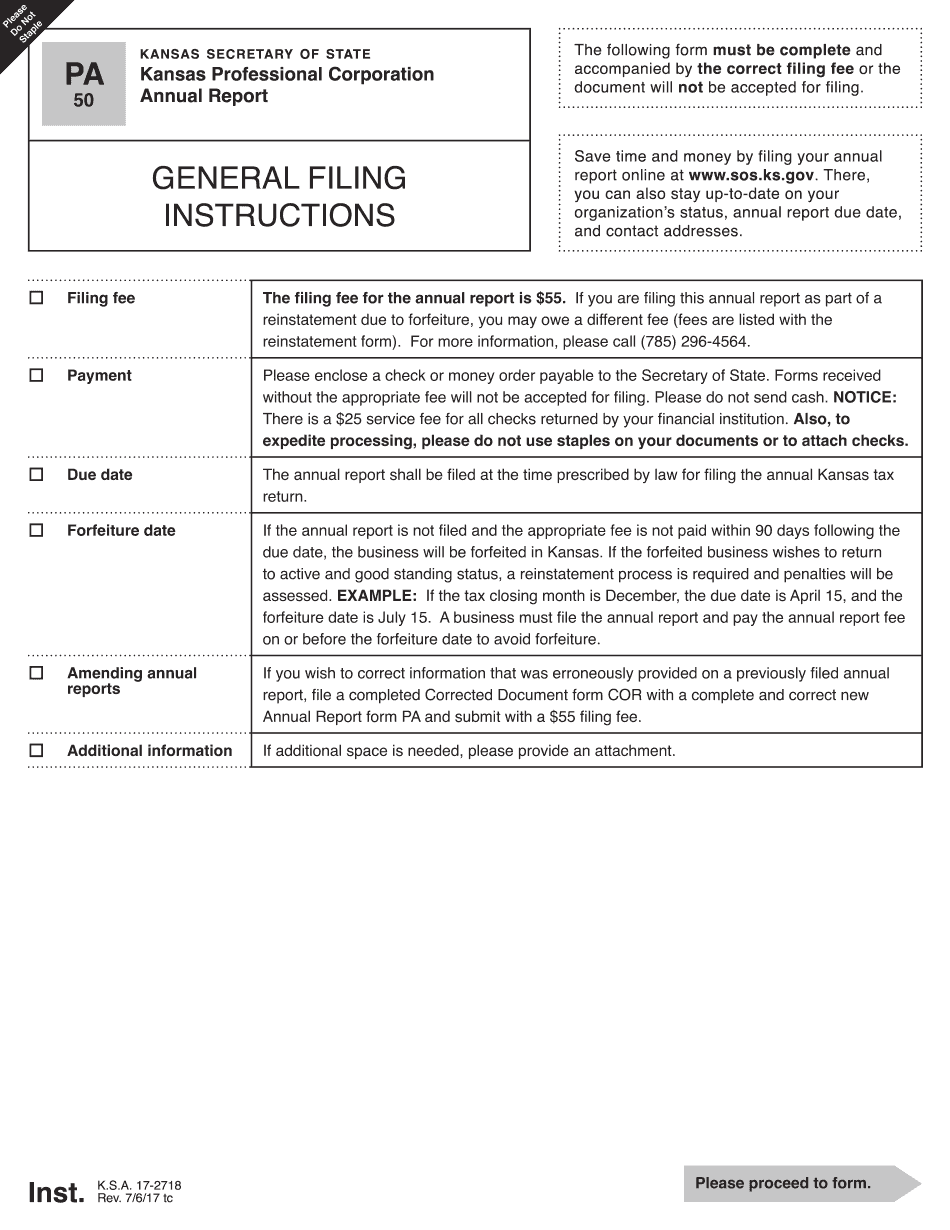

The annual filing in Kansas is essential for businesses to maintain their good standing with the state. This process typically involves submitting an annual report that outlines the company’s financial status and operational activities over the past year. Businesses must ensure compliance with state regulations to avoid penalties and maintain their corporate status.

Filing Deadlines and Important Dates

In Kansas, the deadline for annual filing is typically set for the 15th day of the fourth month following the end of the business's fiscal year. For most businesses operating on a calendar year, this means the annual report is due by April 15. It is crucial for businesses to mark this date on their calendars to ensure timely submission and avoid late fees.

Required Documents for Annual Filing

To complete the annual filing in Kansas, businesses must gather several key documents. These typically include:

- Annual report form specific to the business entity type (LLC, corporation, etc.)

- Financial statements, including balance sheets and income statements

- Any amendments to the business structure or operating agreements

- Payment for the annual fee, which varies by entity type

Form Submission Methods

Businesses in Kansas can submit their annual filing through various methods. The most common methods include:

- Online submission through the Kansas Secretary of State’s website

- Mailing the completed form and required documents to the appropriate state office

- In-person submission at designated state offices

Penalties for Non-Compliance

Failing to file the annual report on time can result in significant penalties for businesses in Kansas. Common repercussions include:

- Late fees that accumulate over time

- Potential loss of good standing status

- Increased scrutiny from state authorities

Eligibility Criteria for Filing

All registered businesses in Kansas are required to file an annual report, regardless of their size or revenue. This requirement applies to various business types, including:

- Corporations

- Limited Liability Companies (LLCs)

- Partnerships

It is important for businesses to verify their eligibility and ensure compliance with state regulations to avoid complications.

Quick guide on how to complete links to state incorporation websites irsgov

Complete Links To State Incorporation Websites IRS gov effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can easily access the necessary form and securely save it online. airSlate SignNow supplies all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Links To State Incorporation Websites IRS gov on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The simplest way to edit and electronically sign Links To State Incorporation Websites IRS gov with ease

- Obtain Links To State Incorporation Websites IRS gov and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Links To State Incorporation Websites IRS gov and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct links to state incorporation websites irsgov

Create this form in 5 minutes!

How to create an eSignature for the links to state incorporation websites irsgov

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is annual filing ks?

Annual filing ks refers to the required process for businesses in Kansas to file annual reports and taxes with the state. Utilizing solutions like airSlate SignNow can simplify this process, making it easier to manage and submit your annual filings efficiently.

-

How can airSlate SignNow assist with annual filing ks?

airSlate SignNow streamlines the document signing process, enabling you to prepare and eSign your annual filing ks quickly. Its user-friendly interface ensures that you can easily gather necessary signatures and submit forms, reducing stress during filing season.

-

What are the pricing options for airSlate SignNow related to annual filing ks?

airSlate SignNow offers competitive pricing plans designed to fit businesses of all sizes, allowing you to manage your annual filing ks without breaking the bank. There are multiple tiers available, ensuring you can choose a plan that meets your specific needs and budget.

-

Does airSlate SignNow have features specifically for annual filing ks?

Yes, airSlate SignNow includes several features tailored for annual filing ks, such as customizable templates and automatic reminders for deadlines. These features help ensure that you stay organized and compliant with Kansas filing requirements.

-

What are the benefits of using airSlate SignNow for annual filing ks?

Using airSlate SignNow for your annual filing ks provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our platform empowers you to manage your filings from anywhere, simplifying the entire process.

-

Can I integrate airSlate SignNow with my existing accounting software for annual filing ks?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing you to manage your annual filing ks alongside your financial records. This compatibility helps maintain a smooth workflow while ensuring accuracy in your filings.

-

Is there customer support available for queries related to annual filing ks?

Yes, if you have questions or need assistance with annual filing ks, airSlate SignNow provides dedicated customer support. Our team is available to help you navigate the platform and address any concerns related to your filings.

Get more for Links To State Incorporation Websites IRS gov

- I received a 10 day opportunity or mutually agreed upon period to conduct a risk assessment or inspection for the form

- Impaired memory form

- The seller of any interest in form

- Residential real property is required to provide the buyer with any information on lead based paint hazards from

- Risk assessments or inspections in the sellers possession and notify the buyer of any known lead based paint form

- This article is to provide an alternate distribution of the rest and remainder of your form

- Fillable online connecticut will instructions mutual wills form

- Property should your spouse predecease you and the provisions for distribution form

Find out other Links To State Incorporation Websites IRS gov

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online