Form 886 H HOH Rev 10 Internal Revenue Service 2019-2026

What is the Form 886 H HOH Rev 10 Internal Revenue Service

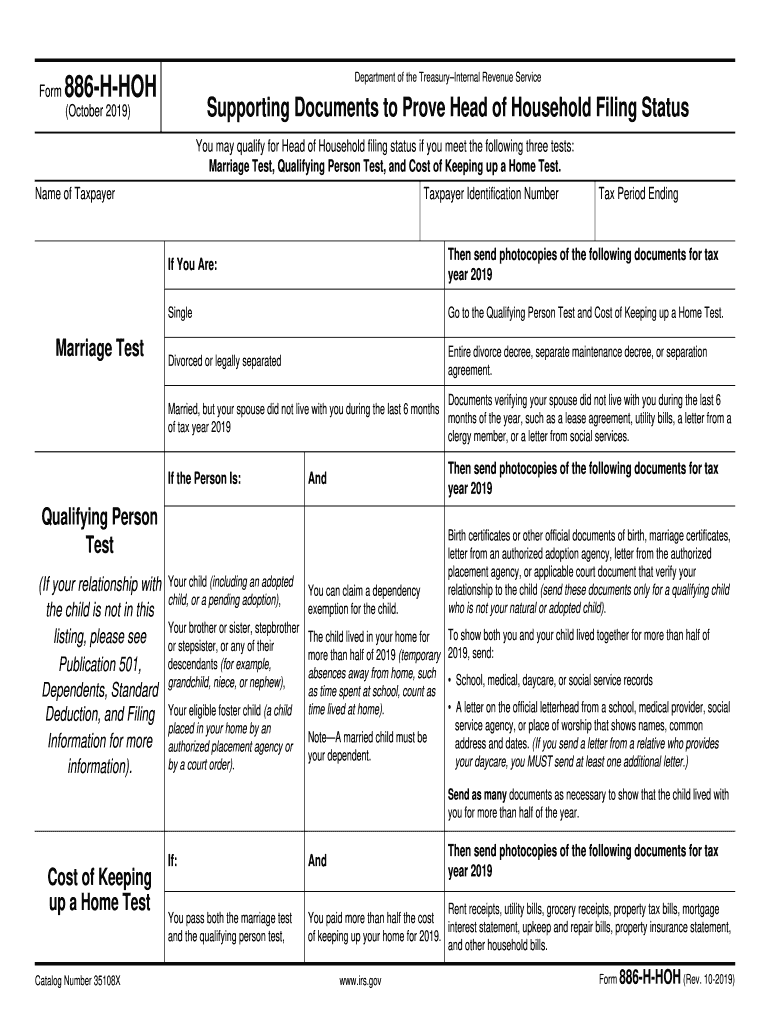

The Form 886 H HOH Rev 10 is a document used by the Internal Revenue Service (IRS) to determine eligibility for the Head of Household (HOH) filing status. This form is essential for taxpayers who wish to claim this status, which often results in a lower tax rate and higher standard deduction compared to filing as a single individual. The form requires specific information about the taxpayer's dependents and household income, making it a crucial part of the tax filing process for eligible individuals.

Steps to complete the Form 886 H HOH Rev 10 Internal Revenue Service

Completing the Form 886 H HOH Rev 10 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including Social Security numbers for yourself and your dependents, proof of residency, and income statements. Next, fill out the form by providing your personal information, including filing status and the details of your dependents. It is important to accurately report your income and any deductions you are claiming. After completing the form, review it for any errors before submitting it with your tax return.

Legal use of the Form 886 H HOH Rev 10 Internal Revenue Service

The legal use of the Form 886 H HOH Rev 10 is governed by IRS regulations, which stipulate the requirements for claiming Head of Household status. This form must be completed truthfully and accurately to avoid penalties or audits. The IRS may request additional documentation to verify the information provided, especially regarding the eligibility of dependents and the taxpayer's household situation. Compliance with these legal requirements is crucial for maintaining the integrity of the tax filing process.

Eligibility Criteria

To qualify for Head of Household status using the Form 886 H HOH Rev 10, certain eligibility criteria must be met. The taxpayer must be unmarried or considered unmarried on the last day of the tax year. Additionally, the taxpayer must have paid more than half the cost of maintaining a home for themselves and a qualifying person, such as a child or dependent relative. It is essential to review these criteria carefully to ensure that the correct filing status is claimed, as it can significantly impact tax liability.

Required Documents

When completing the Form 886 H HOH Rev 10, several documents are required to support the claims made on the form. These include proof of identity, such as a Social Security card, documentation of income, and records that verify the taxpayer's household expenses. Additionally, any relevant documents that demonstrate the relationship to dependents, such as birth certificates or custody agreements, should be included. Having these documents ready can streamline the filing process and help avoid delays.

Filing Deadlines / Important Dates

Filing deadlines for the Form 886 H HOH Rev 10 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest on unpaid taxes. Taxpayers should also consider filing for an extension if they are unable to meet the deadline.

Quick guide on how to complete form 886 h hoh rev 10 2019 internal revenue service

Complete Form 886 H HOH Rev 10 Internal Revenue Service effortlessly on any device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle Form 886 H HOH Rev 10 Internal Revenue Service on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Form 886 H HOH Rev 10 Internal Revenue Service with ease

- Find Form 886 H HOH Rev 10 Internal Revenue Service and click Get Form to begin.

- Use the tools provided to complete your form.

- Highlight important sections of your documents or obscure sensitive details with the tools designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 886 H HOH Rev 10 Internal Revenue Service and ensure excellent communication throughout every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 886 h hoh rev 10 2019 internal revenue service

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the significance of the 886 h hoh in electronic signatures?

The 886 h hoh refers to a specific identification code for certain electronic signature solutions. Understanding this code can help businesses identify technologies like airSlate SignNow that streamline document management and enhance compliance. By utilizing a platform that supports the 886 h hoh, companies can ensure their eSigning processes are secure and efficient.

-

How does airSlate SignNow compare to other eSignature solutions for 886 h hoh documentation?

airSlate SignNow provides a user-friendly interface and strong compliance features specifically designed for managing 886 h hoh documents. Unlike many competitors, it offers customizable workflows and advanced integrations to suit various business needs. This makes it an ideal choice for organizations looking to optimize their document signing processes.

-

What are the pricing options for using airSlate SignNow with 886 h hoh?

airSlate SignNow offers several pricing plans that cater to different business sizes and requirements, including options optimized for handling 886 h hoh documentation. Customers can choose from monthly or annual subscriptions, ensuring flexibility. Each plan includes comprehensive features, making it cost-effective for businesses of all types.

-

Can airSlate SignNow integrate with other applications while handling 886 h hoh?

Yes, airSlate SignNow can seamlessly integrate with numerous applications while managing 886 h hoh documents. This includes popular platforms such as Salesforce, Google Drive, and Microsoft Office. Such integrations enhance productivity, making it easier for your team to work with documents efficiently.

-

What are the key benefits of using airSlate SignNow for 886 h hoh document workflows?

Utilizing airSlate SignNow for 886 h hoh document workflows offers several key benefits, including improved compliance and faster turnaround times for eSignatures. The platform's intuitive design allows users to create and send documents effortlessly, which can signNowly enhance operational efficiency. Moreover, it ensures security throughout the signing process.

-

Is airSlate SignNow compliant with legal requirements for 886 h hoh electronic signatures?

Yes, airSlate SignNow is fully compliant with legal requirements for electronic signatures, ensuring that all 886 h hoh documents hold legal validity. The platform adheres to regulations such as the ESIGN Act and UETA, giving businesses peace of mind when using electronic signatures. This compliance is crucial for maintaining document integrity and authenticity.

-

What features does airSlate SignNow offer specifically for managing 886 h hoh?

airSlate SignNow includes several features tailored for managing 886 h hoh documentation, such as customizable templates, automated workflows, and advanced tracking capabilities. These features streamline the signing process, allowing you to monitor document status in real-time. They also facilitate collaboration among team members, enhancing overall productivity.

Get more for Form 886 H HOH Rev 10 Internal Revenue Service

- Virginia criminal complaint form dc 311 fillable

- Jv672 form

- Form 2519

- Cdtfa 65 notice of closeout for sellers permit form

- 2018 form 8453 c california e file return authorization for corporations 2018 form 8453 c california e file return

- Download california judicial council amp court forms lawyaw

- 484 backer notice of exclusions from medicare benefitsskilled nursing facility nemb snf cms form

- Work release form the university of texas at san antonio

Find out other Form 886 H HOH Rev 10 Internal Revenue Service

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document