Global Stock Plan Services Substitute Form W 8BEN for Use by Individuals Only 2022

What is the Global Stock Plan Services Substitute Form W-8BEN for Use By Individuals Only

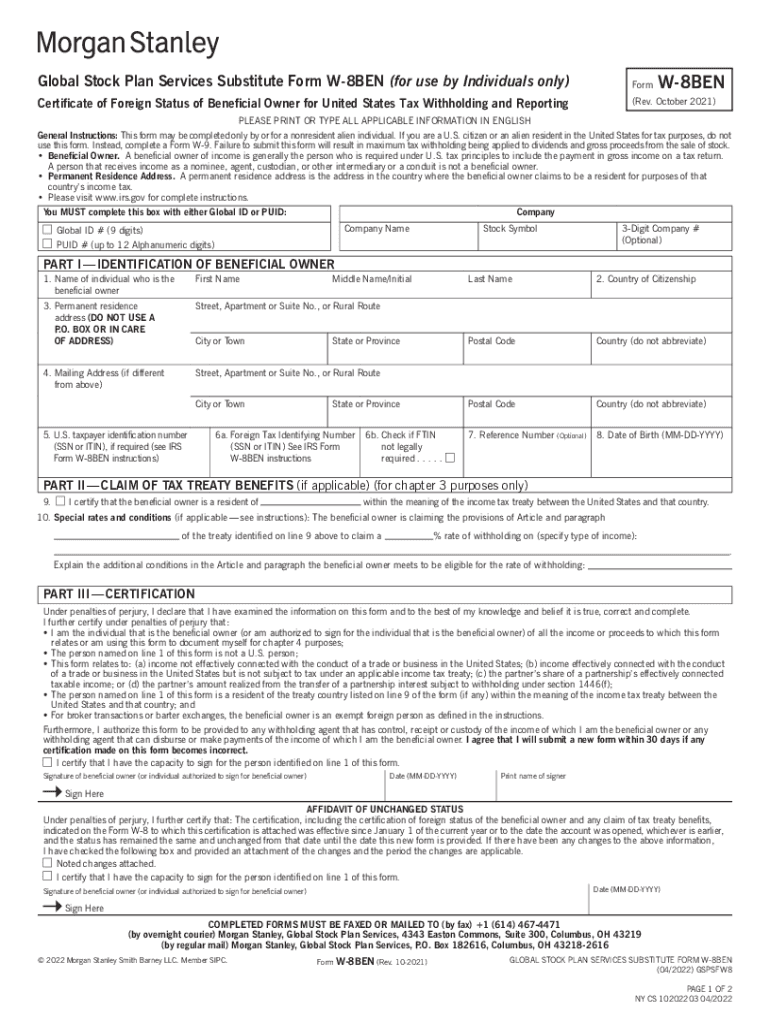

The Global Stock Plan Services Substitute Form W-8BEN for Use By Individuals Only is a tax form utilized by non-U.S. individuals to certify their foreign status. This form helps individuals claim benefits under an income tax treaty and avoid unnecessary withholding on certain types of income, including dividends and interest. By submitting this form, individuals can ensure that they are taxed at the correct rates as specified by U.S. tax laws and applicable treaties.

How to use the Global Stock Plan Services Substitute Form W-8BEN for Use By Individuals Only

This form is primarily used by individuals who receive income from U.S. sources and wish to establish their foreign status for tax purposes. To use the form, individuals must fill it out accurately, providing personal information such as name, country of citizenship, and tax identification number. Once completed, the form should be submitted to the withholding agent or financial institution that requires it, rather than being sent directly to the IRS.

Steps to complete the Global Stock Plan Services Substitute Form W-8BEN for Use By Individuals Only

Completing the Global Stock Plan Services Substitute Form W-8BEN involves several key steps:

- Gather necessary personal information, including your name, address, and country of citizenship.

- Provide your foreign tax identification number, if applicable.

- Indicate the type of income you are receiving and any applicable tax treaty benefits.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the appropriate withholding agent or financial institution.

Key elements of the Global Stock Plan Services Substitute Form W-8BEN for Use By Individuals Only

Several key elements are essential when completing the Global Stock Plan Services Substitute Form W-8BEN:

- Name: The individual's full legal name must be provided.

- Country of Citizenship: This indicates the country where the individual holds citizenship.

- Foreign Tax Identification Number: This number is used to identify the individual in their country of residence.

- Claim of Tax Treaty Benefits: If applicable, individuals must specify the tax treaty benefits they are claiming.

- Signature and Date: The form must be signed and dated to validate the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Global Stock Plan Services Substitute Form W-8BEN. Individuals must ensure that they meet the eligibility criteria outlined by the IRS to utilize this form. Additionally, it is important to keep abreast of any changes in tax laws or treaty agreements that may affect the form's requirements and benefits.

Form Submission Methods

The Global Stock Plan Services Substitute Form W-8BEN can be submitted through various methods, depending on the requirements of the withholding agent or financial institution. Common submission methods include:

- Online Submission: Some institutions may allow electronic submission through secure portals.

- Mail: The completed form can be mailed directly to the withholding agent.

- In-Person: Individuals may also have the option to submit the form in person at the financial institution.

Create this form in 5 minutes or less

Find and fill out the correct global stock plan services substitute form w 8ben for use by individuals only

Create this form in 5 minutes!

How to create an eSignature for the global stock plan services substitute form w 8ben for use by individuals only

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only?

The Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only is a tax form used by non-U.S. individuals to signNow their foreign status and claim tax treaty benefits. This form is essential for individuals participating in global stock plans to ensure compliance with U.S. tax regulations.

-

How can I access the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only?

You can easily access the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only through the airSlate SignNow platform. Our user-friendly interface allows you to download, fill out, and eSign the form quickly, ensuring a seamless experience.

-

What are the benefits of using airSlate SignNow for the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only?

Using airSlate SignNow for the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only offers numerous benefits, including enhanced security, easy document tracking, and the ability to eSign from anywhere. This ensures that your form is processed efficiently and securely.

-

Is there a cost associated with using the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Our pricing plans are flexible, allowing you to choose the best option that fits your needs while ensuring you can manage the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only efficiently.

-

Can I integrate airSlate SignNow with other software for managing the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only?

Absolutely! airSlate SignNow offers integrations with various software solutions, making it easy to manage the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only alongside your existing tools. This integration streamlines your workflow and enhances productivity.

-

What features does airSlate SignNow provide for the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time document tracking for the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only. These features simplify the process and ensure that your documents are handled efficiently.

-

How does airSlate SignNow ensure the security of the Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only

- Victoria application form 2015 2019

- Sa389 2015 2018 form

- A critical evaluation of community rail policy core form

- Vehicle suitable for safe use declaration 2015 2019 form

- Important your vehicle must be safe for use on the form

- Acfi answer appraisal pack 2013 2019 form

- Carer adjustment payment australian government department of form

- Request to withdraw a lodged document form

Find out other Global Stock Plan Services Substitute Form W 8BEN for Use By Individuals Only

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free