Medicare Part B Refund Form 2012-2026

What is the Medicare Part B Refund Form

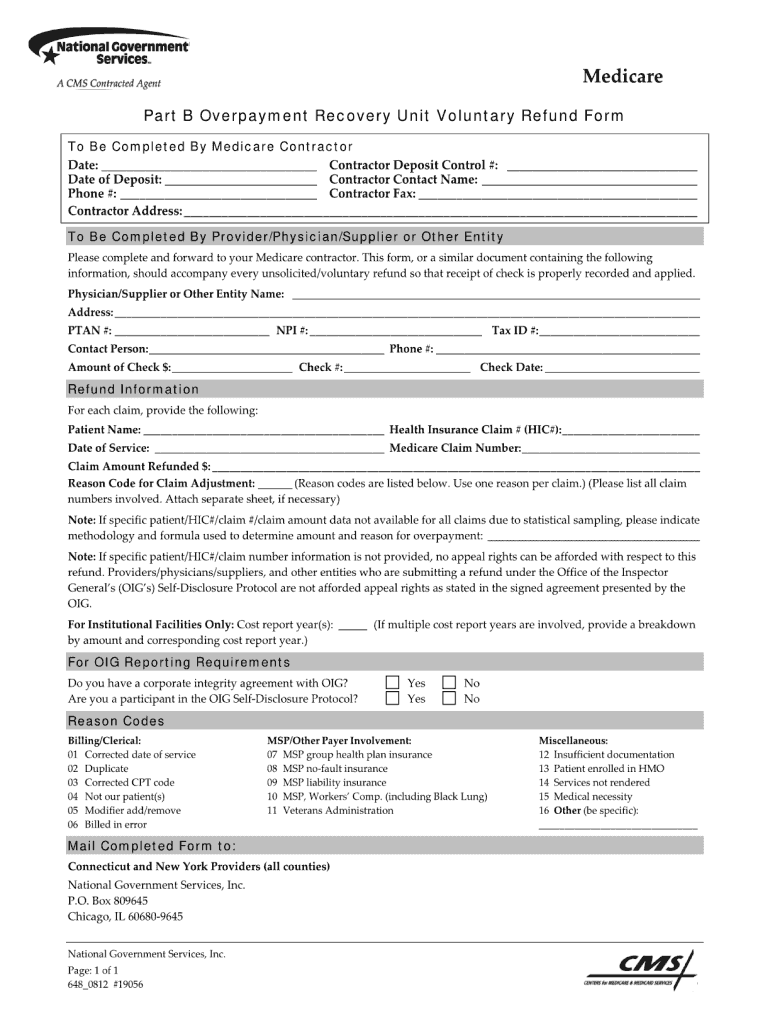

The Medicare Part B Refund Form is a document used by beneficiaries to request a refund for overpayments made towards their Medicare Part B premiums. This form is essential for individuals who have mistakenly paid more than required or who have experienced changes in their Medicare coverage that affect their premium amounts. Understanding the purpose and function of this form is crucial for ensuring that beneficiaries can reclaim any excess payments efficiently.

How to use the Medicare Part B Refund Form

Using the Medicare Part B Refund Form involves several clear steps. First, beneficiaries need to obtain the form, which can typically be found on the official Medicare website or through their local Social Security office. Once the form is in hand, individuals should fill it out carefully, providing accurate information regarding their personal details and the specific overpayment situation. After completing the form, it must be submitted to the appropriate Medicare administrative contractor for processing.

Steps to complete the Medicare Part B Refund Form

Completing the Medicare Part B Refund Form requires attention to detail. Here are the steps to follow:

- Download the form from the Medicare website or request a physical copy.

- Fill in your personal information, including your name, address, and Medicare number.

- Clearly state the reason for the refund request, specifying the overpayment details.

- Attach any supporting documents that verify the overpayment, such as payment receipts or notices from Medicare.

- Review the completed form for accuracy before submitting it.

Legal use of the Medicare Part B Refund Form

The Medicare Part B Refund Form is legally recognized, provided it is filled out correctly and submitted according to Medicare guidelines. This form serves as a formal request for reimbursement and must comply with all relevant regulations to ensure that the request is processed without issue. Beneficiaries should keep copies of all submitted documents for their records, as this can be important in case of any disputes or follow-up inquiries.

Required Documents

When submitting the Medicare Part B Refund Form, certain documents are necessary to support the claim. These typically include:

- A completed Medicare Part B Refund Form.

- Proof of payment, such as bank statements or payment receipts.

- Any correspondence from Medicare regarding the overpayment.

Having these documents ready can facilitate a smoother processing experience and help ensure that the refund is issued promptly.

Form Submission Methods

Beneficiaries can submit the Medicare Part B Refund Form through various methods. The most common submission methods include:

- Online submission via the Medicare website, if available.

- Mailing the completed form to the designated Medicare administrative contractor.

- In-person delivery at a local Social Security office or Medicare office.

Choosing the right submission method can depend on individual preferences and the urgency of the refund request.

Quick guide on how to complete medicare part b refund form

Complete Medicare Part B Refund Form seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Medicare Part B Refund Form on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The easiest way to modify and eSign Medicare Part B Refund Form with ease

- Obtain Medicare Part B Refund Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Identify important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Alter and eSign Medicare Part B Refund Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the medicare part b refund form

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is a Medicare refund and how can I qualify for it?

A Medicare refund refers to the return of overpaid premiums or uncovered medical expenses. To qualify for a Medicare refund, you typically need to ensure you've adhered to all payment procedures and submitted any required claims promptly. It’s important to review your healthcare costs and Medicare statements to identify any discrepancies that could lead to a potential refund.

-

How can airSlate SignNow help me manage my Medicare refund documentation?

airSlate SignNow offers an easy-to-use platform to digitize and manage your Medicare refund documents. You can securely sign, send, and store important paperwork related to your Medicare refund, streamlining the process and ensuring you don't miss any crucial deadlines. This can help you quickly respond to any requests for information regarding your refund.

-

Are there any fees associated with processing a Medicare refund?

The cost of processing a Medicare refund can vary based on your specific case and provider. Using airSlate SignNow can save you time and resources, avoiding potential fees associated with traditional mailing methods. It's advisable to clarify with your Medicare provider about any specific charges related to refunds.

-

What features does airSlate SignNow offer for tracking my Medicare refund?

airSlate SignNow features document tracking and notifications that keep you updated on the status of your Medicare refund submissions. With real-time tracking, you can monitor when your documents are viewed or signed, ensuring you stay informed throughout the process. This proactive approach helps you manage your refund more effectively.

-

Can I integrate airSlate SignNow with other tools to manage my Medicare refund?

Yes, airSlate SignNow integrates with various platforms such as Google Drive and other cloud storage solutions, making it easy to manage your Medicare refund documents in one place. This integration allows you to streamline your workflow, simplifying how you gather, store, and refer to your refund information. Efficient document management is key for any Medicare-related processes.

-

What are the benefits of using airSlate SignNow for Medicare refund claims?

Using airSlate SignNow for your Medicare refund claims offers several benefits including enhanced security, convenience, and speed. The easy-to-use electronic signing feature accelerates the claim submission process, ensuring your refunds are processed more quickly. Additionally, the platform's secure environment protects your sensitive information.

-

Is airSlate SignNow suitable for seniors who are seeking a Medicare refund?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it an excellent choice for seniors managing their Medicare refund claims. The simplicity of the platform allows users of all ages to eSign documents easily, eliminating the frustration of complex paperwork associated with refunds. Support resources are also available to assist seniors in navigating the process.

Get more for Medicare Part B Refund Form

- 2019 m1x amended income tax return minnesota form

- Transaction privilege use and severance tax return tpt 2 transaction privilege use and severance tax return tpt 2 form

- Uc 018 unemployment tax and wage report unemployment tax and wage report form

- How can i assemble my tax return like schedued a or c etc form

- Serious security the decade ending y2k bug that wasnt form

- Schedule ct 1041 k 1 beneficiarys share of certain form

- Internal revenue service locations ampamp hours near hartford ct form

- Connecticut annual summary and transmittal of ctgov form

Find out other Medicare Part B Refund Form

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now