Boe 305 Ah Inyo Fillable 2012-2026

What is the form 305 ah?

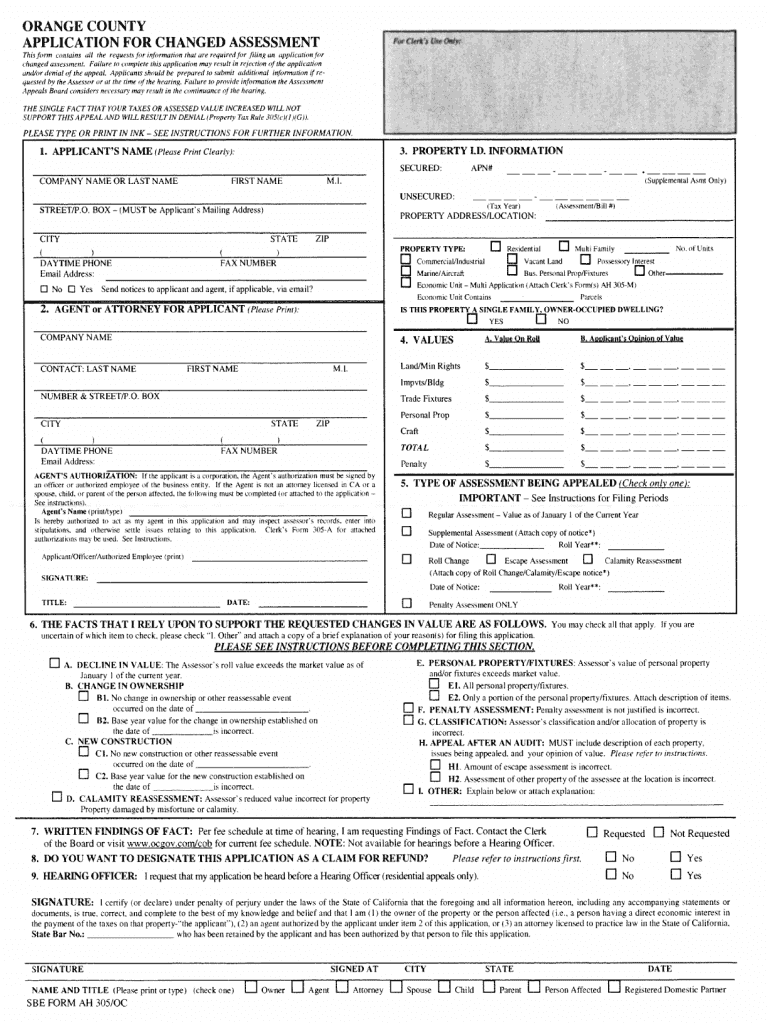

The form 305 ah, also known as the SBE Form AH 305, is a document used primarily in California for property tax purposes. This form is essential for taxpayers who are seeking to claim exemptions or adjustments related to property assessments. It is specifically designed for individuals and businesses to report changes in property ownership or status that may affect their tax liabilities. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations.

Steps to complete the form 305 ah

Completing the form 305 ah involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property in question, including ownership details and any relevant tax identification numbers. Next, fill out the form by providing the required information in each section, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions. Finally, submit the completed form to the appropriate local tax authority, either electronically or via mail, depending on the submission guidelines provided by your county.

Legal use of the form 305 ah

The legal use of the form 305 ah is governed by California tax laws and regulations. This form must be filled out and submitted in accordance with the guidelines set forth by the California State Board of Equalization. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal consequences. The form serves as a formal declaration to the tax authorities regarding property status and exemptions, making its proper use vital for compliance.

Required documents for the form 305 ah

When submitting the form 305 ah, certain documents may be required to support your claims. These can include proof of property ownership, previous tax returns, and any other documentation that verifies the information provided on the form. It is advisable to check with your local tax authority for a complete list of required documents, as this can vary by county. Having all necessary documents ready can facilitate a smoother submission process and help avoid delays.

Form submission methods for the form 305 ah

The form 305 ah can typically be submitted through various methods, depending on the regulations of your local tax authority. Common submission methods include online filing through the official tax authority website, mailing a physical copy of the form, or delivering it in person to the appropriate office. Each method has its own advantages, such as speed or direct confirmation of receipt, so it is important to choose the one that best meets your needs.

Filing deadlines for the form 305 ah

Filing deadlines for the form 305 ah are crucial to ensure compliance with tax regulations. Generally, these deadlines align with local property tax assessment periods, which can vary by county. It is essential to be aware of these dates to avoid penalties or interest charges for late submissions. Checking with your local tax authority for specific deadlines and any changes from year to year is advisable to stay informed and compliant.

Quick guide on how to complete boe 305 ah inyo fillable

Prepare Boe 305 Ah Inyo Fillable effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Boe 305 Ah Inyo Fillable on any device with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Boe 305 Ah Inyo Fillable easily

- Locate Boe 305 Ah Inyo Fillable and click on Get Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your needs in document management in a few clicks from any device you choose. Modify and eSign Boe 305 Ah Inyo Fillable and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the boe 305 ah inyo fillable

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the new fee structure for airSlate SignNow?

The new fee structure for airSlate SignNow has been designed to provide greater transparency and value. It includes various pricing tiers that cater to different business needs, ensuring you find a plan that suits your requirements. The changes reflect our commitment to delivering cost-effective solutions without compromising on features.

-

Are there any hidden costs in the new fee system?

No, airSlate SignNow is dedicated to transparency, and there are no hidden costs associated with the new fee system. All charges will be clearly outlined upon selection of your plan, so you know exactly what to expect. This allows you to budget effectively without any surprises.

-

What benefits can I expect with the new fee plans?

With the new fee plans in airSlate SignNow, you gain access to an enhanced suite of features designed for ease of use and better functionality. These plans support increased document signing capabilities, more integrations, and greater customer support. Ultimately, these benefits translate to improved efficiency and productivity for your business.

-

How does the new fee affect existing contracts?

For existing users, the new fee will take effect upon the renewal of your current plan. There are options available to transition smoothly to the new fee structure, ensuring you can benefit from upgraded features without disruption. We recommend reviewing your account to understand how these changes will apply to you.

-

Can I try airSlate SignNow before committing to the new fee?

Yes! airSlate SignNow offers a free trial period to let you explore the platform and its features before committing to any new fee. This trial enables you to experience the efficiency and ease of use of our eSigning solution firsthand. Sign up today to see how it can benefit your business.

-

What integrations are available under the new fee plans?

Under the new fee plans, airSlate SignNow continues to offer robust integrations with a variety of applications, including CRM software and document management systems. These integrations optimize your workflow, making it easier to manage documents and signatures efficiently. Adding these integrations can further leverage the capabilities of your eSigning process.

-

How can the new fee improve my signing experience?

The new fee structure is aimed at enhancing the overall signing experience by introducing features that make the process faster and more intuitive. With streamlined workflows and better support options, you'll find it easier to manage your documents and eSignatures. This all contributes to a more satisfying experience for both you and your clients.

Get more for Boe 305 Ah Inyo Fillable

- Summary or informal administration

- State of minnesota hereinafter referred to as the trustor whether one or more form

- Control number sd 00llc form

- State of south dakota hereinafter referred to as the trustor and the trustee form

- State of west virginia hereinafter referred to as the trustor and the trustee form

- Notice of satisfaction of mortgage form

- Y otc t 1 professional services agreement between form

- Commercial lease extension legal form

Find out other Boe 305 Ah Inyo Fillable

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile