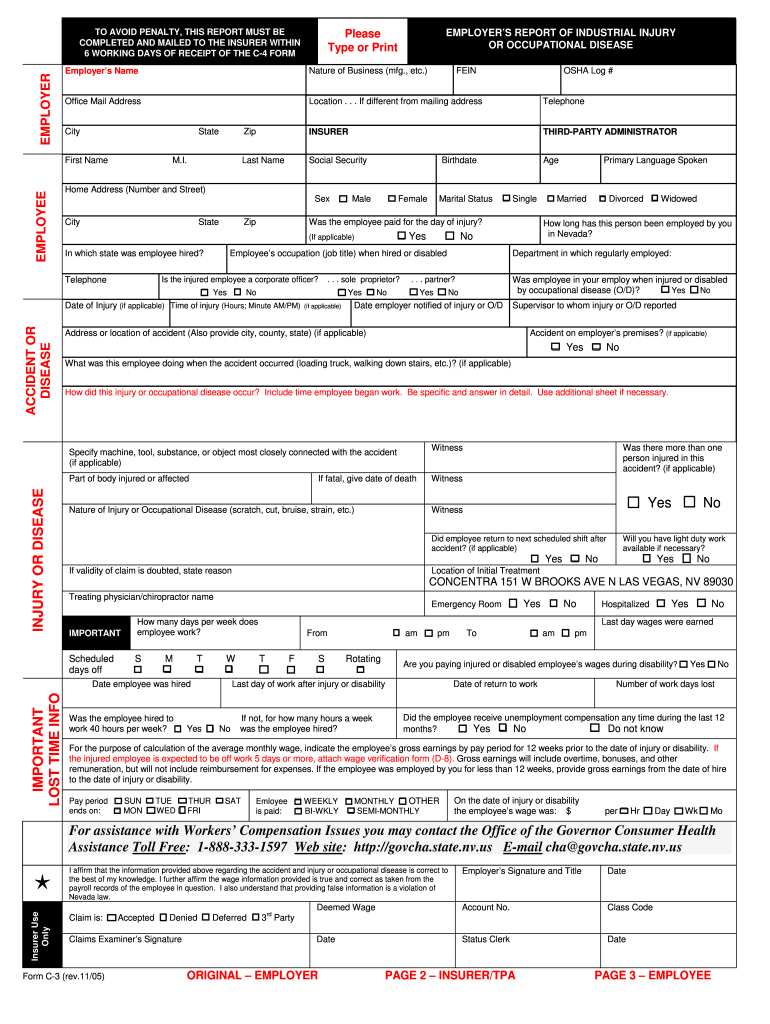

C 3 Form 2005

What is the C 3 Form

The C 3 Form is a specific document used primarily in the context of tax reporting and compliance in the United States. This form is essential for certain businesses and individuals who need to report specific financial information to the Internal Revenue Service (IRS). Understanding the purpose of the C 3 Form is crucial for ensuring accurate tax filings and compliance with federal regulations.

How to use the C 3 Form

Using the C 3 Form involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents and information that pertain to the reporting period. Next, accurately fill out the form, ensuring that all entries are correct and reflect the required data. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS. It is important to follow the instructions carefully to avoid delays or penalties.

Steps to complete the C 3 Form

Completing the C 3 Form requires careful attention to detail. Here are the steps to follow:

- Review the form instructions thoroughly to understand the requirements.

- Collect all relevant financial records, including income statements and expense reports.

- Fill out the form section by section, ensuring accuracy in all entries.

- Double-check all calculations and information for correctness.

- Sign and date the form as required.

- Submit the form through the appropriate channel, whether online or by mail.

Legal use of the C 3 Form

The legal use of the C 3 Form is governed by IRS regulations. This form must be filled out accurately to comply with federal tax laws. Incorrect or incomplete submissions can lead to legal repercussions, including fines or audits. It is essential to understand the legal implications of the information reported on the form and to keep copies for your records.

Filing Deadlines / Important Dates

Filing deadlines for the C 3 Form vary depending on the specific tax year and the type of entity submitting the form. Typically, the form must be filed by the tax deadline for the respective year, which is often April 15 for individuals and March 15 for certain business entities. It is crucial to stay informed about any changes in deadlines to avoid late filing penalties.

Required Documents

To complete the C 3 Form accurately, several documents may be required. These typically include:

- Income statements detailing earnings for the reporting period.

- Expense reports that outline all deductible expenses.

- Previous tax returns for reference and accuracy.

- Any supporting documentation that substantiates claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

The C 3 Form can be submitted through various methods, depending on the preferences of the filer and IRS guidelines. Options typically include:

- Online submission through the IRS e-file system, which is often the fastest method.

- Mailing the completed form to the designated IRS address, ensuring it is postmarked by the deadline.

- In-person submission at designated IRS offices, although this method may require an appointment.

Quick guide on how to complete c 3 form 2005

Complete C 3 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage C 3 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to alter and eSign C 3 Form with ease

- Locate C 3 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for such purposes.

- Create your electronic signature using the Sign feature, which takes mere moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choosing. Alter and eSign C 3 Form and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct c 3 form 2005

Create this form in 5 minutes!

How to create an eSignature for the c 3 form 2005

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is a C 3 Form and how can airSlate SignNow help with it?

A C 3 Form is a critical document used for various administrative tasks, and airSlate SignNow simplifies its management. With our platform, users can easily create, send, and eSign C 3 Forms, ensuring a streamlined process that saves time and reduces errors. This makes it an ideal solution for businesses that frequently handle C 3 Forms.

-

How much does it cost to use airSlate SignNow for processing C 3 Forms?

airSlate SignNow offers flexible pricing plans, making it affordable for businesses of all sizes to manage C 3 Forms. Our plans are designed to cater to different needs, from basic functionalities to advanced features for larger teams. Visit our pricing page to find the best option that suits your requirements for handling C 3 Forms.

-

What features does airSlate SignNow provide for C 3 Form management?

airSlate SignNow includes a variety of features for efficient C 3 Form management, such as customizable templates, automated workflows, and secure eSignature capabilities. These features ensure that your C 3 Forms are not only processed quickly but also maintain compliance and security. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other applications for managing C 3 Forms?

Yes, airSlate SignNow can seamlessly integrate with numerous applications, enhancing your ability to manage C 3 Forms. Integrations with CRM systems, cloud storage, and productivity tools allow you to streamline your workflow and keep all your data synchronized. This flexibility makes it easier to incorporate C 3 Forms into your existing processes.

-

Is it secure to eSign C 3 Forms using airSlate SignNow?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your C 3 Forms and sensitive data. With features like encryption, secure cloud storage, and compliance with regulations such as GDPR and HIPAA, you can trust that your eSigned C 3 Forms are safe and secure.

-

How can airSlate SignNow benefit my business when handling C 3 Forms?

Using airSlate SignNow to handle C 3 Forms can signNowly enhance your business efficiency. The platform reduces the time spent on paperwork by enabling quick eSignatures and automated workflows, which can lead to faster decision-making. Additionally, it helps mitigate errors associated with manual processing, improving overall accuracy.

-

What industries can benefit from using airSlate SignNow for C 3 Forms?

Various industries can benefit from airSlate SignNow when processing C 3 Forms, including healthcare, finance, and education. Each of these sectors often requires secure and efficient document management and eSigning solutions. By utilizing airSlate SignNow, businesses in these industries can ensure compliance and improve operational efficiency when dealing with C 3 Forms.

Get more for C 3 Form

Find out other C 3 Form

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free