Payroll Report Form

What is the payroll report?

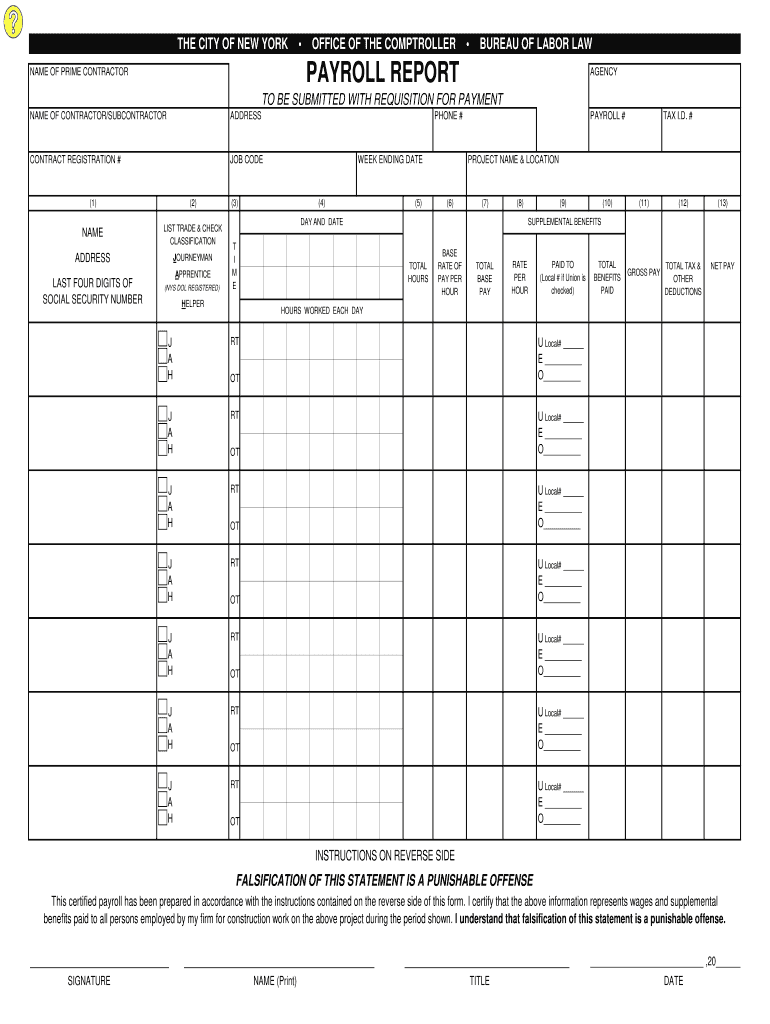

The payroll report is a comprehensive document that outlines the earnings, deductions, and net pay for employees within a specific pay period. This report serves as a crucial tool for businesses to ensure accurate payroll processing and compliance with federal and state regulations. It typically includes details such as employee names, hours worked, gross pay, taxes withheld, and any additional deductions like health insurance or retirement contributions. Understanding the payroll report is essential for both employers and employees to maintain transparency and accuracy in financial records.

Steps to complete the payroll report

Completing a payroll report involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary employee information, including names, Social Security numbers, and pay rates. Next, calculate the total hours worked by each employee during the pay period. This includes regular hours, overtime, and any leave taken. After determining the gross pay, apply the appropriate tax withholdings and deductions. Finally, compile this information into the payroll report format, ensuring all entries are accurate and complete before submission.

Key elements of the payroll report

A well-structured payroll report contains several essential elements that provide a clear overview of payroll transactions. Key components include:

- Employee Information: Names, identification numbers, and job titles.

- Pay Period: The start and end dates for the payroll cycle.

- Hours Worked: Total hours each employee worked, including overtime.

- Gross Pay: Total earnings before deductions.

- Deductions: Federal, state, and local taxes, along with other deductions.

- Net Pay: The final amount employees receive after all deductions.

Legal use of the payroll report

The payroll report must adhere to various legal requirements to be considered valid. In the United States, employers are required to maintain accurate payroll records to comply with the Fair Labor Standards Act (FLSA) and Internal Revenue Service (IRS) regulations. This includes ensuring that all employee information is up-to-date and that payroll calculations are accurate. Additionally, electronic payroll reports must meet standards set by the ESIGN Act, ensuring that they are legally binding and secure. Employers should regularly review their payroll processes to ensure compliance with all applicable laws.

How to obtain the payroll report

Obtaining a payroll report can vary depending on the business's payroll system. Many companies generate payroll reports through their accounting software or payroll service providers. Employers can typically access these reports directly from their software dashboard or by requesting them from their payroll department. For employees, payroll reports may be available through employee self-service portals, where they can view and download their pay stubs and annual earnings statements. In cases where reports are not readily available, employees may need to contact their HR department for assistance.

Examples of using the payroll report

Payroll reports serve multiple purposes within an organization. For instance, they are used to ensure accurate tax filings, as the information contained within them is crucial for completing forms such as the W-2 and 941. Additionally, payroll reports can assist in budgeting and financial planning, providing insights into labor costs and employee compensation trends. Employers may also use these reports to resolve payroll discrepancies or disputes by referencing the documented hours and earnings for each employee.

Quick guide on how to complete payroll report

Effortlessly Prepare Payroll Report on Any Device

The management of online documents has become increasingly popular among organizations and individuals. It presents an ideal environmentally friendly alternative to traditional printed and signed paperwork, as it allows you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Payroll Report on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to Edit and eSign Payroll Report With Ease

- Locate Payroll Report and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and eSign Payroll Report to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll report

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is a Payroll Report and how can airSlate SignNow help with it?

A Payroll Report is a comprehensive document that summarizes employee wages, hours worked, and deductions for a specific pay period. With airSlate SignNow, you can easily send, eSign, and manage these reports digitally, ensuring accuracy and compliance while saving time on manual processes.

-

How does airSlate SignNow ensure the security of my Payroll Reports?

airSlate SignNow prioritizes the security of your Payroll Reports by utilizing advanced encryption protocols and secure cloud storage. This ensures that your sensitive payroll data is protected against unauthorized access, giving you peace of mind when managing employee documents.

-

Can I integrate airSlate SignNow with my existing payroll software?

Yes, airSlate SignNow offers seamless integrations with various payroll software solutions. This allows you to streamline the process of generating and signing Payroll Reports, minimizing manual entry and enhancing overall efficiency.

-

What are the pricing options for airSlate SignNow for managing Payroll Reports?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Whether you need essential features for Payroll Reports or advanced capabilities, you can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for creating Payroll Reports?

airSlate SignNow includes features like customizable templates, automated workflows, and bulk sending, making it easy to create and distribute Payroll Reports. These tools help you save time and ensure consistency across all your payroll documentation.

-

How can airSlate SignNow improve the efficiency of my payroll process?

By using airSlate SignNow for Payroll Reports, you can automate document routing, eSigning, and approvals, signNowly reducing the time spent on payroll processes. This efficiency not only streamlines your workflow but also minimizes errors related to manual handling.

-

Is it easy to get support if I have questions about Payroll Reports with airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive customer support, including live chat, email assistance, and a detailed knowledge base. If you have any questions about managing your Payroll Reports, our team is ready to help you resolve them quickly.

Get more for Payroll Report

Find out other Payroll Report

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later

- Sign Louisiana LLC Operating Agreement Computer

- How Do I Sign Massachusetts LLC Operating Agreement

- Sign Michigan LLC Operating Agreement Later

- Sign Oklahoma LLC Operating Agreement Safe

- Sign Rhode Island LLC Operating Agreement Mobile

- Sign Wisconsin LLC Operating Agreement Mobile

- Can I Sign Wyoming LLC Operating Agreement

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online