State Form 43709 Indiana 2015-2026

What is the State Form 43709 Indiana

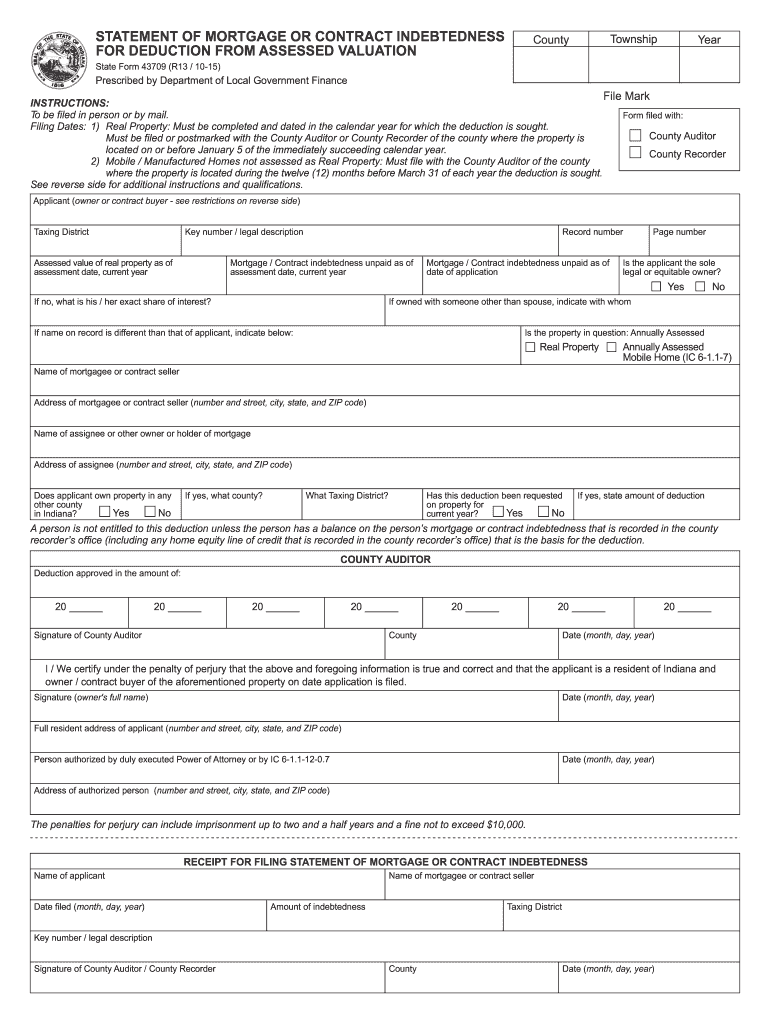

The State Form 43709 Indiana, commonly referred to as the Indiana form deduction, is a document used for reporting mortgage indebtedness in the state of Indiana. This form allows taxpayers to claim deductions related to their mortgage, which can significantly impact their tax liabilities. It is essential for homeowners who wish to take advantage of potential tax benefits associated with their mortgage payments. The form is specifically designed to ensure that all relevant information regarding the mortgage is accurately reported to the Indiana Department of Revenue.

How to use the State Form 43709 Indiana

Using the State Form 43709 Indiana involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to your mortgage, including loan statements and payment records. Next, fill out the form by providing detailed information about your mortgage, such as the lender's name, loan amount, and property address. Ensure that all sections are completed accurately to avoid delays or issues with your tax return. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements of the Indiana Department of Revenue.

Steps to complete the State Form 43709 Indiana

Completing the State Form 43709 Indiana requires careful attention to detail. Follow these steps to ensure proper completion:

- Gather necessary documents, including mortgage statements and tax records.

- Provide personal information, including your name, address, and Social Security number.

- Enter mortgage details, including the lender's name, loan amount, and property information.

- Calculate the mortgage deduction based on the provided information.

- Review the form for accuracy before submission.

After completing these steps, submit the form according to the guidelines provided by the Indiana Department of Revenue.

Key elements of the State Form 43709 Indiana

The State Form 43709 Indiana includes several key elements that are crucial for accurate reporting. These elements consist of:

- Borrower Information: This section requires the borrower's name, address, and Social Security number.

- Lender Information: Details about the mortgage lender, including their name and contact information.

- Loan Amount: The total amount of the mortgage loan.

- Property Address: The physical address of the property associated with the mortgage.

- Deduction Calculation: A section for calculating the total deductible amount based on the mortgage details.

Each of these elements plays a vital role in ensuring the form is filled out correctly and complies with state regulations.

Legal use of the State Form 43709 Indiana

The legal use of the State Form 43709 Indiana is governed by state tax laws that outline how mortgage deductions can be claimed. To ensure compliance, taxpayers must accurately report their mortgage indebtedness and adhere to the guidelines set forth by the Indiana Department of Revenue. This includes maintaining proper documentation to support the information provided on the form. Failure to comply with these legal requirements may result in penalties or disallowance of the claimed deductions.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the State Form 43709 Indiana to avoid late penalties. Generally, the form must be submitted by the same deadline as your state income tax return. For most taxpayers, this date falls on April 15 of each year. However, if you are unable to meet this deadline, it is advisable to check for any extensions or specific changes announced by the Indiana Department of Revenue. Keeping track of these important dates ensures that you remain compliant and can take advantage of available deductions.

Quick guide on how to complete state form 43709 indiana

Accomplish State Form 43709 Indiana effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage State Form 43709 Indiana on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign State Form 43709 Indiana with ease

- Obtain State Form 43709 Indiana and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign State Form 43709 Indiana and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state form 43709 indiana

Create this form in 5 minutes!

How to create an eSignature for the state form 43709 indiana

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Indiana form deduction?

The Indiana form deduction refers to specific deductions available for individuals and businesses filing taxes in Indiana. Understanding the Indiana form deduction can help you maximize your tax savings and ensure compliance with state regulations. It's essential to consult with a tax professional or use software that incorporates Indiana form deduction to make the process smoother.

-

How can airSlate SignNow help with the Indiana form deduction process?

airSlate SignNow simplifies the documentation needed for the Indiana form deduction by enabling you to eSign and send documents quickly. This streamlines the sending of required forms and records related to your tax deductions, making your filing process more efficient. By using our platform, you can ensure that all documents concerning your Indiana form deduction are managed securely and effortlessly.

-

Are there any costs associated with using airSlate SignNow for Indiana form deduction?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing your Indiana form deduction. You can choose a plan that fits your budget and access powerful features designed to enhance your document management. The investment you make in our service can lead to signNow time and money savings when preparing taxes.

-

What features does airSlate SignNow offer for managing Indiana form deduction?

airSlate SignNow provides features such as customizable eSignature workflows, templates for tax-related documents, and secure cloud storage. These tools are designed to help you efficiently manage your Indiana form deduction paperwork, ensuring that all necessary documents are easily accessible and shareable. Automation features also reduce manual labor, allowing you to focus more on your core activities.

-

Can I integrate airSlate SignNow with other applications for Indiana form deduction management?

Yes, airSlate SignNow supports an array of integrations with popular applications like CRM systems, accounting software, and other tools used in tax preparation. By integrating these applications, managing your Indiana form deduction becomes even more streamlined, reducing the likelihood of errors and saving time. This interconnectivity allows for a comprehensive approach to your document management needs.

-

How secure is airSlate SignNow when handling documents for Indiana form deduction?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive information related to your Indiana form deduction. Our platform utilizes bank-grade encryption and advanced security protocols to protect your documents from unauthorized access. You can confidently use our service, knowing that your data is safe and compliant with industry standards.

-

Is airSlate SignNow user-friendly for managing Indiana form deduction paperwork?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and utilize the platform effectively. Whether you are tech-savvy or not, you can quickly learn how to manage your Indiana form deduction documents with our intuitive interface and straightforward features. Getting started is a breeze, allowing you to focus on your document needs rather than the software.

Get more for State Form 43709 Indiana

Find out other State Form 43709 Indiana

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online