Indiana State Form 43709 2003

What is the Indiana State Form 43709

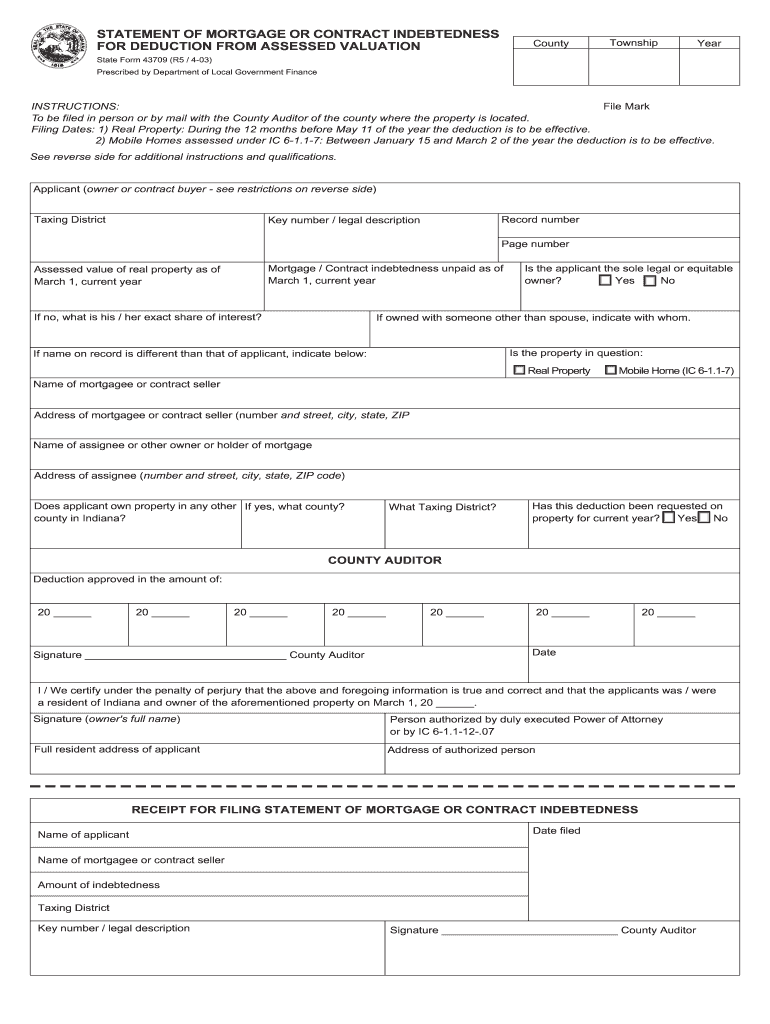

The Indiana State Form 43709, commonly referred to as the mortgage deduction form 43709, is a document used by property owners in Indiana to claim property tax deductions related to mortgage exemptions. This form is essential for individuals seeking to benefit from tax reductions on their primary residence. It is designed to provide the state with necessary information about the property, including its location, ownership details, and the amount of mortgage interest paid, which can influence the deduction amount.

How to use the Indiana State Form 43709

Using the Indiana State Form 43709 involves several steps to ensure accurate completion and submission. First, gather all relevant information, such as property details, mortgage information, and personal identification. Next, fill out the form carefully, ensuring that all sections are completed accurately. After filling out the form, review it for any errors before submission. This form can be submitted electronically or via mail, depending on the preferred method of filing.

Steps to complete the Indiana State Form 43709

Completing the Indiana State Form 43709 requires attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the Indiana Department of Revenue website.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details about the property, including its address and tax identification number.

- Indicate the total amount of mortgage interest paid during the tax year.

- Sign and date the form to certify that the information provided is accurate.

Key elements of the Indiana State Form 43709

Several key elements are crucial when filling out the Indiana State Form 43709. These include:

- Property Information: Accurate details about the property, including its location and tax identification number.

- Mortgage Interest: The total amount of mortgage interest paid must be clearly stated, as this directly affects the deduction.

- Owner Information: Personal details of the property owner, including their Social Security number and contact information.

Eligibility Criteria

To qualify for using the Indiana State Form 43709, applicants must meet specific eligibility criteria. Generally, the form is intended for homeowners who have a mortgage on their primary residence. Additionally, applicants must be able to provide proof of mortgage interest payments and must not exceed certain income thresholds, which can affect the eligibility for property tax deductions.

Form Submission Methods

The Indiana State Form 43709 can be submitted through various methods, catering to different preferences:

- Online Submission: Many taxpayers choose to file electronically through the Indiana Department of Revenue's online portal.

- Mail: The completed form can also be printed and mailed to the appropriate tax office.

- In-Person: Taxpayers may opt to deliver the form in person at designated tax offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete state form 43709

Ensure Accuracy on Indiana State Form 43709

Engaging in contracts, overseeing listings, arranging calls, and hosting viewings—realtors and real estate agents juggle a variety of responsibilities on a daily basis. Many of these tasks require handling numerous documents, such as Indiana State Form 43709, which need to be processed swiftly and with precision.

airSlate SignNow is a comprehensive platform designed to assist professionals in real estate reduce their paperwork load, enabling them to concentrate more on their clients' goals throughout the negotiation process and helping them secure the most advantageous terms for their agreements.

Steps to complete Indiana State Form 43709 using airSlate SignNow:

- Access the Indiana State Form 43709 page or utilize our library’s search functionalities to locate the document you require.

- Click Get form—you will be instantly taken to the editor.

- Begin filling out the form by selecting fillable sections and entering your information.

- Add additional text and modify its settings if necessary.

- Select the Sign option in the upper toolbar to create your electronic signature.

- Explore other features to enhance and improve your document, like drawing, highlighting, adding shapes, etc.

- Open the comments tab and add annotations regarding your document.

- Conclude the process by downloading, sharing, or sending your document to your designated users or organizations.

Eliminate paper for good and simplify the homebuying experience with our user-friendly and robust platform. Experience greater ease when completing Indiana State Form 43709 and other real estate documents online. Try our solution today!

Create this form in 5 minutes or less

Find and fill out the correct state form 43709

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

-

Do I need to fill out the state admission form to participate in state counselling in the NEET UG 2018?

There is two way to participate in state counseling》Fill the state quota counseling admission form(for 15% quota) and give the preference to your own state with this if your marks are higher and if you are eligible to get admission in your state then you will get the college.》Fill out the form for state counseling like karnataka state counseling has started and Rajasthan counseling will start from 18th june.In 2nd way you will fill the form for 85% state quota and has higher chances to get college in your own state.NOTE= YOU WILL GET COLLEGE IN OTHER STATE (IN 15% QUOTA) WHEN YOU WILL CROSS THE PARTICULAR CUT OFF OF THE NEET AND THAT STATE.BEST OF LUCK.PLEASE DO FOLLOW ME ON QUORA.

-

Which form do I have to fill out to get into LNCT Bhopal? I am from another state.

Dear candidatEngineering admission in lnct Bhopal is possible based on candidates marks in board exam and with jee mains rankFor more detailsContactNavnit singh(admission counselor for Bhopal and other engineering colleges)7065197100whatsapp no-7827599577

Create this form in 5 minutes!

How to create an eSignature for the state form 43709

How to generate an electronic signature for the State Form 43709 in the online mode

How to generate an electronic signature for your State Form 43709 in Chrome

How to make an electronic signature for putting it on the State Form 43709 in Gmail

How to make an eSignature for the State Form 43709 straight from your smartphone

How to create an electronic signature for the State Form 43709 on iOS

How to generate an electronic signature for the State Form 43709 on Android devices

People also ask

-

What is Indiana State Form 43709?

Indiana State Form 43709 is a specific document required for certain transactions in Indiana. It is often used for filing various tax-related forms and requires precise information to ensure compliance. Utilizing airSlate SignNow can streamline the completion and e-signing process for Form 43709, ensuring that your submissions are both accurate and timely.

-

How can airSlate SignNow help with Indiana State Form 43709?

airSlate SignNow provides a user-friendly platform to create, send, and e-sign Indiana State Form 43709 effortlessly. With features such as templates and document tracking, you can ensure that your form is filled out correctly and submitted on time. This solution minimizes the risk of errors, making your filing process more efficient.

-

Is there a cost associated with using airSlate SignNow for Indiana State Form 43709?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. The plans provide access to essential features needed to manage documents like Indiana State Form 43709 effectively. For detailed pricing information, visit our website and choose the plan that best fits your requirements.

-

What features does airSlate SignNow offer for managing Indiana State Form 43709?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage. These tools make it easy to handle Indiana State Form 43709 efficiently, ensuring that you can manage your documents with ease and confidence. Additionally, the platform supports real-time collaboration among team members.

-

Can I integrate airSlate SignNow with other applications for Indiana State Form 43709?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to access and manage Indiana State Form 43709 alongside your other essential documents, enhancing your workflow and productivity.

-

What are the benefits of using airSlate SignNow for Indiana State Form 43709?

Using airSlate SignNow for Indiana State Form 43709 offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick e-signing and document sharing, which can save time and reduce the hassle of traditional paper forms. Furthermore, your documents are stored securely in the cloud.

-

Is it easy to use airSlate SignNow for Indiana State Form 43709?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to use for Indiana State Form 43709. The intuitive interface guides users through the process of creating, sending, and signing documents, ensuring that even those with minimal technical experience can navigate the system effectively.

Get more for Indiana State Form 43709

Find out other Indiana State Form 43709

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors