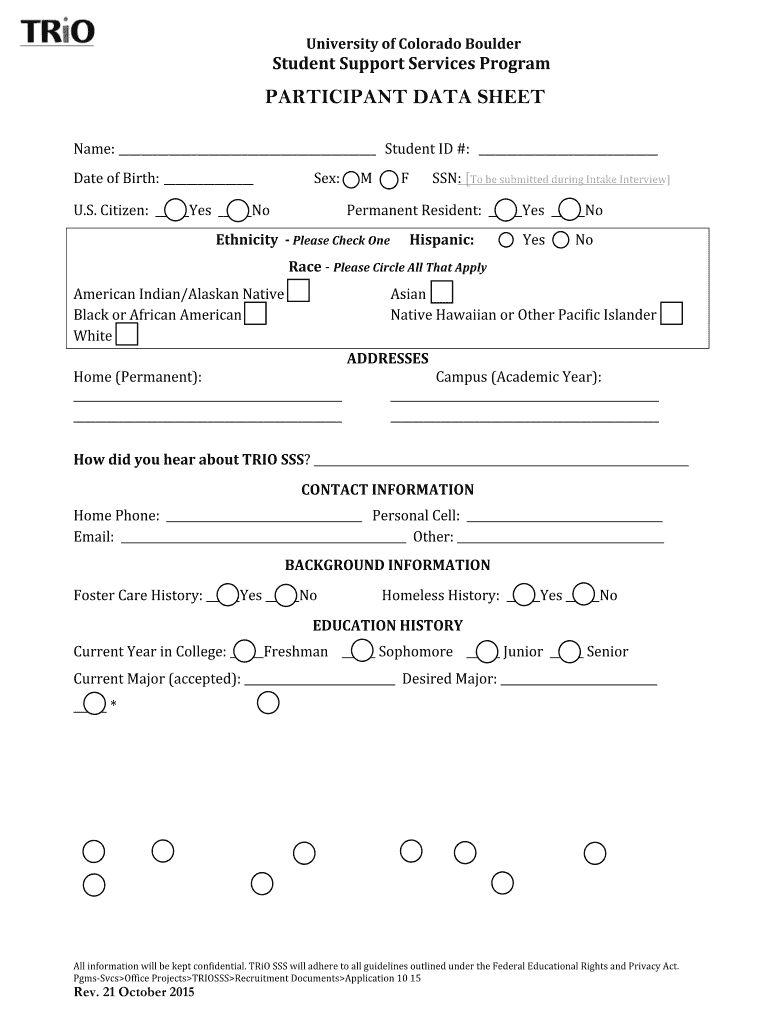

Participant Data Sheet University of Colorado Boulder 2015-2026

Understanding the CU Boulder Tax Forms

The CU Boulder tax forms are essential documents that facilitate the reporting of income and tax obligations for students, staff, and faculty associated with the University of Colorado Boulder. These forms are designed to comply with IRS regulations and ensure that individuals fulfill their tax responsibilities accurately. Key forms include the W-2 for employees and the 1098-T for students, which reports tuition payments and related expenses. Understanding these forms is crucial for maintaining compliance and avoiding potential penalties.

Steps to Complete the CU Boulder Tax Forms

Completing the CU Boulder tax forms involves several important steps to ensure accuracy and compliance. Begin by gathering necessary documents such as your Social Security number, income statements, and any relevant tax deductions. Next, carefully fill out the required forms, ensuring that all information is accurate and complete. Double-check for any missing signatures or dates, as these can lead to processing delays. Finally, submit the forms by the designated deadline, either electronically or via mail, depending on the specific requirements for each form.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for timely submission of CU Boulder tax forms. Typically, the IRS requires that W-2 forms be issued to employees by January 31, while 1098-T forms are generally provided by the end of January as well. For personal tax returns, the deadline is usually April 15. It is important to stay informed about any changes to these dates, as they can vary from year to year. Mark these dates on your calendar to avoid late submissions and potential penalties.

Legal Use of the CU Boulder Tax Forms

The legal use of CU Boulder tax forms is governed by IRS regulations and guidelines. These forms must be filled out accurately to ensure compliance with federal tax laws. Failure to provide correct information can result in penalties or audits. It is essential to keep records of all submitted forms and any supporting documentation for at least three years, as the IRS may request this information during an audit. Utilizing reliable digital tools for eSigning and submitting these forms can enhance security and maintain compliance.

Obtaining the CU Boulder Tax Forms

CU Boulder tax forms can be obtained through various channels. The university's official website typically provides downloadable versions of the necessary forms, including W-2s and 1098-Ts. Additionally, students and employees can access their tax documents through the university's financial services portal. For those who prefer physical copies, forms may also be requested from the university's administrative offices. Ensuring you have the correct form is vital for accurate tax reporting.

Key Elements of the CU Boulder Tax Forms

Key elements of CU Boulder tax forms include personal identification information, income details, and specific tax-related data. For instance, the W-2 form includes wages earned, taxes withheld, and employer identification details. The 1098-T form outlines tuition payments and adjustments made throughout the year. Understanding these elements is essential for accurately reporting income and claiming any eligible tax credits or deductions. Properly completing these sections can significantly impact your tax obligations.

Digital vs. Paper Version of CU Boulder Tax Forms

Choosing between digital and paper versions of CU Boulder tax forms can impact the convenience and security of your submission. Digital forms allow for easier completion, eSigning, and faster submission, often resulting in quicker processing times. Additionally, digital submissions reduce the risk of lost documents and provide a clear audit trail. However, some individuals may prefer paper forms for their tangible nature. Understanding the benefits of each option can help you make an informed decision based on your personal preferences and needs.

Quick guide on how to complete participant data sheet university of colorado boulder

Complete Participant Data Sheet University Of Colorado Boulder effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Participant Data Sheet University Of Colorado Boulder on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The simplest method to alter and eSign Participant Data Sheet University Of Colorado Boulder with ease

- Find Participant Data Sheet University Of Colorado Boulder and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or obscure confidential information with features specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to finalize your changes.

- Decide how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Participant Data Sheet University Of Colorado Boulder to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the participant data sheet university of colorado boulder

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What are CU Boulder tax forms?

CU Boulder tax forms are official documents required for reporting income and tax information associated with Boulder, Colorado-based students and employees. These forms ensure compliance with both state and federal tax regulations. Understanding these forms is essential for accurate tax filing.

-

How can airSlate SignNow help with CU Boulder tax forms?

AirSlate SignNow helps streamline the process of managing CU Boulder tax forms by allowing users to easily send, receive, and eSign these documents electronically. This eliminates the hassle of physical paperwork and speeds up the submission process. Additionally, our platform ensures secure handling of sensitive tax information.

-

Is airSlate SignNow cost-effective for handling CU Boulder tax forms?

Yes, airSlate SignNow offers a cost-effective solution for managing CU Boulder tax forms. With transparent pricing plans and no hidden fees, you'll find our service to be budget-friendly while still providing essential features. Investing in our platform can save time and reduce costs associated with traditional paperwork.

-

Are there specific features for handling CU Boulder tax forms in airSlate SignNow?

AirSlate SignNow includes several features designed specifically for handling CU Boulder tax forms, such as customizable templates, automated workflows, and advanced security options. These features enhance the efficiency and accuracy of document handling. Users can track the status of their forms easily, providing peace of mind.

-

What are the benefits of using airSlate SignNow for CU Boulder tax forms?

Using airSlate SignNow for CU Boulder tax forms offers numerous benefits, including convenience, efficiency, and security. Users can electronically sign documents from anywhere, reducing delays associated with mailing. Our platform also provides clear audit trails, ensuring compliance and transparency.

-

Can I integrate airSlate SignNow with other tools for managing CU Boulder tax forms?

Absolutely! airSlate SignNow integrates with various tools and services commonly used to manage CU Boulder tax forms, such as Google Drive, Dropbox, and CRMs. This interoperability helps streamline your workflow, allowing for seamless document storage and sharing across platforms.

-

Is training available for using airSlate SignNow for CU Boulder tax forms?

Yes, airSlate SignNow provides comprehensive training and resources for effectively using our platform for CU Boulder tax forms. Our support team offers tutorials, webinars, and user guides to help you navigate the features. Whether you're a new or a seasoned user, we ensure you have the knowledge to maximize your experience.

Get more for Participant Data Sheet University Of Colorado Boulder

Find out other Participant Data Sheet University Of Colorado Boulder

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free