1023 Form 2006

What is the 1023 Form

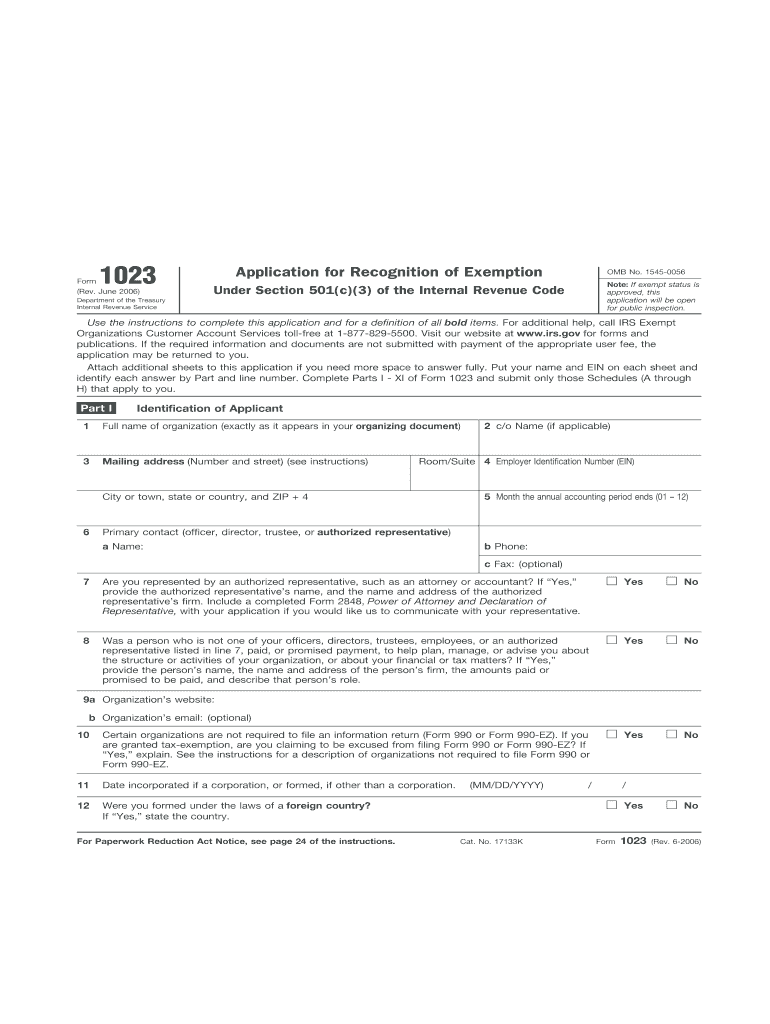

The 1023 Form, officially known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is a crucial document for organizations seeking tax-exempt status in the United States. This form is primarily used by nonprofit organizations to apply for federal tax exemption, allowing them to operate without paying federal income tax. Completing the 1023 Form accurately is essential for organizations to gain the benefits associated with tax-exempt status, including eligibility for grants and donations that are tax-deductible for contributors.

How to use the 1023 Form

Using the 1023 Form involves several steps to ensure that all necessary information is accurately provided. Organizations must first gather relevant details about their mission, structure, and financials. This includes information about the organization’s activities, governance, and funding sources. After gathering the required information, organizations can fill out the form, ensuring that they provide clear and concise answers to each question. It is advisable to review the completed form for accuracy before submission to avoid delays in processing.

Steps to complete the 1023 Form

Completing the 1023 Form involves a systematic approach to ensure compliance with IRS requirements. Here are key steps to follow:

- Gather necessary documentation, including articles of incorporation, bylaws, and financial statements.

- Provide detailed descriptions of the organization's purpose, activities, and programs.

- Complete the form by answering all questions thoroughly and accurately.

- Review the form for completeness and accuracy before submission.

- Submit the form along with the required fee to the IRS.

Legal use of the 1023 Form

The legal use of the 1023 Form is governed by the Internal Revenue Code, which outlines the requirements for organizations seeking tax-exempt status. Proper completion of this form is essential for compliance with federal laws. Organizations must ensure that their activities align with the criteria set forth by the IRS, including being organized and operated exclusively for charitable, educational, or other specified purposes. Failure to comply with these requirements can result in denial of tax-exempt status or revocation of existing status.

IRS Guidelines

The IRS provides specific guidelines for completing the 1023 Form, which organizations must follow to ensure their application is processed smoothly. These guidelines include detailed instructions on the type of information required, how to present financial data, and the importance of providing supporting documentation. Organizations should refer to the IRS website or consult with a tax professional for the most current guidelines and requirements to avoid common pitfalls during the application process.

Required Documents

To successfully complete the 1023 Form, organizations must submit several required documents. These typically include:

- Articles of incorporation and bylaws.

- Financial statements for the past three years, if applicable.

- A detailed narrative of the organization’s activities.

- Information about the board of directors and key personnel.

Having these documents prepared in advance can streamline the application process and help ensure that the form is completed accurately.

Quick guide on how to complete 2006 1023 form

Easily Prepare 1023 Form on Any Device

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without interruptions. Handle 1023 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign 1023 Form Effortlessly

- Obtain 1023 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact confidential information with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign 1023 Form to ensure clear communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2006 1023 form

Create this form in 5 minutes!

How to create an eSignature for the 2006 1023 form

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the 1023 Form used for?

The 1023 Form is an application form used by organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. By completing the 1023 Form, nonprofits can obtain federal tax exemption, which is crucial for fundraising and operation. Understanding how to properly fill out the 1023 Form can greatly enhance a nonprofit's chances of approval.

-

How can airSlate SignNow help with the 1023 Form?

airSlate SignNow provides a streamlined way to send and eSign the 1023 Form, ensuring that the necessary documents are securely signed and submitted. Our platform simplifies the process, making it easy for nonprofit organizations to manage their applications without the hassle of traditional paperwork. Additionally, our templates can help guide you through the completion of the 1023 Form.

-

Is there a cost associated with using airSlate SignNow for the 1023 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including features for managing the 1023 Form. Our pricing is competitive and designed to provide value for organizations looking to streamline their document workflows. With a subscription, you’ll receive access to unlimited eSignatures, templates, and more to assist in the completion of the 1023 Form.

-

What features does airSlate SignNow offer for the 1023 Form?

airSlate SignNow offers several features that are beneficial for handling the 1023 Form, including customizable templates, secure eSigning, and real-time tracking of document status. Our user-friendly interface allows organizations to easily navigate the form and ensure all necessary signatures are collected promptly. Furthermore, integration with other applications enhances workflow efficiency for nonprofits.

-

Can I integrate airSlate SignNow with other software while completing the 1023 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enabling organizations to enhance their workflow while completing the 1023 Form. Whether you use CRM systems, cloud storage, or project management tools, our integrations ensure that your document management process remains efficient and connected.

-

What are the benefits of using airSlate SignNow for the 1023 Form?

Using airSlate SignNow for the 1023 Form offers numerous benefits, including reduced processing time and improved compliance with IRS requirements. Our platform ensures that documents are securely signed and stored, minimizing the risk of errors and delays. Additionally, the ease of use allows organizations to focus on their mission rather than getting bogged down by paperwork.

-

How secure is my data when using airSlate SignNow for the 1023 Form?

Security is a top priority at airSlate SignNow. When you use our platform for the 1023 Form, your data is encrypted and stored securely, ensuring compliance with industry standards. We implement robust security measures to protect sensitive information, giving organizations peace of mind while managing their important documents.

Get more for 1023 Form

Find out other 1023 Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later