1023 Form 2013

What is the 1023 Form

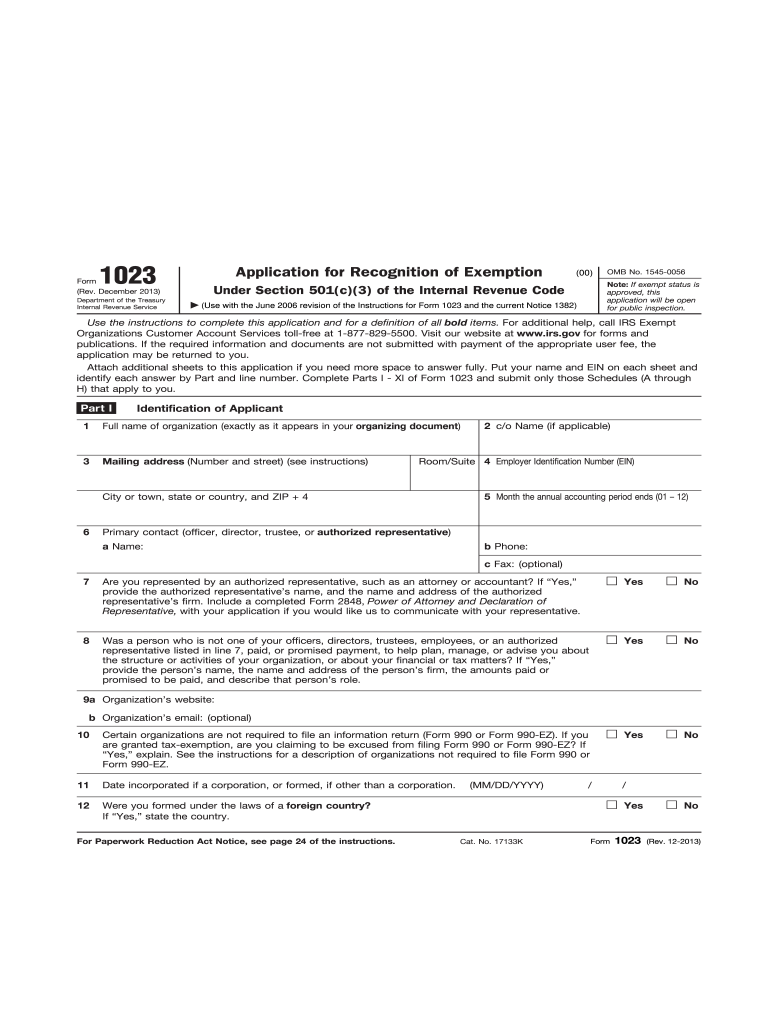

The 1023 Form, officially known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is a crucial document for organizations seeking tax-exempt status in the United States. This form is primarily used by nonprofit organizations to apply for federal tax exemption, allowing them to operate without the burden of federal income tax. The 1023 Form requires detailed information about the organization’s structure, governance, and programs to demonstrate that it meets the criteria set forth by the IRS.

How to use the 1023 Form

Using the 1023 Form involves several key steps to ensure proper completion and submission. Organizations must gather necessary information, including their mission statement, financial data, and details about their programs. Once all information is compiled, the form can be filled out either digitally or on paper. Accurate completion is essential, as errors can lead to delays or rejections. After filling out the form, organizations should review it thoroughly before submitting it to the IRS, either online or via mail.

Steps to complete the 1023 Form

Completing the 1023 Form involves a systematic approach. First, organizations should familiarize themselves with the form's sections, which include eligibility information, organizational structure, and financial data. Next, they should gather supporting documents, such as articles of incorporation and bylaws. Each section must be filled out accurately, ensuring all required information is provided. After completing the form, it’s advisable to have it reviewed by a knowledgeable individual or legal advisor to catch any potential errors before submission.

Required Documents

When submitting the 1023 Form, organizations must include several required documents to support their application. These documents typically include:

- Articles of incorporation or organization

- Bylaws or governing documents

- Financial statements for the past three years, if applicable

- Detailed descriptions of the organization's programs and activities

- Conflict of interest policy

Providing these documents is essential for demonstrating compliance with IRS requirements and ensuring a smooth application process.

Legal use of the 1023 Form

The legal use of the 1023 Form is governed by IRS regulations that outline the criteria for tax-exempt status under Section 501(c)(3). Organizations must ensure that their activities align with the charitable purposes defined by the IRS. Misuse of the form or providing false information can lead to penalties, including denial of tax-exempt status or revocation of existing status. It is important for organizations to maintain transparency and adhere to all legal requirements throughout their operations.

Filing Deadlines / Important Dates

Organizations must be aware of specific filing deadlines associated with the 1023 Form to avoid penalties. Generally, the form should be submitted within 27 months of the organization’s formation date to qualify for retroactive tax-exempt status. If filed after this period, the organization may lose the ability to claim tax exemptions for prior years. Keeping track of these deadlines is crucial for maintaining compliance and ensuring the organization’s financial health.

Quick guide on how to complete 2013 1023 form

Complete 1023 Form seamlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly replacement for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without delays. Manage 1023 Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centered procedure today.

The easiest way to modify and electronically sign 1023 Form effortlessly

- Find 1023 Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to submit your form, either by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your selected device. Edit and eSign 1023 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 1023 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 1023 form

How to generate an eSignature for your 2013 1023 Form online

How to make an electronic signature for your 2013 1023 Form in Google Chrome

How to create an eSignature for putting it on the 2013 1023 Form in Gmail

How to create an eSignature for the 2013 1023 Form from your smart phone

How to make an eSignature for the 2013 1023 Form on iOS devices

How to create an electronic signature for the 2013 1023 Form on Android

People also ask

-

What is the 1023 Form and how can airSlate SignNow help?

The 1023 Form is an application for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. With airSlate SignNow, you can effortlessly prepare, send, and eSign your 1023 Form, ensuring that you meet all legal requirements while saving time and resources.

-

How much does it cost to use airSlate SignNow for the 1023 Form?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for organizations needing to submit the 1023 Form. You can choose a plan that fits your budget and requirements, ensuring you get the best value for your eSigning needs.

-

Can I customize the 1023 Form using airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize the 1023 Form to meet your organization’s specific needs. You can add your logo, adjust fields, and ensure that all necessary information is included, streamlining the application process.

-

What features does airSlate SignNow offer for managing the 1023 Form?

airSlate SignNow provides a range of features for managing the 1023 Form, including eSignature capabilities, document tracking, and templates. These features help you efficiently handle your application while ensuring compliance with IRS requirements.

-

Is airSlate SignNow compliant with legal standards for the 1023 Form?

Absolutely! airSlate SignNow is designed to comply with all legal standards for eSigning documents, including the 1023 Form. Our platform adheres to ESIGN and UETA laws, ensuring that your submissions are valid and recognized by authorities.

-

Can I integrate airSlate SignNow with other tools when completing the 1023 Form?

Yes, airSlate SignNow offers seamless integrations with various tools and applications, enhancing your workflow when completing the 1023 Form. You can connect it with CRM systems, cloud storage services, and more to streamline your document management.

-

What are the benefits of using airSlate SignNow for the 1023 Form?

Using airSlate SignNow for the 1023 Form provides numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. The platform’s user-friendly interface allows you to complete your application with ease, minimizing errors and delays.

Get more for 1023 Form

Find out other 1023 Form

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT