Form W 3c Rev November IRS Gov 2014

What is the Form W-3C Rev November?

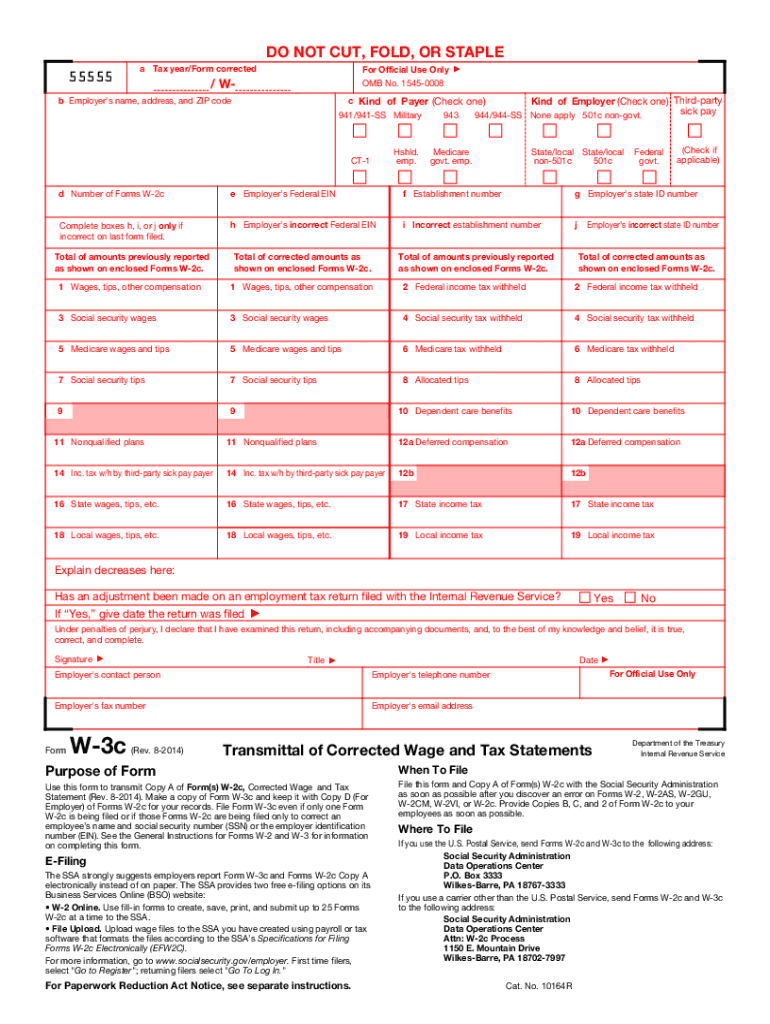

The Form W-3C Rev November is a tax form used in the United States to transmit corrected information returns to the Internal Revenue Service (IRS). It is primarily utilized by employers who need to correct errors on previously submitted Forms W-2, which report wages and tax withholdings for employees. This form ensures that the IRS has accurate records of employee earnings and tax contributions, which is essential for both compliance and reporting purposes.

How to use the Form W-3C Rev November

Using the Form W-3C Rev November involves several steps to ensure accuracy and compliance. First, gather all necessary information, including the original W-2 forms that require correction. Next, complete the W-3C by providing the correct details, such as the employee's name, Social Security number, and the corrected wage amounts. After completing the form, it should be submitted alongside the corrected W-2 forms to the IRS. It is important to keep copies of all submitted documents for your records.

Steps to complete the Form W-3C Rev November

Completing the Form W-3C Rev November requires careful attention to detail. Follow these steps for accuracy:

- Obtain the latest version of the Form W-3C from the IRS website.

- Fill in your employer information, including your name, address, and Employer Identification Number (EIN).

- Enter the corrected information for each employee, including their name, Social Security number, and the corrected amounts.

- Double-check all entries for accuracy to avoid further corrections.

- Sign and date the form before submission.

Legal use of the Form W-3C Rev November

The legal use of the Form W-3C Rev November is governed by IRS regulations. It is crucial for employers to use this form to correct any inaccuracies in previously filed W-2 forms. Failure to submit accurate information can lead to penalties and complications with employee tax records. The form must be filed in a timely manner to ensure compliance with IRS deadlines, which helps maintain the integrity of tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-3C Rev November are critical for compliance. Employers must submit the corrected forms to the IRS by the end of February if filing on paper, or by the end of March if filing electronically. It is advisable to check the IRS website for any updates on deadlines, as these can vary year to year. Timely filing helps avoid potential penalties and ensures that employees' tax records are accurate.

Form Submission Methods

The Form W-3C Rev November can be submitted to the IRS through various methods. Employers may choose to file the form electronically, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. It is essential to follow the specific submission guidelines provided by the IRS to ensure proper processing of the form.

Quick guide on how to complete form w 3c rev november 2015 irsgov

Complete Form W 3c Rev November IRS gov effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form W 3c Rev November IRS gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form W 3c Rev November IRS gov easily

- Obtain Form W 3c Rev November IRS gov and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 3c Rev November IRS gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 3c rev november 2015 irsgov

Create this form in 5 minutes!

How to create an eSignature for the form w 3c rev november 2015 irsgov

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is Form W 3c Rev November IRS gov?

Form W 3c Rev November IRS gov is a transmittal form used specifically for reporting adjustments to previously filed Forms W-2 and W-2c. This form is essential for employers to correct errors made in wage statements, ensuring compliance with IRS regulations.

-

How can airSlate SignNow assist with completing Form W 3c Rev November IRS gov?

airSlate SignNow simplifies the process of completing Form W 3c Rev November IRS gov by allowing businesses to collaborate and eSign documents online. Our platform provides templates and an intuitive interface, making it easy to fill out and submit forms accurately.

-

Is airSlate SignNow cost-effective for businesses needing to file Form W 3c Rev November IRS gov?

Yes, airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. Our cost-effective solutions enable you to efficiently manage and file Form W 3c Rev November IRS gov without incurring high costs, ensuring you stay compliant.

-

What features does airSlate SignNow provide for handling Form W 3c Rev November IRS gov?

With airSlate SignNow, you can access features such as customizable templates, secure eSigning, document storage, and audit trails. These features are designed to streamline the process of managing and filing Form W 3c Rev November IRS gov efficiently.

-

Can I integrate airSlate SignNow with other software for Form W 3c Rev November IRS gov?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to enhance your workflow. This means you can easily link with accounting software, CRM systems, and more to manage Form W 3c Rev November IRS gov effectively.

-

What are the benefits of using airSlate SignNow for Form W 3c Rev November IRS gov submissions?

Using airSlate SignNow for your Form W 3c Rev November IRS gov submissions provides numerous benefits such as reduced processing time, enhanced security features, and easy collaboration among team members. These advantages ensure your compliance while also improving overall efficiency.

-

How secure is airSlate SignNow when handling Form W 3c Rev November IRS gov?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and authentication measures, ensuring that your sensitive Form W 3c Rev November IRS gov and other documents are protected from unauthorized access.

Get more for Form W 3c Rev November IRS gov

- Canada hockey player registration form

- Chiropractic intake form complete balance health

- Application for supplementary letters patent form 3 corporations act

- Child abuse registry form manitoba ringette association

- Important information and funeral planning guide

- Essentail goaltending form

- Cibc pre authorized debit form pdf

- Certificate of automobile insurance final form

Find out other Form W 3c Rev November IRS gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors