8850 Form 2015

What is the 8850 Form

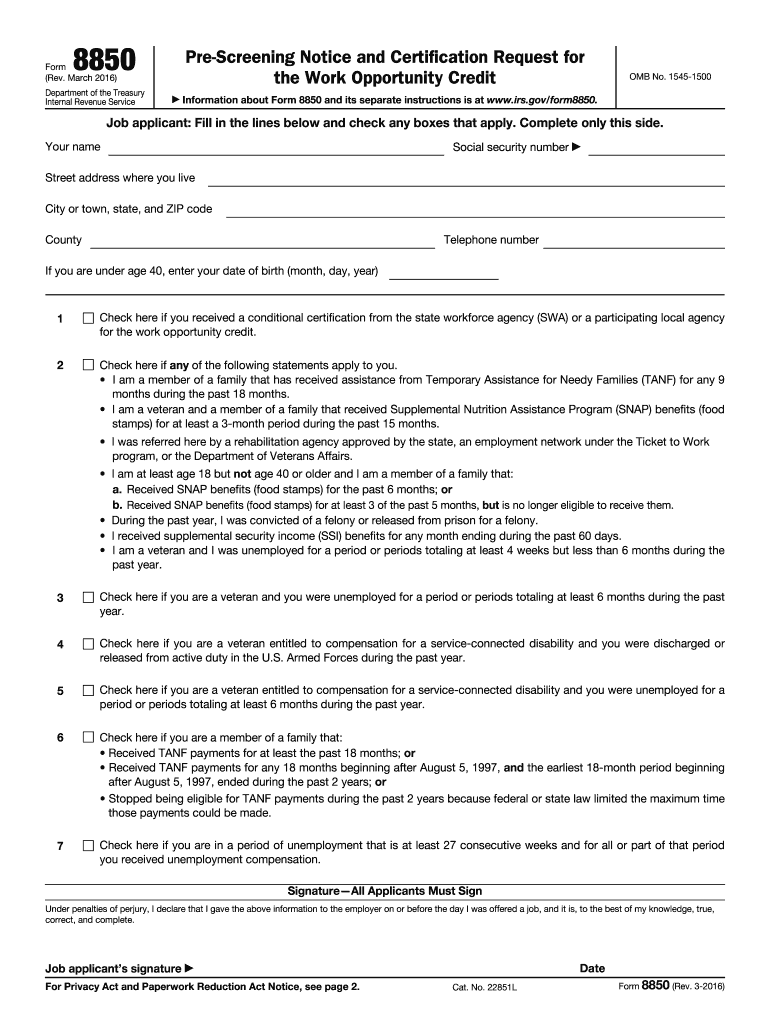

The 8850 Form, officially known as the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, is a crucial document for employers in the United States seeking to claim tax credits for hiring individuals from targeted groups. This form is used to pre-screen potential employees to determine their eligibility for the Work Opportunity Tax Credit (WOTC). The WOTC is designed to encourage the hiring of individuals who may face barriers to employment, such as veterans, long-term unemployed individuals, and recipients of certain public assistance programs.

How to use the 8850 Form

Using the 8850 Form involves several steps that ensure compliance with IRS requirements. Employers should first complete the form with accurate information about the prospective employee and the employer's details. Once filled out, the form must be submitted to the appropriate state workforce agency within 28 days of the employee's start date. This submission allows the agency to assess the applicant's eligibility for the Work Opportunity Tax Credit. Employers can use the form to track their hiring practices and maximize potential tax credits.

Steps to complete the 8850 Form

Completing the 8850 Form requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the prospective employee, including their name, Social Security number, and any applicable eligibility criteria.

- Fill out the employer's information, including the business name, address, and contact details.

- Indicate the targeted group the employee belongs to, as this will determine eligibility for the tax credit.

- Review the completed form for accuracy and completeness.

- Submit the form to the state workforce agency within the specified timeframe.

Legal use of the 8850 Form

The legal use of the 8850 Form is governed by IRS regulations. Employers must ensure that the form is completed accurately and submitted on time to qualify for the Work Opportunity Tax Credit. Failure to comply with these regulations may result in penalties or the denial of tax credits. It is important for employers to maintain records of submitted forms and any correspondence with state agencies to support their claims in case of an audit.

Eligibility Criteria

To qualify for the Work Opportunity Tax Credit using the 8850 Form, employers must ensure that the prospective employee meets specific eligibility criteria. These criteria include being a member of a targeted group, such as:

- Veterans

- Long-term unemployed individuals

- Recipients of Temporary Assistance for Needy Families (TANF)

- Individuals receiving Supplemental Nutrition Assistance Program (SNAP) benefits

Employers should verify the eligibility of candidates before completing the form to ensure compliance and maximize tax benefits.

Form Submission Methods

The 8850 Form can be submitted through various methods, allowing employers flexibility in how they manage their documentation. The primary submission methods include:

- Online Submission: Many states offer online portals for submitting the form, streamlining the process and ensuring quicker responses.

- Mail Submission: Employers can also print the completed form and mail it to the designated state workforce agency.

- In-Person Submission: Some employers may choose to deliver the form in person to their local workforce agency office.

Choosing the appropriate submission method can enhance the efficiency of the application process and ensure timely responses from state agencies.

Quick guide on how to complete 2015 8850 form

Complete 8850 Form effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle 8850 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign 8850 Form with ease

- Obtain 8850 Form and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 8850 Form to ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8850 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8850 form

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 8850 Form and why is it important?

The 8850 Form, also known as the Pre-Screening Notice and Certification Request for the Work Opportunity Tax Credit, is essential for employers looking to claim tax credits for hiring individuals from specific target groups. This form helps businesses understand eligibility and streamline the hiring process, ultimately benefiting their bottom line.

-

How does airSlate SignNow simplify the 8850 Form signing process?

airSlate SignNow offers an intuitive platform that allows users to prepare, send, and eSign the 8850 Form effortlessly. With customizable templates and automated workflows, you can ensure that all necessary parties complete the form quickly and securely, reducing the time spent on paperwork.

-

Can I integrate the 8850 Form with other applications using airSlate SignNow?

Yes, airSlate SignNow provides seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. This means you can easily access and manage the 8850 Form alongside your other business tools, enhancing overall productivity.

-

What are the pricing options for using airSlate SignNow for the 8850 Form?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs. Whether you're a small business or a large enterprise, you can choose a plan that suits your budget while giving you access to powerful features for managing the 8850 Form and other documents.

-

Is airSlate SignNow compliant with legal standards for the 8850 Form?

Absolutely, airSlate SignNow is designed to comply with all relevant legal standards and regulations. This ensures that your eSigned 8850 Form is legally binding and meets the requirements set forth by the IRS, providing peace of mind for your business.

-

What features does airSlate SignNow offer for managing the 8850 Form?

airSlate SignNow includes features such as electronic signatures, document tracking, and customizable workflows specifically for the 8850 Form. These tools help streamline the process and ensure that your hiring documentation is organized and easily accessible.

-

How secure is the information submitted with the 8850 Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. All data submitted with the 8850 Form is encrypted and stored securely, protecting sensitive information from unauthorized access while maintaining compliance with industry standards.

Get more for 8850 Form

- Form b felony conviction notification section

- Rhode island college upward bound program ric form

- Faculty development resources ucsf medical education form

- Consortium agreement form uwmedu

- 2019 20 student application for third party contract invoicing tpc form

- Exemption from all student success amp support program services form

- Sick tray request form chapman university chapman

- Affidavit of completion of homeschool utah valley university uvu form

Find out other 8850 Form

- Create eSignature Document Free

- Create eSignature Document Simple

- Create eSignature Document Easy

- Create eSignature Form Online

- Create eSignature Document Mac

- Create eSignature Form Free

- How To Create eSignature Document

- Create eSignature PPT Free

- Create eSignature PPT Fast

- Create eSignature Presentation Online

- Erase eSignature PDF Computer

- How Do I Erase eSignature PDF

- Create eSignature Presentation Fast

- Create eSignature Presentation Simple

- Redact eSignature PDF Online

- Erase eSignature Presentation Safe

- Redact eSignature Word Later

- How To Redact eSignature PDF

- How Do I Redact eSignature Document

- How Can I Redact eSignature Document