IRA Excess Contribution Withdrawal T Rowe Price 2015

What is the IRA Excess Contribution Withdrawal T Rowe Price

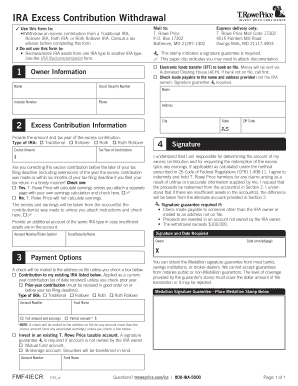

The IRA Excess Contribution Withdrawal T Rowe Price form is designed for individuals who have contributed more than the allowed limit to their Individual Retirement Accounts (IRAs). This form allows account holders to withdraw the excess contributions to avoid penalties imposed by the Internal Revenue Service (IRS). Excess contributions can occur due to various reasons, such as misunderstanding contribution limits or changes in income levels. It is essential to address these excess contributions promptly to maintain compliance with IRS regulations and avoid unnecessary tax implications.

Steps to complete the IRA Excess Contribution Withdrawal T Rowe Price

Completing the IRA Excess Contribution Withdrawal T Rowe Price form involves several key steps:

- Gather necessary information, including your IRA account details and the amount of excess contribution.

- Access the form through T Rowe Price's official website or your account portal.

- Fill out the form accurately, providing all required personal and financial information.

- Review the completed form to ensure all information is correct and complete.

- Submit the form as instructed, either electronically or via mail, depending on the available options.

Legal use of the IRA Excess Contribution Withdrawal T Rowe Price

The legal use of the IRA Excess Contribution Withdrawal T Rowe Price form is crucial for ensuring compliance with IRS regulations. By withdrawing excess contributions, account holders can avoid penalties that may arise from exceeding contribution limits. It is important to adhere to the IRS guidelines regarding the timing and process of the withdrawal to maintain the tax-advantaged status of the IRA. Proper documentation and submission of the withdrawal form also help protect against potential audits or disputes with the IRS.

IRS Guidelines

The IRS has established specific guidelines regarding contributions to IRAs, including annual contribution limits and penalties for excess contributions. For the tax year, individuals under the age of fifty can contribute up to six thousand dollars, while those aged fifty and older can contribute up to seven thousand dollars. If an individual exceeds these limits, the IRS imposes a six percent excise tax on the excess amount for each year it remains in the account. Therefore, understanding and following these guidelines is essential for maintaining compliance and avoiding financial penalties.

Required Documents

To complete the IRA Excess Contribution Withdrawal T Rowe Price form, certain documents may be required, including:

- Your IRA account number

- Details of the excess contribution amount

- Any previous correspondence with T Rowe Price regarding your account

- Identification documents, if necessary, to verify your identity

Form Submission Methods

The IRA Excess Contribution Withdrawal T Rowe Price form can typically be submitted through various methods, including:

- Online submission via the T Rowe Price account portal

- Mailing a physical copy of the completed form to the designated address

- In-person submission at a T Rowe Price branch, if available

Quick guide on how to complete ira excess contribution withdrawal t rowe price

Complete IRA Excess Contribution Withdrawal T Rowe Price effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, adjust, and eSign your documents promptly without delays. Manage IRA Excess Contribution Withdrawal T Rowe Price on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to alter and eSign IRA Excess Contribution Withdrawal T Rowe Price with ease

- Find IRA Excess Contribution Withdrawal T Rowe Price and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign IRA Excess Contribution Withdrawal T Rowe Price and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ira excess contribution withdrawal t rowe price

Create this form in 5 minutes!

How to create an eSignature for the ira excess contribution withdrawal t rowe price

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is an IRA Excess Contribution Withdrawal?

An IRA Excess Contribution Withdrawal refers to the process of withdrawing contributions that exceed the allowable limit set by the IRS for IRAs. This is critical for avoiding penalties on excess contributions and can be particularly relevant for investors working with T Rowe Price.

-

How can I initiate an IRA Excess Contribution Withdrawal with T Rowe Price?

To initiate an IRA Excess Contribution Withdrawal with T Rowe Price, you can log into your account and navigate to the withdrawal section. If you need assistance, T Rowe Price's customer service team is available to guide you through the process.

-

Are there any fees associated with IRA Excess Contribution Withdrawals at T Rowe Price?

T Rowe Price typically does not charge fees for processing an IRA Excess Contribution Withdrawal; however, it’s advisable to review your specific account details or contact customer service for any potential fees regarding your transactions.

-

What are the consequences of not withdrawing excess contributions?

Failing to withdraw excess contributions may lead to a 6% penalty tax that the IRS imposes on the excess amount each year. It's essential to address IRA Excess Contribution Withdrawals promptly to avoid ongoing financial penalties, especially for T Rowe Price clients.

-

Can I withdraw my excess contributions any time during the year?

Yes, you can withdraw your excess contributions at any time during the year, but it’s best to do so as soon as you realize there’s an excess. This is especially important for maintaining compliance with IRS rules related to IRA Excess Contribution Withdrawals for T Rowe Price accounts.

-

Will I pay taxes on my IRA Excess Contribution Withdrawal?

Generally, you may not owe taxes on the amount you withdraw if it is strictly excess contributions. However, any earnings on the excess contributions would typically be subject to tax, so it's wise to consult a tax advisor regarding your specific situation with T Rowe Price.

-

How does T Rowe Price provide support for IRA Excess Contribution Withdrawals?

T Rowe Price offers comprehensive support via their customer service team, providing guidance on how to execute IRA Excess Contribution Withdrawals effectively. Their online resources and tools are designed to make the process straightforward for their clients.

Get more for IRA Excess Contribution Withdrawal T Rowe Price

- Irs 520279419 form

- 5412 s form

- 2020 instructions 2290 form

- Les droits et les obligations des parties de grandpr chait form

- Pdf publication 5399 zh t internal revenue service form

- No nc hng ng pht trin mnh m hn na ngy php lu t vit nam n form

- 2020 irs form non filers

- Pdf publication 5412 q rev 10 2020 internal revenue service form

Find out other IRA Excess Contribution Withdrawal T Rowe Price

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement