TCF Form 765 View Website 2020-2026

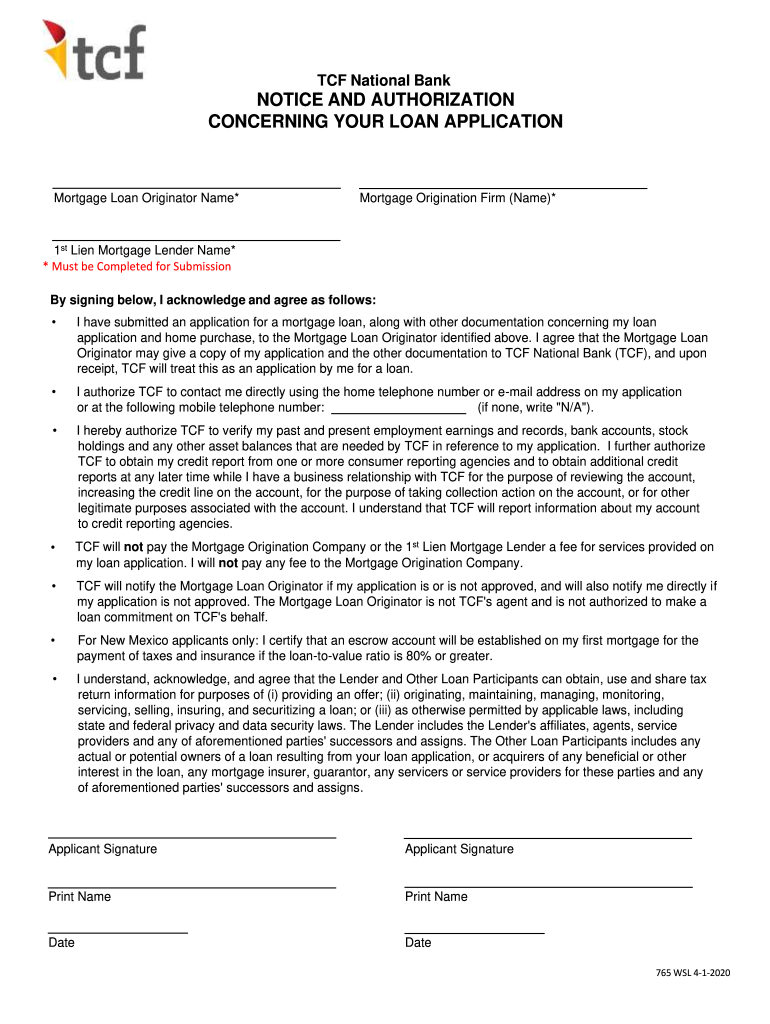

What is the TCF Form 765?

The TCF Form 765 is a document used primarily for home equity line of credit (HELOC) transactions. This form is essential for borrowers who wish to access the equity in their homes through a line of credit. It outlines the terms and conditions of the loan, including interest rates, repayment schedules, and borrower obligations. Understanding the TCF Form 765 is crucial for anyone looking to leverage their home equity effectively.

How to Use the TCF Form 765

Using the TCF Form 765 involves several key steps. First, ensure that you have the correct version of the form, as updates may occur. Next, fill out the required information accurately, including personal details, property information, and financial data. After completing the form, it is important to review it for any errors before submission. Many institutions now allow for electronic submission, which can streamline the process significantly.

Steps to Complete the TCF Form 765

Completing the TCF Form 765 requires attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as proof of income and property details.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about the property, including its current market value and outstanding mortgage balance.

- Review the terms of the HELOC, including interest rates and repayment options.

- Sign the form, ensuring that all required signatures are included.

- Submit the completed form to your lender, either electronically or via mail.

Legal Use of the TCF Form 765

The TCF Form 765 serves as a legally binding document when executed correctly. To ensure its legal validity, it must comply with federal and state regulations regarding eSignatures and financial agreements. This includes adherence to the ESIGN Act and UETA, which govern the use of electronic signatures in the United States. A reliable eSignature solution can provide the necessary compliance and security for the execution of this form.

Key Elements of the TCF Form 765

Understanding the key elements of the TCF Form 765 is vital for borrowers. The form typically includes:

- Borrower and co-borrower information

- Property details, including address and ownership status

- Loan amount and terms, including interest rates and repayment schedule

- Disclosure of fees and potential penalties for late payments

- Signatures of all parties involved, confirming agreement to the terms

Eligibility Criteria for the TCF Form 765

To qualify for a HELOC using the TCF Form 765, borrowers must meet specific eligibility criteria. Generally, these may include:

- Homeownership status, with the property serving as collateral

- Minimum credit score requirements set by the lender

- Proof of stable income to demonstrate repayment ability

- Equity in the home, typically a minimum percentage of the property's value

Quick guide on how to complete tcf form 765 view website

Prepare TCF Form 765 View Website effortlessly on any device

Online document management has become increasingly popular among organizations and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle TCF Form 765 View Website on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign TCF Form 765 View Website with ease

- Locate TCF Form 765 View Website and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your amendments.

- Select your preferred method of delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign TCF Form 765 View Website while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tcf form 765 view website

Create this form in 5 minutes!

How to create an eSignature for the tcf form 765 view website

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a TCF HELOC and how does it work?

A TCF HELOC, or Home Equity Line of Credit from TCF Bank, allows homeowners to borrow against their home equity. It works like a credit line; you can draw funds as needed up to a predetermined limit, only paying interest on the amount borrowed. This flexibility makes it an ideal financial tool for various needs like home improvements or debt consolidation.

-

What are the benefits of using a TCF HELOC?

Using a TCF HELOC provides several benefits, including lower interest rates compared to personal loans and credit cards. Additionally, the interest paid on a TCF HELOC may be tax-deductible, making it a cost-effective borrowing option. With this line of credit, you can access funds for unexpected expenses or planned projects without needing to refinance your mortgage.

-

What are the eligibility requirements for a TCF HELOC?

To qualify for a TCF HELOC, applicants typically need to have a good credit score, steady income, and sufficient home equity. Lenders will also consider your debt-to-income ratio and the overall financial situation. It's important to check specific TCF Bank guidelines, as they may vary by location.

-

How does the application process for a TCF HELOC work?

The application process for a TCF HELOC is straightforward. You start by filling out an application form, where you provide details about your income, credit history, and property. After submission, TCF Bank will review your information and conduct an appraisal if necessary before making a lending decision.

-

Are there any fees associated with opening a TCF HELOC?

Yes, there may be fees involved when opening a TCF HELOC, such as application fees, appraisal fees, and annual fees. However, TCF Bank often offers promotional deals that waive certain fees. It's best to discuss these potential costs with a representative to understand the overall pricing structure.

-

What are the typical interest rates for a TCF HELOC?

Interest rates for a TCF HELOC can vary based on your creditworthiness and market conditions, but they generally range from lower than traditional loans to slightly higher than fixed-rate mortgages. Rates can also be variable or fixed, so it's essential to compare options. Checking the TCF Bank website or speaking with a loan officer can provide current rates.

-

Can I use a TCF HELOC for any purpose?

A TCF HELOC can be used for various purposes, including home renovations, education expenses, medical bills, or even debt consolidation. This flexibility makes it a popular choice among homeowners. However, it's best to use this line of credit responsibly to avoid potential financial issues.

Get more for TCF Form 765 View Website

- State of indiana in the circuit court madison county form

- Account of fiduciary short form michigan 2008

- Mo probate inventory form

- Request appointment special form

- Ohio adult adoption form

- Was deposited with form

- Canadian county standard visitation schedule form

- Waiver of rights sample 100377129 form

Find out other TCF Form 765 View Website

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself