Self Employed Business Form

What is the self-employed business?

A self-employed business refers to a work arrangement where individuals operate their own enterprises, providing goods or services independently. This model allows for flexibility and autonomy, enabling self-employed individuals to set their own hours and determine their business strategies. Common examples include freelancers, consultants, and small business owners. Understanding the nature of self-employment is crucial for navigating tax obligations and compliance with local regulations.

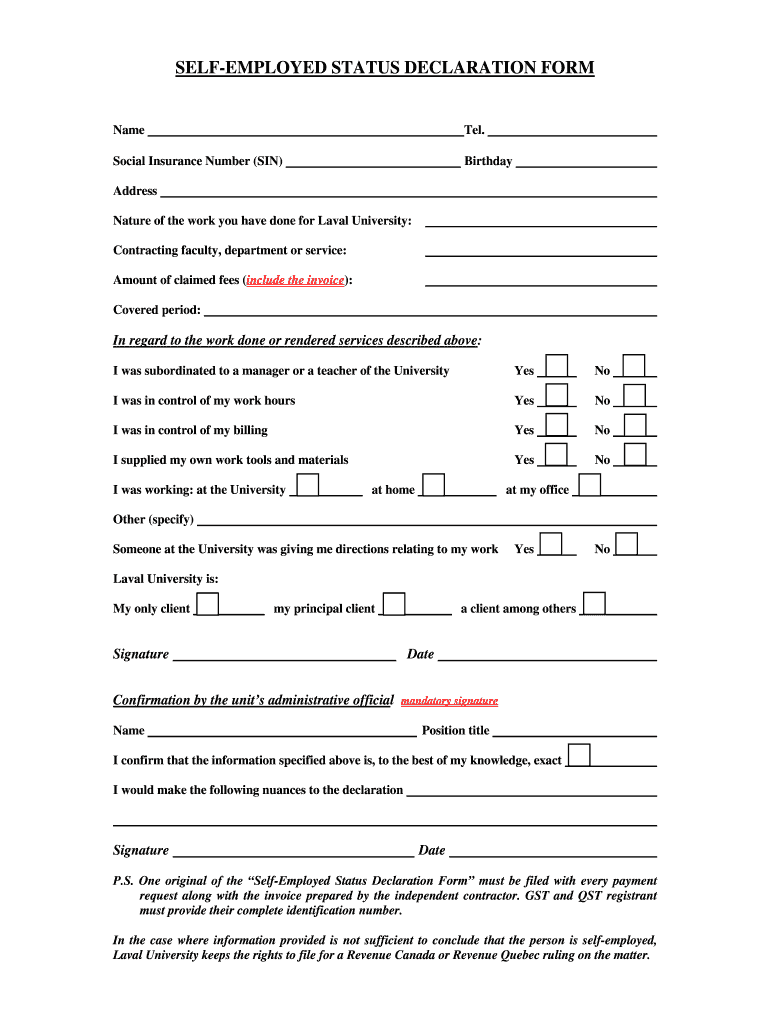

Steps to complete the self-employed business declaration

Completing the self-employed business declaration involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including income statements, expense records, and any relevant identification.

- Fill out the self-employed status declaration form, providing detailed information about your business activities and financials.

- Review the form for accuracy, ensuring all information is complete and correct.

- Submit the form through the appropriate channels, which may include online submission or mailing it to the relevant authority.

Legal use of the self-employed business

To legally operate a self-employed business, individuals must comply with local, state, and federal regulations. This includes registering the business, obtaining necessary permits, and adhering to tax obligations. It's important to understand the legal framework governing self-employment, including the implications of contracts, liability, and intellectual property rights. Ensuring compliance helps protect the business and the individual's personal assets.

Required documents for self-employed status

When declaring self-employed status, several documents are typically required to substantiate your claim. These may include:

- Tax returns from previous years to demonstrate income.

- Invoices or contracts that outline the services provided.

- Bank statements to verify income and expenses.

- Any licenses or permits required for your specific business type.

Eligibility criteria for self-employed individuals

Eligibility for self-employed status generally depends on the nature of the work and the individual's income level. Criteria may include:

- Ability to control the work performed and how it is done.

- Responsibility for business expenses and liabilities.

- Engagement in a trade or business with the intention of making a profit.

IRS guidelines for self-employed individuals

The Internal Revenue Service (IRS) provides specific guidelines for self-employed individuals, including how to report income and expenses. Self-employed individuals must file a Schedule C (Form 1040) to report income or loss from their business. Additionally, they may need to pay self-employment taxes, which cover Social Security and Medicare contributions. Understanding these guidelines is essential for compliance and effective tax planning.

Quick guide on how to complete self employed business

Access Self Employed Business effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Self Employed Business on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to modify and electronically sign Self Employed Business with ease

- Find Self Employed Business and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or obscure confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and electronically sign Self Employed Business to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self employed business

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What features does airSlate SignNow offer for self employed individuals in Calgary?

airSlate SignNow provides an array of features beneficial for self employed Calgary clients, including easy document creation, electronic signatures, and customizable templates. These tools streamline your workflow, enabling you to manage contracts, invoices, and agreements efficiently. Whether you're working from home or on the go, airSlate SignNow supports your needs as a self employed individual.

-

How much does airSlate SignNow cost for self employed users in Calgary?

The pricing for airSlate SignNow is competitive and tailored for self employed Calgary professionals. We offer monthly and annual plans that provide flexibility depending on your needs. With no hidden costs and a simple user interface, it's an affordable solution for managing your documents.

-

Is airSlate SignNow secure for self employed professionals in Calgary?

Absolutely! airSlate SignNow is designed with security as a priority. For self employed Calgary users, our platform utilizes industry-standard encryption and compliance with regulations, ensuring that your sensitive documents are safe during transactions and storage.

-

Can self employed individuals in Calgary integrate airSlate SignNow with other tools?

Yes, airSlate SignNow can be seamlessly integrated with various tools and applications that self employed Calgary users may already be using. This enhances your productivity and allows for a smooth workflow, connecting with popular software for accounting, project management, and more.

-

What are the benefits of using airSlate SignNow for self employed professionals in Calgary?

For self employed Calgary individuals, airSlate SignNow offers key benefits such as time savings, increased efficiency, and reduced paperwork. The ability to sign and send documents electronically simplifies your daily tasks and helps you focus more on growing your business. Enjoy the convenience of managing your documents anytime, anywhere.

-

Does airSlate SignNow offer customer support for self employed users in Calgary?

Yes, airSlate SignNow provides dedicated customer support for all users, including self employed Calgary professionals. Our team is available via chat, email, and phone to assist with any questions or technical issues. We strive to ensure you get the most out of our platform.

-

How does airSlate SignNow help self employed individuals in Calgary manage their contracts?

airSlate SignNow aids self employed Calgary users in effectively managing contracts through features like real-time tracking and automated reminders. You can easily send contracts for signatures and receive notifications when they're completed. This keeps your business organized and ensures contracts are managed on time.

Get more for Self Employed Business

Find out other Self Employed Business

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe