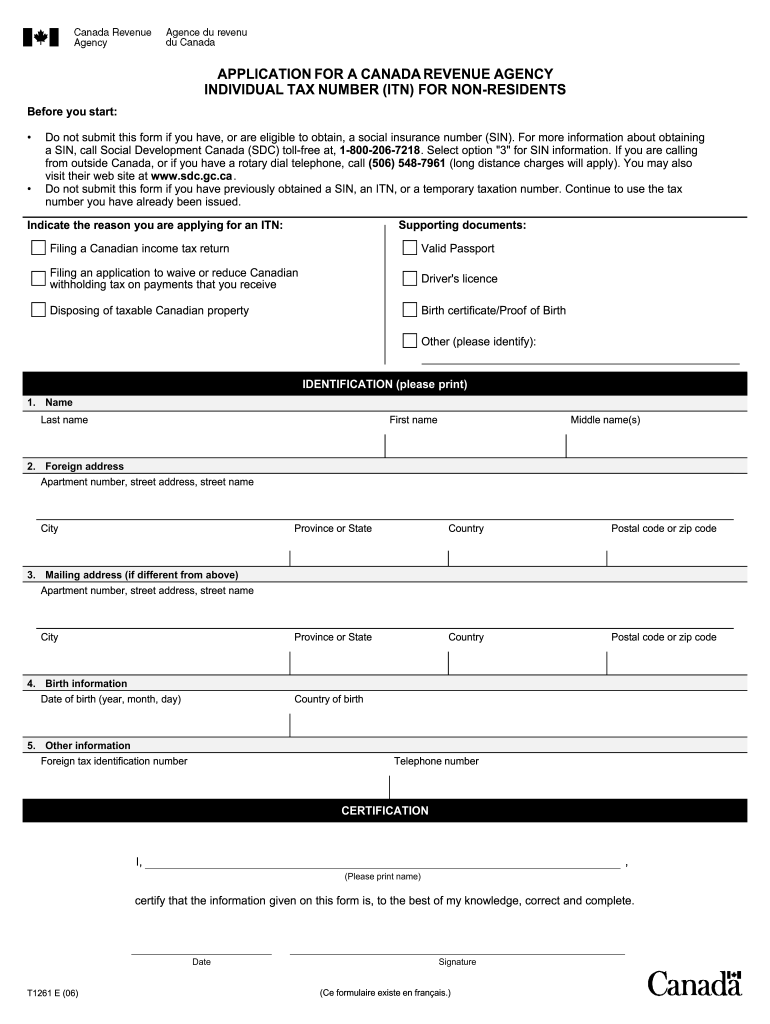

T1261 Form 2006

What is the T1261 Form

The T1261 Form is a tax-related document used primarily in the United States for specific reporting purposes. This form is typically associated with certain tax obligations and is essential for ensuring compliance with federal regulations. Understanding the purpose of the T1261 Form is crucial for individuals and businesses alike, as it helps in accurately reporting income and expenses to the Internal Revenue Service (IRS).

How to use the T1261 Form

Using the T1261 Form involves several key steps to ensure that the information provided is accurate and complete. First, gather all necessary documentation related to your income and expenses. Next, fill out the form carefully, ensuring that all fields are completed as required. It is important to double-check your entries for accuracy to avoid potential issues with the IRS. Once completed, you can submit the form according to the guidelines provided by the IRS.

Steps to complete the T1261 Form

Completing the T1261 Form requires a systematic approach. Follow these steps:

- Gather all relevant financial documents, including income statements and expense receipts.

- Download the T1261 Form from the IRS website or obtain a physical copy.

- Fill out the form, ensuring that you provide accurate information in each section.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, following the instructions provided by the IRS.

Legal use of the T1261 Form

The T1261 Form must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and providing truthful information. Failing to comply with these legal requirements can result in penalties or fines. It is advisable to consult with a tax professional if you have questions about the legal implications of using the T1261 Form.

Filing Deadlines / Important Dates

Filing deadlines for the T1261 Form are critical to avoid late fees and penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individuals. However, if you are filing for a business entity, the deadlines may vary. It is essential to keep track of these important dates and plan accordingly to ensure timely submission.

Required Documents

To complete the T1261 Form, you will need several supporting documents. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Any previous tax returns that may be relevant.

- Documentation of any tax credits you plan to claim.

Having these documents ready will facilitate a smoother completion process.

Form Submission Methods (Online / Mail / In-Person)

The T1261 Form can be submitted through various methods, depending on your preference and the requirements set by the IRS. You can file the form online using the IRS e-filing system, which is often the fastest method. Alternatively, you can print the form and mail it to the appropriate IRS address. In some cases, in-person submission may be available, but it is essential to check with your local IRS office for specific procedures.

Quick guide on how to complete t1261 2006 form

Complete T1261 Form effortlessly on any gadget

Online document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to craft, amend, and eSign your documents promptly without delays. Manage T1261 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign T1261 Form with ease

- Acquire T1261 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for these tasks.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and eSign T1261 Form while ensuring excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1261 2006 form

Create this form in 5 minutes!

How to create an eSignature for the t1261 2006 form

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the T1261 Form, and why do I need it?

The T1261 Form is a Canadian tax form used for the purpose of claiming a tax credit for foreign income. Businesses often require this form to ensure compliance and maximize their tax benefits. Utilizing airSlate SignNow simplifies the eSigning process for T1261 Forms, making it easier to submit important documents.

-

How can I complete and eSign the T1261 Form with airSlate SignNow?

To complete and eSign the T1261 Form using airSlate SignNow, simply upload the document, fill in the required fields, and add eSignature elements where necessary. The user-friendly interface helps streamline the process, ensuring your forms are accurately filled out and securely signed.

-

What are the pricing options for using airSlate SignNow for the T1261 Form?

airSlate SignNow offers several pricing plans based on the features you require, ensuring you find a suitable option for your business needs. Each plan includes the capability to send, sign, and manage forms such as the T1261 Form efficiently. You can choose a plan that aligns with your budget and usage requirements.

-

Are there any benefits to using airSlate SignNow for the T1261 Form?

Using airSlate SignNow for your T1261 Form brings numerous benefits, including faster processing times, enhanced security for sensitive information, and improved workflow efficiency. With eSigning capabilities, you can track the status of documents in real-time, ensuring prompt completion and submission.

-

Does airSlate SignNow integrate with other software for handling the T1261 Form?

Yes, airSlate SignNow integrates seamlessly with various software applications, including cloud storage services and customer relationship management (CRM) tools. This integration allows you to better manage the T1261 Form within your existing workflows, enhancing productivity and document accessibility.

-

Is airSlate SignNow compliant with legal standards for the T1261 Form?

Absolutely! airSlate SignNow complies with legal regulations for electronic signatures, making it a trustworthy platform for handling the T1261 Form. This compliance ensures that your electronically signed documents are legally binding and can be submitted to authorities without issue.

-

Can I access the T1261 Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is compatible with mobile devices, allowing you to access and eSign the T1261 Form on-the-go. The mobile app offers all the features needed to manage your documents efficiently, ensuring you can work from anywhere at any time.

Get more for T1261 Form

- Jv 132 financial declarationjuvenile dependency judicial council forms courts ca

- Jv 251 application and order for california courts courts ca form

- Jv 472 findings and orders after hearing to consider judicial councilf orms courts ca form

- Pos 050 efs 050 proof of electronic service proof of serviceelectronic filing and service judicial council forms courts ca

- Jv285 form

- Wg 030 earnings withholding order for elder and dependent adult abuse judicial council forms courts ca

- Dv 520 info get ready for the court hearing judicial council forms courts ca

- Fl 478 form

Find out other T1261 Form

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form